AARP Hearing Center

After you enroll in Medicare, you need to think about your prescription drug coverage.

Medicare doesn’t automatically cover prescription drugs, but you have two options. If you have original Medicare, you can sign up for a stand-alone Part D plan from a private insurer. Or you can get both medical and drug coverage from a private Medicare Advantage plan.

Unless you have other comparable drug coverage — from a current employer, a former employer or Tricare — you’ll need to sign up for coverage within a certain time. If you miss your deadline, you’ll have to pay a late enrollment penalty.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

If you don’t have creditable coverage, the best time to sign up for a Part D plan is during the seven-month initial enrollment period surrounding your 65th birthday — even if you don’t take daily medications now.

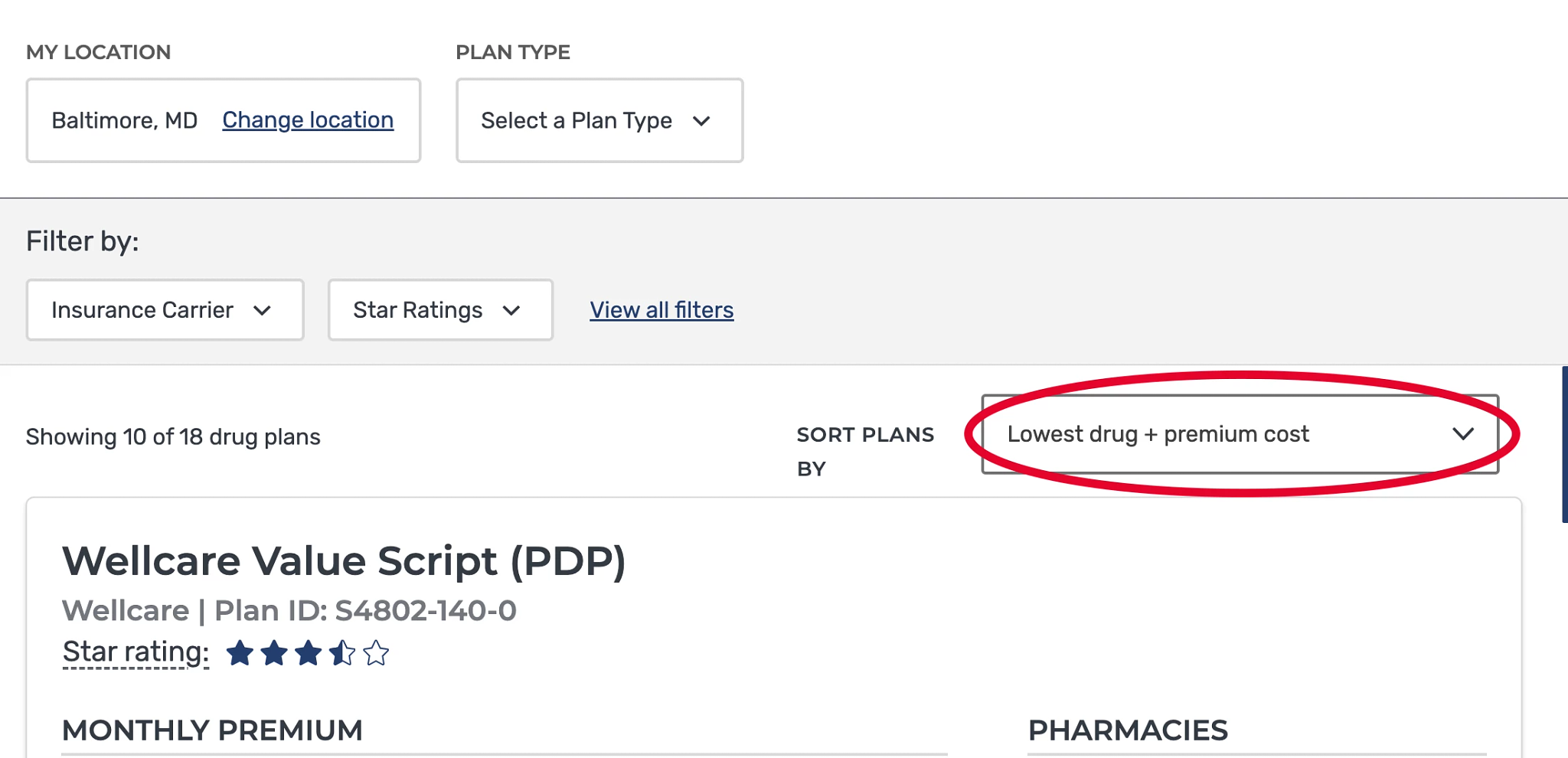

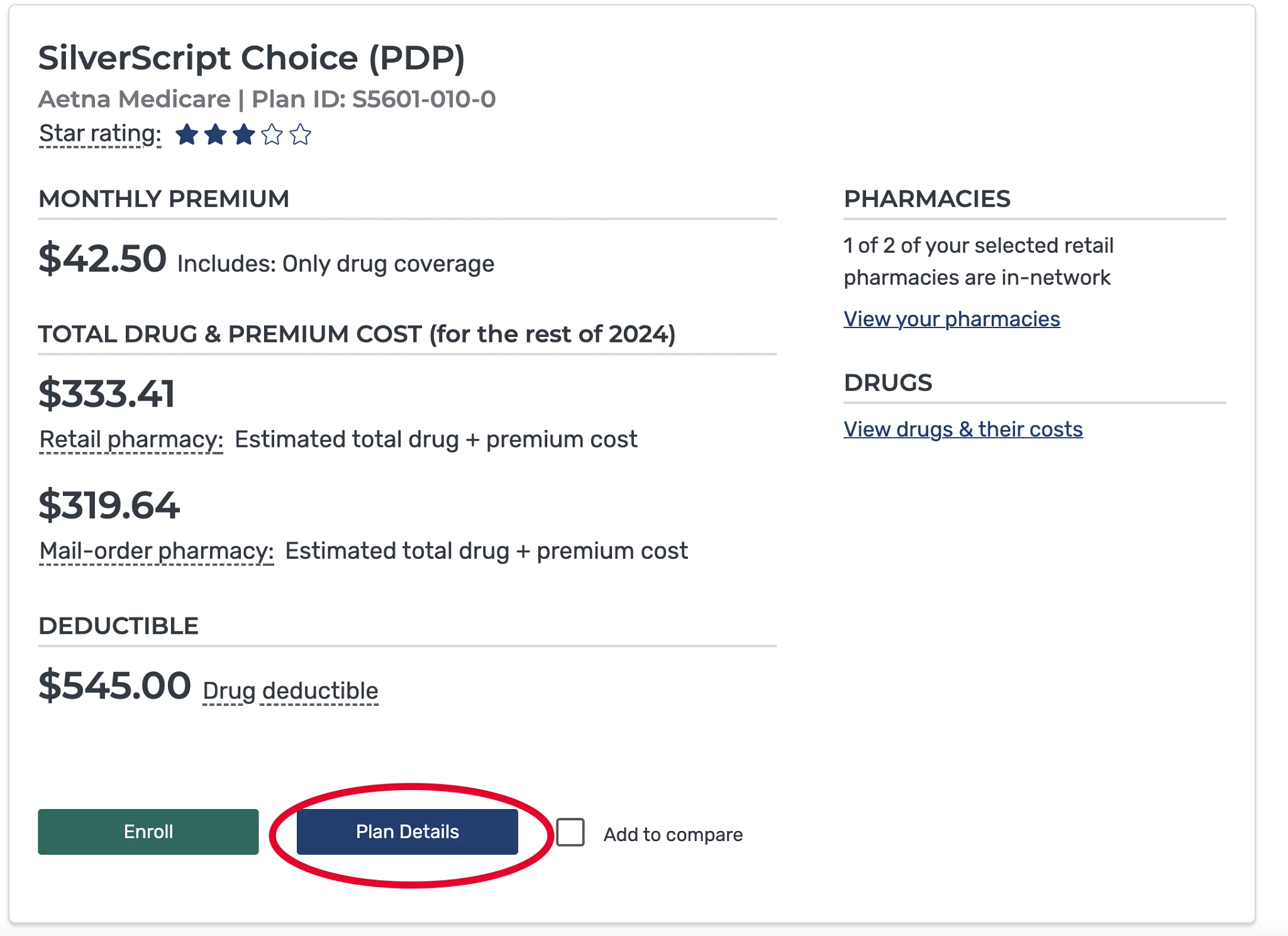

The average Medicare beneficiary has 24 stand-alone Medicare Part D plans to choose from. When choosing a Part D plan, look at premiums, as well as coverage for your prescriptions. A plan with low premiums may cost you more by the end of the year if it charges high copayments for your medications.

But Part D plans can change their costs and covered drugs annually. So it’s a good idea to compare your options during open enrollment every year, which runs Oct. 15 to Dec. 7 for new coverage starting Jan. 1.

7 steps to sign up for a Part D plan

The best way to compare Part D plans offered in your area is to use Medicare’s Plan Finder tool. Here’s a step-by-step guide.

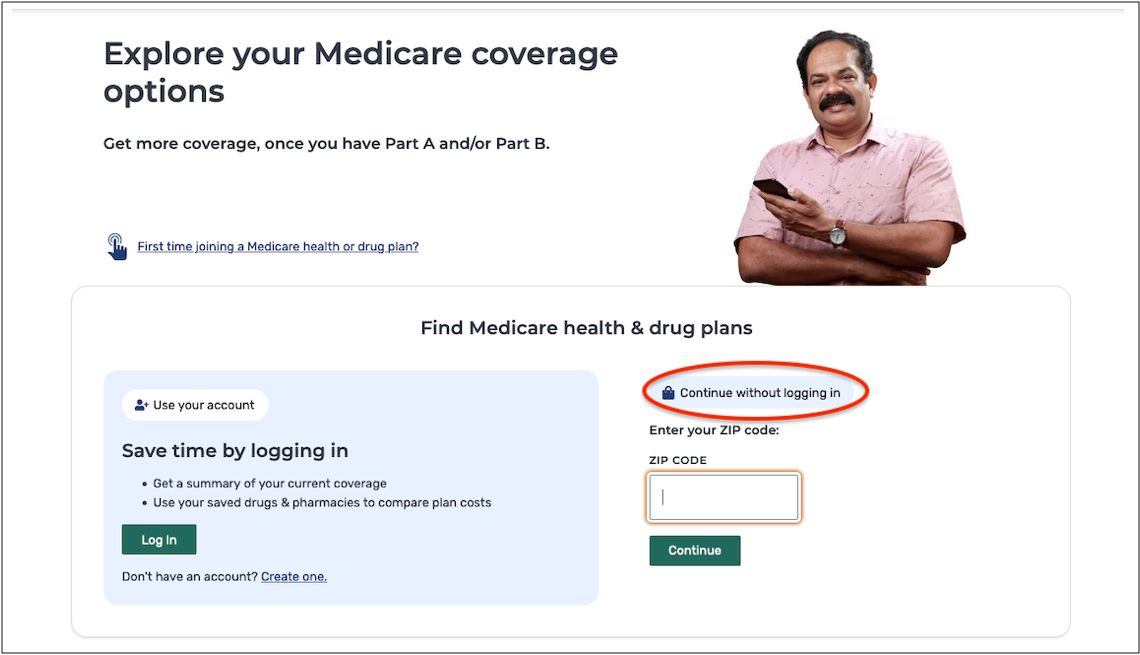

1. You have two options: Use your online Medicare account or click Continue without logging in and enter your ZIP code. You may also be asked to select your county. Click on Medicare Drug Plan (Part D) | Find Plans.

2. Indicate if you get help with your medical expenses. If you’re not sure, you can find out by logging in to your Medicare account.

3. If you don’t receive financial help, you’ll be asked if you want to see your drug costs when you compare plans. Click Yes, so you can get a sense of how much you would spend with each plan.

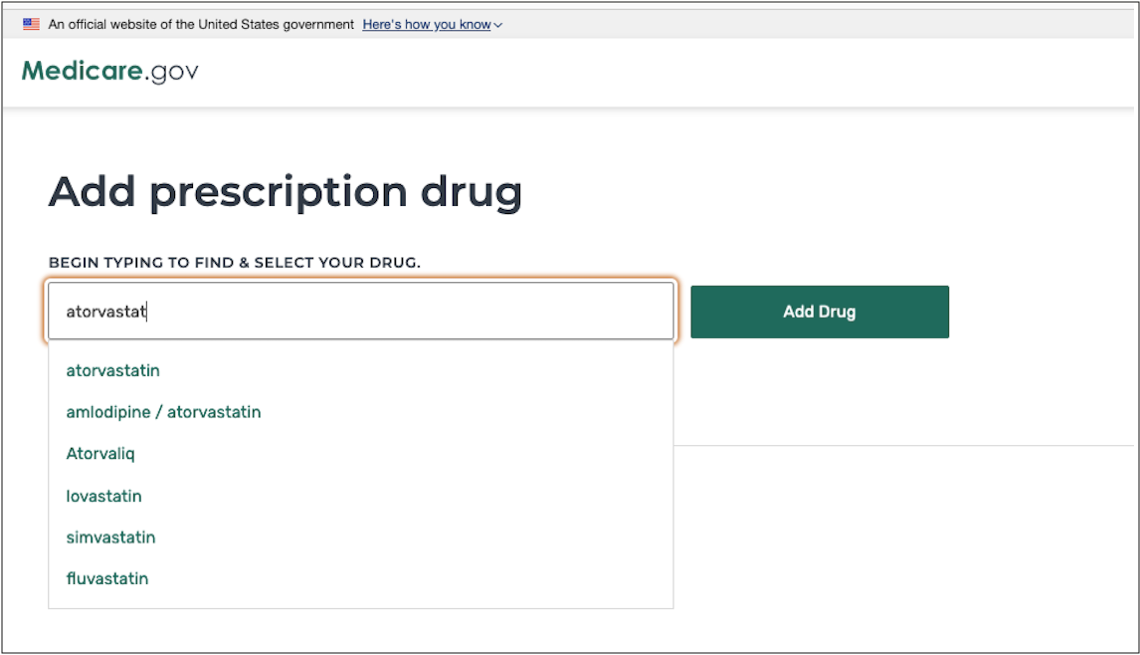

4. Enter the names of your medications. Be sure to include ones you take regularly, so you’ll get a good estimate of ongoing costs. You’ll also need to select the dosage and quantity and indicate how frequently you need to refill your prescriptions. To add another medication, click Add Another Drug. When you’re finished, click Done Adding Drugs.

5. Next, choose up to five pharmacies to fill your prescriptions. Many plans charge lower copayments for preferred pharmacies. You can see how plans work with your pharmacies and copayments for each plan. Enter your pharmacy names or search by your address or ZIP code. When you’re finished selecting pharmacies, click Done.

More on Health

When 9 Biggest Medicare Changes Under New Rx Law Go Into Effect

A year-by-year implementation timeline of the Inflation Reduction Act’s health provisionsHow Much Does Medicare Cost?

Monthly premiums, other out-of-pocket expenses can add up

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices