AARP Hearing Center

Subscribe: Apple Podcasts | Google Play | Spotify | Stitcher | TuneIn

After her father dies, Grace is in charge of investing her father’s lifetime savings. She decides to put her money into gold and silver. Along the way, she realizes the investment isn’t what she had thought it was.

TIP: Do your research and read the fine print. Don’t respond to cold calls and add your name to the Do Not Call Registry. Don’t act now; avoid limited time offers and pushy salespeople.

[00:00:00] HOST:

Coming up on this episode, of AARP's Perfect Scam.

[00:00:03] Once you

get on these lists, those lists tend to be bought, sold, and traded, maybe on

the dark web or elsewhere among this circle of fraudsters, and the people who

are perpetrating these crimes are professionals, and it's their business to

fool you and to lie to you.

[00:00:20] HOST: Any

kind of investment usually has some risk attached to it. Stock market, real

estate, your next car. But what about precious metals? Gold and silver? You

know the one's we're talking about. You see the ads on TV and hear them on the

radio. And something about the pitch seems just so, well, reasonable. But what

is it really like to invest in gold and silver? Are there scammers out there

making money off victims or are these legit businesses that all have some risk

associated with them, just like any investment? For The Perfect Scam, I'm your

host, Will Johnson and we are joined, as always, by my cohost and The AARP's

Fraud Watch Network Ambassador, Frank Abagnale. This come up with the FBI, I

assume.

[00:00:58] Frank

Abagnale: Oh yeah, and I mean who can watch television for 30 minutes without

having an ad come on about buying gold or buying silver?

[00:01:05] HOST: Well you're absolutely right. The advertising is actually

working, because people are in some cases investing wisely, and hopefully it's

going well for them, and then in some cases, falling into situations where they

don't feel they're getting what they paid for.

(MUSIC SEGUE)

[00:01:21] Grace:

Hello?

[00:01:22] HOST: Hi,

Grace, it's Will Johnson, at AARP. How are you?

[00:01:26] Grace: Hi,

Will. How are you?

[00:01:27] HOST: I'm

great.

[00:01:28] HOST: This

is Grace. She has an MBA, describes herself as well-educated and has some

experience dealing with investment scams in the past. When Grace's 90-year-old

father passed away and his IRA rolled over, she was looking for a safe place to

invest her father's lifelong savings.

[00:01:43] Grace: I

had seen many, many television programs about rolling over your IRA into gold

and silver, and so I decided to review it and it sounded like a good deal.

[00:01:58] HOST: So

Grace, let me ask you then, it sounds like you just so I understand, you had a

good amount of money that after your father died that you wanted to invest. You

didn't want to take a payout and also you had, it sounds like you have some

experience in the world of investing and money ... enough to sort of know your

way around and to start asking, ask the right questions.

[00:02:19] Grace:

Well, I have been taking care of my parents as a family caregiver since 2005,

and my father never taught us anything about his finances, and but I have an

MBA and it took me 10 years to figure out quite a few things and talk to many

financial planners over the years, so it's been a learn as I go school of hard

knocks.

[00:02:45] HOST: So,

what did you do next? You decided to invest and how did you go back doing that?

[00:02:48] Grace: So

basically, I called, I got an email, I believe, on my Facebook about this

company and I called them, talked to them, very nice, they kept calling me,

under--, saying that they understood about my mother and, and you know, so I

felt like I was building a trusting relationship with them.

[00:03:16] HOST: And

can you tell us then what the initial investment was, and how that went and

your, sort of your conversations back and forth with this company that you were

investing with?

[00:03:25] Grace: You

mean the amount or...

[00:03:27] HOST:

Sure, yeah if you're willing to share.

[00:03:30] Grace:

Okay, it was 220,000.

[00:03:33] HOST: How

much advice did they give you, or guidance in where they were going to put

this? Did you want to play a big role in that or were you letting them sort

of...

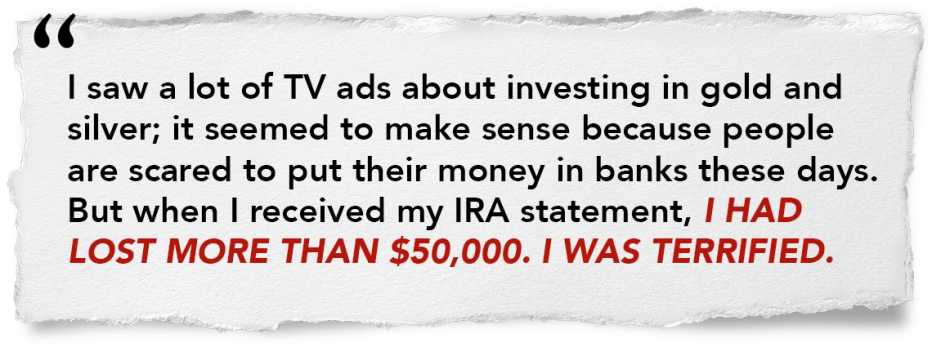

[00:03:38] Grace: I

really deferred to them because I didn't know anything about gold or silver, I

just saw a lot of commercial ads and it sounded like it made sense because

there's a lot of fear about putting your money in the banks.

[00:03:54] HOST: So

you, you invested a good chunk of money that was saved over your father's

lifetime, really, right?

[00:04:00] Grace:

Uh-huh. I did see that the prices were going up, so I was really excited. The

first red flag was when I got the first IRA statement and I had put in 200,000

but it said it was worth 147,000.

[00:04:17] HOST: That

the investment that you made was, had already dropped over $50,000, 55,

$60,000.

[00:04:25] Grace:

Right. So I called the company and started screaming. I said I'd never heard of

an IRA rollover where you put 200, on the other side should be 200, you know.

And I said how could have it gone down because I've been noticing gold and

silver has been going up. She goes, well because it's a semi-numismatic, we

don't really know the value of that. I started to think, how do I know what,

how do I, how can I prove that actually the coins that they said that they put

me in, are actually the coins that I got? So I called them, and he goes, well

you'd have to go where it's the, the vault is and go check it out for yourself.

[00:05:14] HOST:

Where's the vault?

[00:05:15] Grace: It,

the vault's, I believe in Utah.

[00:05:19] HOST: And

can one...

[00:05:19] Grace:

There’s many of these all over the place.

[00:05:21] HOST: But

did he tell you where a specific vault was for you?

[00:05:23] Grace:

Yeah, he did, uh, huh.

[00:05:25] HOST: Wow.

[00:05:27] Grace: So,

I was like, I'm not going to go all the way there, so instead, I called the,

the IRA that was holding it, then she called the vault, and it turned out the

actual coins were different from the ones that he told me he'd put me in.

[00:05:42] HOST: And

they, and how did they differentiate? Are they numbered?

[00:05:46] Grace:

They were different years, and they were different types.

[00:05:50] HOST:

Okay, so somewhere in Utah, there's a vault with your money, with your coins

that they said they got for you, but they're actually not your coins.

[00:05:57] Grace:

Right. So that was another red flag.

[00:05:59] HOST: Were

they less value?

[00:06:01] Grace:

Yes.

[00:06:02] HOST: And

what makes them less value? Less gold, less weight?

[00:06:05] Grace: No,

they were, they were newer. They were brand, brand new for that year. That sent

a big flag and I called, the company fixed it, but it just gave me a funny

feeling about really what do I, you know have here?

[00:06:20] HOST: I'm

sure it did. Yeah. When Grace's 90-year-old mother needed a hip replacement,

she was nervous about being able to cover everything, so she started looking

into the buyback rate of the coins if she needed to free up the money.

[00:06:33] Grace: So,

I was starting to get concerned that there might be, I might have to liquidate

from somewhere, and they told me their number one thing is that they guaranteed

the highest buy back rate, so I talked to them, one of the guys, and it kept

going up to a higher level and the guy told me, okay. We promised that we

guaranteed that we'll buy it back and I had purchased this one coin for 508.

[00:07:04] HOST:

$508? 508 dollars.

[00:07:06] Grace: For

a .25-ounce coin, a quarter ounce coin. So this is where you know, I'm starting

to like really probe with this man, and I said I want out of this. And he goes

fine, we'll buy it back for $300. And I said, are you kidding me? I just bought

these things. This is February. I bought them in December.

[00:07:29] HOST: And

we're not talking about one coin, we're talking about a large investment and a

whole lot.

[00:07:33] Grace:

Yes, yes. And then I also talked about the silver coin. I had purchased it at a

higher rate and what he was willing to back--, pay it back was less than half.

[00:07:47] HOST: So,

did you feel like he was just throwing out this 300 rate kind of casually

and...

[00:07:52] Grace: No,

that was what his buy back, he looked up something and he says, our buy back

rate for today is $300. And I went ballistic because I said, what crazy person

would buy a coin for 508 and find out it's worth only $300? So I finally got

one person one person who was knowledgeable and the correct agency that

oversees coins is the Commodities and Futures and Trading Commission.

[00:08:21] HOST:

Enter Dan Rutherford. He is Director of the Office of Customer Education and Outreach

Office of the Executive Director with U.S. Commodities Future Trading

Commission.

[00:08:29] Dan

Rutherford: The U.S. Commodities Futures Trading Commission basically has

jurisdiction over commodity futures markets, as well as other derivative

markets and financial instruments, so you know, when people talk about trading

futures contracts in gold or in other forms of commodities, those are the

markets that we regulate.

[00:08:46] HOST: To

back up a little more for those of us who may not be very experienced in the

world of investment, a commodity future is what?

[00:08:54] Dan

Rutherford: So commodity, when you think about commodities you can think about

things like corn, oil, gas, and again precious metals or even inert metals,

like copper and things.

[00:09:05] HOST: And

because we're talking about investments here, we have this quick disclaimer

from Dan.

[00:09:09] Dan

Rutherford: The views I'm about to express are my own and do not necessarily

reflect those of the commission, or any individual commissioner. Also, this

information is for educational and informational purposes only and should not

be construed as legal or investment advice.

[00:09:26] HOST:

Alright, back to the show. The fact is that gold and silver investing is not so

simple. We could take an entire show to cover just the basics. Grace definitely

learned that along the way. The bottom line is that if you're thinking about

investments like gold and silver, do your research. As with any business where

a lot of money's involved, there are bad actors out there. Dan's office works

with dealers who are registered only. If businesses are not registered, they

are actually operating illegally.

[00:09:51] HOST: So

some of this then falls outside of what you guys manage. So if it's outside of

that, anecdotally or otherwise, have you heard how scammers then go about

making themselves seem legit?

[00:10:01] Dan

Rutherford: Uh, yes, so a lot of times, and you'll see the advertisements,

advertising online and sometimes on television or on the radio, you know

they'll promise coins or bullion and a lot of times you know they'll, they may

even cold call you or market you via email. And in those sorts of situations

any time you're getting a cold call or receiving an email offering an

investment, you should pretty much just say no, if you will, because the

chances of those offers being legitimate is pretty slim. You know, we've seen

cases where investors have been sold large lots of gold for a small down

payment. The money was actually then used to purchase futures contracts. There

was never any real physical gold but you know the customers were told that

their gold was in vaults in secured locations around the world, that you know,

they were paying insurance on gold that didn't exist. So there's a lot of

different stories and a lot of different methods that you know these scammers

would utilize. It just depends on how they, how they pushed the right buttons.

When they get you on the phone, they do what's called probing, and they may ask

you a couple of questions. If they get the sense that you're interested in big

returns, they'll walk you down that path until, you know, you're convinced that

this is the right investment for you. If they get the sense on the other hand

that you're interested in safety and security, they'll walk you down that path.

And the whole effort is really intended to, to get you believing in what

they're selling. And they'll change their stories, depending on who they're

talking to or how often they talk to you. And a lot of times what they'll do is

they may get you to make a small initial investment, and think that it's no big

deal. But over time, they'll call you back, they'll be telling you what great

returns you've had so far, and how you should be investing more with them, and

they'll continue to pressure you to invest more and more and more over time.

You know, they're professionals at what they do, and so you know, people who

are victimized really shouldn't feel ashamed and people who haven't been

victimized and think that it can't happen to them, only have to realize that

the people who are perpetrating these crimes are professionals, and it's their

business to fool you and to lie to you.

[00:12:38] HOST: Are

they completely cold calls in your experience, or do they somehow get a little

background and are able to identify people they may want to take advantage of?

[00:12:47] Dan

Rutherford: What tends to happen and what we've seen in generally across most

financial frauds is once you get on these lists, those lists tend to be bought,

sold, and traded maybe on the dark web or elsewhere among the circle of

fraudsters, and so if you start getting calls from one, you know chances are

you'll be getting calls from others. So you know, if you haven't put your name

on the Do Not Call registry, if you haven't eliminated junk mail, those would

be a couple of good steps that you can take now to sort of turn down the volume

at least a little bit, but never respond to a cold call or a solicitation that

you didn't initiate yourself.

[00:13:34] HOST: Dan

always says avoid anyone offering guaranteed returns, anyone saying that

precious metal will not fluctuate during times of upheaval, and be wary of

anyone that doesn't tell you exactly where your coins are being held. Don't act

now. Avoid limited time offers or if they're being too pushy, and make sure

you're dealing with a registered broker.

[00:13:52] Dan

Rutherford: Now you can check that registration by going to SmartCheck.com, and

using the National Futures Association's basic database. You can look up, you

can type in the name of the person or broker or firm that you're dealing with,

and if they don't show up in the database, you know that that person is not registered,

and you probably shouldn't be doing business with them.

[00:14:16] HOST: Over

time and with a lot of research and talking to the right people, Grace was able

to get her money back, but she regrets falling for the advertising and the hard

sell.

[00:14:26] Grace: I'm

embarrassed to say, I have an MBA and all the top education that a person can

have, but street smarts and trusting and lack of wisdom about something that

you don't know really and you're just deferring to an expert, even though I

tried to do as best as I could to research this, I could never believe, based

upon the way it was sold to me, that this was a risky venture. Definitely read

the fine print. Do not just trust people for what they say and do your own

research, and just because you have high ethics, doesn't mean the other person

on the other side has high ethics.

[00:15:13] HOST: It

sounds like a lot for anyone to learn who's getting into it, so Grace, thanks

so much for talking to us today, we really appreciate it.

[00:15:19] Grace:

Thank you. I just hope I help a lot of people.

(MUSIC SEQUE)

[00:15:25] HOST:

Frank, I'm going to start with this one asking you about the dark web is

brought up. We haven't talked a lot about that. And the gentleman in the story

mentions that that's where lists can be bought and sold and I'm assuming that's

very true.

[00:15:40] Frank

Abagnale: Yeah, but it's a lot easier than that. To give you an example, you

know I live in a part of Charleston, South Carolina, by the zip code alone,

there are no homes in that zip code under a million dollars, okay? So really,

it's just a matter of me just simply getting that zip code and then finding out

what, who lives in that zip code area knowing that they're in an area of at

least a million dollar home, so there are people of substantial wealth that are

and that becomes my list of people to solicit.

[00:16:10] HOST: So I

don't necessarily have to be surfing around on the dark web.

[00:16:12] Frank

Abagnale: Not on the dark web to get that, you know that's very easy to find

out and there are lists you can buy of wealthy areas, wealthy neighborhoods,

wealthy people. You know, this is a lot of the old back to the scams of bait

and switch. I'm basically giving you, offering you something that's really not

what it truly is and then, or I switch it to something else. But we've had

cases where people have literally, actually bought gold coins, where the gold

coins are actually shipped to you certified, registered mail.

[00:16:41] HOST: So

they're not in a vault in...

[00:16:42] Frank

Abagnale: Yeah, they're not in a vault or in your house now, so I get the gold

coins, so I think, wow, this is great. I bought these here, they've arrived, I

look at them, they look beautiful.

[00:16:50] HOST: And

bite them, right, is that how people test gold.

[00:16:53] Frank

Abagnale: Yeah, I mean that doesn't work, but I mean I look at them, you know,

and I'm very impressed with them, come with all these certification papers and

all that, so obviously all I do is put it in my safe at home, or I might put it

in my safe deposit box at the bank, but then when the time comes for me to

actually sell them, it turns out that they're not real gold, that they're just

gold-plated or they're fake, and the papers that they sent me are fake.

[00:17:18] HOST: You’ve

been scammed.

[00:17:18] Frank

Abagnale: Yes, so all of this really comes down to again some common sense.

First of all, I'm not going to buy anything from anybody that's soliciting me

when it comes to me investing large sums of money. So if I get an email or I see

a pop-up ad or something like that, I'm not going to do business with that type

of company. I'm going to research out a legitimate company through my bank,

someone my bank may recommend, a company that they know, they've checked out,

they've done business with, my financial advisor. If I have a trusted financial

advisor. I'm going to deal with a legitimate, absolutely registered company,

that, that has some experience and background before I would go invest like

$200,000 into those companies, so again, you just start off by being,

understanding that I didn't, I'm not going to do business with someone that's

solicited me, that I know very little about or some ad I saw just because it

looks like an impressive ad online, or even on TV or radio until I've gone to

the proper people and asked and checked, and again, you can, you could call the

Commodities and Exchange, and they can tell you that's not a legitimate

company, not a registered company with us. We'd advise not doing business with

that company, or yes, ma'am, this is a very legitimate company, been in

business many years and we've never had any complaints from that company, so

again, you do a little research, but again, I'd be very leery about sending

anybody money and of course, as she mentioned, Grace mentioned, you need to do

your research, and you need to read the fine print because even if it's a legitimate

company, they may have ops in their fine print that allow them to devalue it or

to sell it to you at a lesser price, or charge some huge commission if you want

to get out early or you want to sell it early or something like that.

[00:19:06] HOST: So

this is a little different than say somebody calling you on the phone and

having a scam worked out, in that this is a legitimate business, gold and silver

is bought and sold, and it's been around a long time. But, and so it gets into

this sort of area where there may be very legitimate businesses doing it. There

may be some that while it's mostly legitimate, but maybe there's parts of it

that seem a little shady or a little fishy.

[00:19:32] Frank

Abagnale: Yeah, and there are many, many companies that are basically

legitimate companies with employees at those companies and they may even have a

little history, but they're not ethical business people, and so they purposely

have drawn up through very sophisticated lawyers, little things in there that

then are going to work against you, that they're going to make money off the

money you give them, and you're not going to get represented the way you

should. But that's because you didn't read the fine print and you signed it.

[00:20:02] HOST: So

we talked a lot about this outside of the show, at least I did in sort of

preparing. Do you consider that a scam?

[00:20:08] Frank

Abagnale: I consider it a scam, because they're basically scamming people they

knew up front that when they wrote those words in the contract that was the way

they were going to make money, and they were going to take people's money from

them, so it's very unethical, and you know, the bottom line is, as I remind

people all the time, and I know that people think this is simplistic, but when

you've dealt with fraud on the good side, as I have for 40 years, you realize

that we truly are living in a very, very unethical society. We don't teach ethics

at home. We don't teach ethics in school, because the teacher would be accused

of teaching morality, we don't teach ethics in the university, and we certainly

don't teach it in the workplace, so we have raised an entire generation of

people who have a lot of lack of character and ethics in their makeup, so doing

these kind of things, it's all about, how can I make money for me, and not

about whether it's right or it's wrong, and I think we're only going to see a

tremendous increase in more frauds like this until one day we wake up and

realize, you know what, we really need to bring character and ethics back into

the home, back into the school, back into the university. I've had three sons

go to graduate school. Only the one that went to law school had a course

offered on ethics. And that's ridiculous that we've come to that point. This

has nothing to do with religion. This is strictly right and wrong, so if you

don't teach it to someone somewhere along in their lifetime, they're going to

go down that unethical path.

[00:21:37] HOST: It's

interesting you bring that up and actually there's another podcast that's out

of Australia that we've shared with our son, and it's all about ethics, but I

think before we listen to that, the word "ethics" is probably one we

hadn't discussed much. He's still relatively young and so it might not make

sense, but it really is up to parents right now in the home to be able to pass

these ideas of ethics, ethical behavior along.

[00:22:00] Frank

Abagnale: A number of years ago, I wrote a code of ethics. I put it on my

website under publications. Today 3,000 U.S. companies my code of ethics,

because I say to those companies when I lecture to them, that it is very important

that you have a code of conduct and a code of ethics so that when you hire

someone, you're saying to them, this is what we believe, this is what we

practice, and this is what we expect you to practice and believe, and you

instill that in them on an annual basis, where the CFO or the CEO goes over our

ethics. And I wrote it in very simple terms, it's not long, it's one sheet. It

has a blank space so you can fill in your company's name, and I tell people,

feel free to edit it to add to it if you don't like something in it or you want

to put something in it, but absolutely, please make sure that your employees

have a code of ethics and is a part of their job.

[00:22:47] HOST: And

it becomes of the company culture.

[00:22:50] Frank

Abagnale: Right, absolutely.

[00:22:52] HOST: We'd

like to welcome Jen Beam back to the podcast. She is with the Fraud Watch

Network and manages the very active and interesting Fraud Watch Network

Facebook page. Jen, how are you?

[00:23:01] Jen Beam:

Hi Will.

[00:22:46] HOST:

Vacation rental scams are a kind of a hot area, right? Craig's List, people

posting vacation places that either maybe don't exist or they don't own?

[00:23:11] Jen Beam:

Absolutely. You know, especially if folks are like me and maybe not as

organized and do some last minute searching for some deals, you really are at

risk. Especially for those too good to be true vacation rentals, so if you see

a picture of some amazing cottage and you know, at rock bottom price, chances

are it's not a real deal.

[00:23:36] HOST: So

what are people doing? So like say on Craig's List, they'll say, oh I've got a,

you know an amazing place. The price is unbelievable. And then you're putting

down a deposit or something, or how are they, what's the scam?

[00:23:47] Jen Beam:

Yeah, so one of the things that we're seeing is that folks will, you know the

posting with have an excuse for having to drop the price, you know, so normally

I rent this for $3000 a week, but I just had a last minute cancellation, so that's

why I'm offering it for you know 500 bucks. They need a deposit, or they need

you to pay in full because it's such a low price, and they disappear. There's

actually no, that's a fake picture and that guy has taken off with your money.

You really have to slow down, go through, really try to you know look carefully

before you click that button.

[00:24:24] HOST:

Alright, so as you plan your next vacation, heed that warning and take Jen's

advice. Jen Beam, with the Fraud Watch Network and the Fraud Watch Network

Facebook page, where can people learn more?

[00:24:36] Jen Beam:

Yes, so Facebook.com/fraudwatchnetwork, we post daily there. We also have a

website, AARP.org/fraudwatchnetwork and post scam alerts, videos, blogs, all

sorts of good stuff that helps folks protect themselves from scams and frauds.

[00:24:52] HOST:

Alright, safe booking out there. Thanks again, Jen.

[00:24:53] Jen Beam:

Thanks, Will.

(MUSIC SEGUE)

[00:24:57] HOST:

Frank, I'm not going to let you get away without a little more chat about the

dark web. I've heard at one point that 90 percent of web traffic is on the dark

web. I think people are fascinated by it.

[00:25:06] Frank

Abagnale: YEs, and there's a lot of information but you know, we still monitor

chatrooms at the FBI Academy, so when agents go through their 20 weeks of

training they, they get to monitor these chatrooms that have been around for

years and when I do AARP seminars, and I actually show people the chatrooms and

the information that's being given away on them, and when you look at the

screens going by, these are scrolls that go by, they're selling all kinds of

information, mother's maiden name, bank information, driver's license numbers,

Social Security numbers, security questions you would be asked if you were trying

to access your account. It's just a tremendous amount of information, so it's

not new, it's just the dark web has even a lot more information than chatrooms

do, and that the information is traded and I remind people all the time that

information is money, and so people make a lot of money with data and

information and it's very valuable, like gold or like cash. The problem today

is unlike 25 years ago, is crime now is so global because of the internet, so

you're dealing with criminals thousands of miles away in India, Pakistan,

Afghanistan, China, India. So it's very difficult for law enforcement, so even

if you track something back and say, I know this is being perpetrated out of

this apartment in Moscow, you can't go to Moscow and arrest them, so you have

to hope you go get the cooperation of the Moscow police, the Russian police to

actually go and do something, and they're not going to do that unless it

benefits them somehow, or that person is perpetrating crimes against, against

them. So thought they don't really endorse these crimes, they tend to look the

other way unless it's affecting their society and their government.

[00:26:48] HOST:

Right. A complicated web, a global web. Frank Abagnale is one of the world's

foremost experts on the topic of fraud, scams, and also my cohost here, and the

AARP's Fraud Watch Network Ambassador. So thanks, as always, for joining us.

[00:27:03] Frank

Abagnale: Thanks, Will. Great being with you.

[00:27:05] HOST: For

more information and resources on how to protect yourself from becoming a

victim of a scam, visit AARP's Fraud Watch Network website,

AARP.org/fraudwatchnetwork.

[00:27:16] HOST:

Alright, I'd like to thank producers, Julie Getz and Brook Ellis. Our audio

engineer, Julio Gonzales, and of course, my cohost, Frank Abagnale.

[00:27:24] Frank

Abagnale: Thanks, Will.

[00:27:24] HOST: And

be sure to subscribe, download, rate, and of course, like our podcast on Apple

Podcast or wherever you find your favorite podcasts.

END OF TRANSCRIPT

Next Episode

Episode 5: Tracy's Romance Scam

Find out what happens to Tracy when she gets scammed after making a connection with a widower online.