AARP Hearing Center

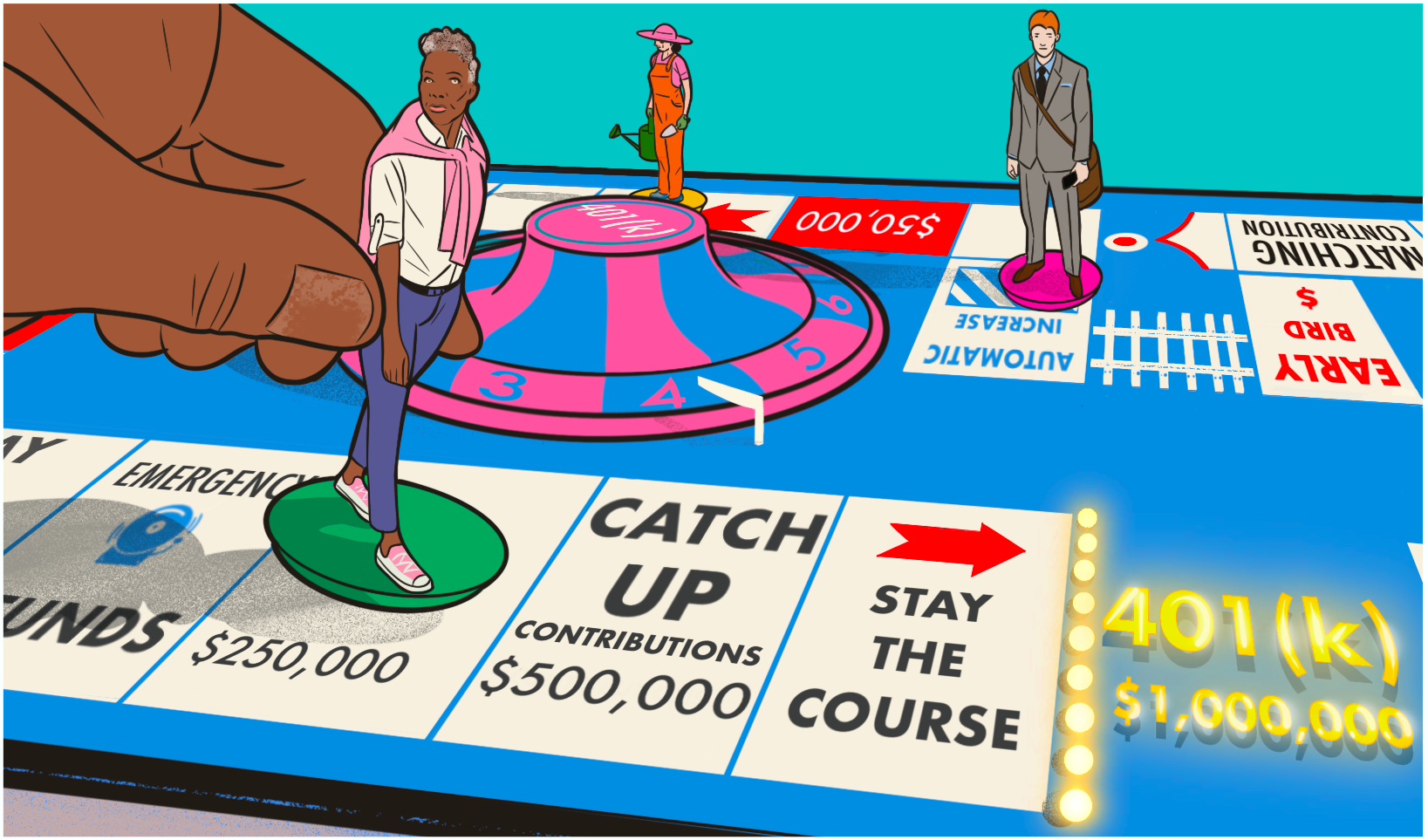

Who wants to be a 401(k) millionaire?

Most of us, probably. And those who make it are growing in number. Fidelity Investments, one of the biggest retirement plan providers, reported a record 497,000 seven-figure accounts among its 401(k) plan holders in the second quarter of 2024, a 31.5 percent increase from a year earlier.

That’s still just a sliver of Fidelity’s 401(k) customers — less than 2 percent — and market conditions have certainly played a role in the rising number. After all, stocks loom large in most retirement plan portfolios, and the S&P 500 gained nearly 15 percent in the first half of 2024.

Check out the 401(k) Savings and Planning Calculator

Find out how much you're saving with AARP's 401(k) calculator.

Still, the money habits of these dedicated savers can give others a blueprint to follow, says Mike Shamrell, vice president of thought leadership for Fidelity. “These are not hypothetical scenarios,” he says. “These are real people who through the course of their careers were able to reach this point.”

Everyone has a different plan for retirement, and $1 million might not be your magic number to achieve it. Whatever your goal, however, every saver can learn from folks who’ve managed to save the most, by taking maximum advantage of the 401(k)’s strengths as a retirement tool.

Lesson 1: Start early (and get the match)

Fidelity’s 401(k) millionaires are roughly divided between boomers and members of Generation X, the youngest of whom are turning 44 this year.

“These are people who have been saving for quite some time,” Shamrell says. “These are not people that found some hot stock and added it to their 401(k) and boom, overnight, they had a million dollars. They’ve really taken a long-term approach to get to where they are.”

As your career progresses and you look for new job opportunities, consider retirement plan options as well as salary offers, recommends Ted Benna, a retirement benefits consultant who is credited with creating the 401(k).

If a prospective workplace offers a 401(k) plan, he says, ask yourself, “Do they offer a matching contribution and how much is it?” A company that provides a generous match can help you reach 401(k) millionaire status faster than one that does not.

“That’s free money,” Shamrell says, “so get started as soon as you can.”

More From AARP

How to Protect Your Retirement Savings

Poor investment returns early can hurt you more than losses later

4 Strategies for Making Your Money Last

Here’s how to ensure you’ll have the cash you need for as long as you live

Do You Really Need to Save $1 Million to Retire?

Base savings goal on how, and where, you want to live

13 Ways to Dodge Early Withdrawal Penalties

Tapping IRA or 401(k) costs less for certain expenses

Recommended for You