AARP Hearing Center

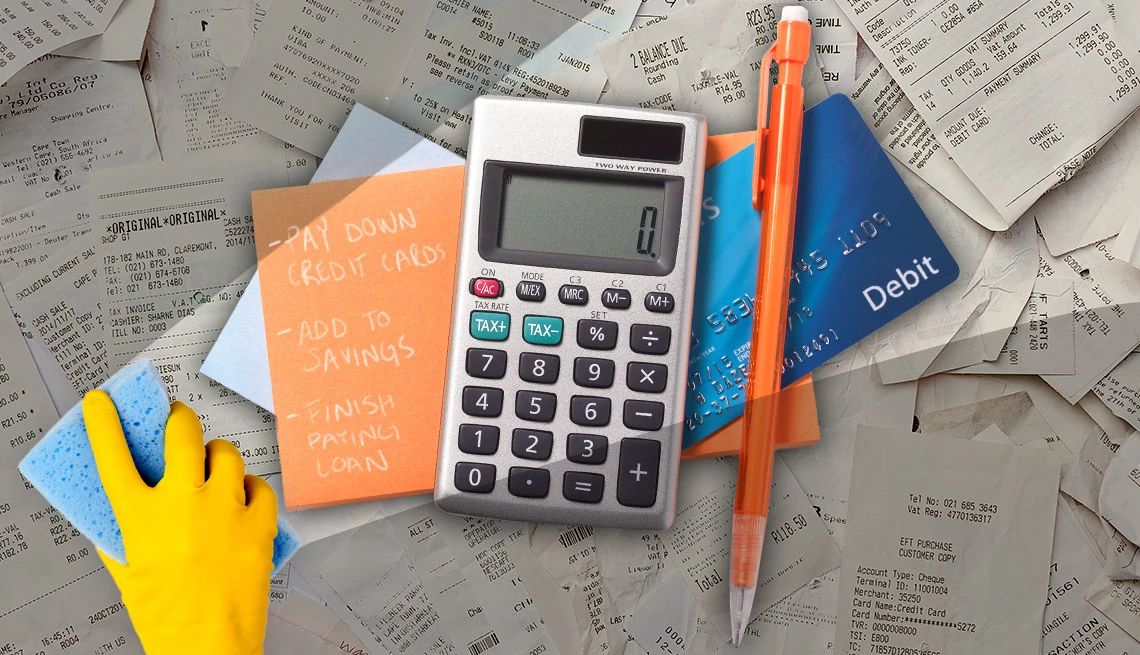

Forget cleaning out the closet, scrubbing the floors and washing the windows. The start of spring is an even better time to get your finances in order.

“One thing on many people’s minds is cleaning. But what if you put that cleaning energy to your financial house?” says consumer savings expert Andrea Woroch. “Considering consumer credit card debt has reached a new record high of $1.13 trillion, it’s a good time to focus on refreshing your spending and saving habits.“ That’s particularly true of people nearing or entering retirement. Half of retirees live on less than 50 percent of their preretirement income, according to research from Goldman Sachs Asset Management. And 40 percent of older adults rely on Social Security alone, which averages $1,657 a month, the National Council on Aging reports.

Whether you’re on a fixed income, have cash in the bank or are still working, a financial spring cleaning can help you save money, reset your priorities and get you closer to your short- and long-term goals.

1. Spruce up your budget

Taxes are due, vacation planning is underway and the end of the year is in your sights. That makes springtime a great season to give your budget an overhaul.

“First and foremost, it’s a good time of year to take a fresh look at your budget and see how you’ve been doing during the first quarter,” says Emily Irwin, head of advice relations at Wells Fargo Bank. “Do you need to make any adjustments based on the economy?” Assessing your budget means taking a realistic and detailed look at your spending patterns and identifying areas to cut expenses.

If you need help creating a budget, there are free resources available to older adults, including AARP’s Money Map digital tool which helps you create a budget; The National Foundation for Credit Counseling, which offers free access to NFCC Certified Counselors; and the Federal Trade Commission’s website, which has a budget sheet as well as free educational material covering different money matters.

2. Tackle your debt

The days of being flush with cash during the pandemic are long over. Thanks in part to inflation, many consumers rely on credit cards to cover spending shortfalls. That’s true of the nearly 3 in 4 Americans 50 and over who carry some form of debt, according to AARP’s Debt Survey. It also found 61 percent of the close to 7,400 surveyed who carry debt feel that their level of debt is a problem, including 16 percent who say it is a major problem.

More From AARP

How to Protect What You Collect

Tips for caring for your collectibles, including proper organization, accurately assessing the value and more

99 Great Ways to Save

How to beat inflation and find lower prices on nearly everything

7 Tips to Slash Your Grocery Bill

Inflation still packing punch at the supermarket checkout

Recommended for You