AARP Hearing Center

For more than 10 years after Kate Kleinert lost her husband to cancer, she had ruled out dating, because “I still considered myself married.”

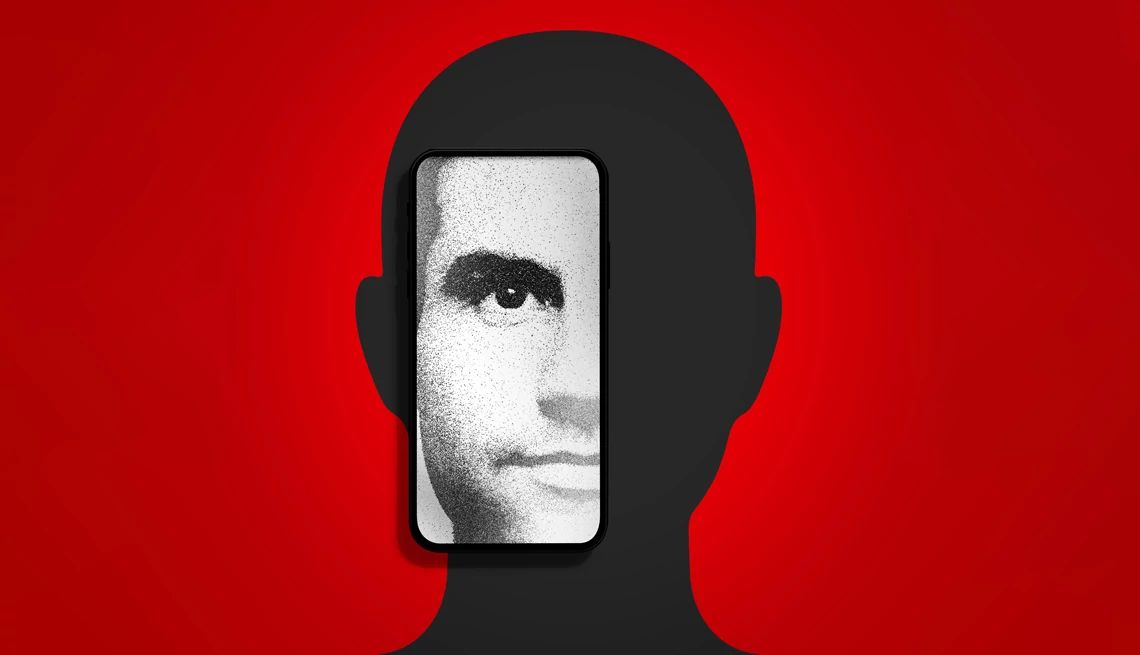

The suburban Philadelphia woman had a change of heart in August 2020, when a handsome “surgeon” asked to be her Facebook friend. Soon he became romantic and professed his love. “Since the time I fell in love with you, I can’t stop thinking about you,” he told her. “I can only see my future with you. I will never stop loving you. I pray that I will always wake up next to you and hold you in my arms forever.”

But there was no love and no forever.

She ended up losing everything she owned — including her home — in a coldhearted scam that played on her emotional vulnerability and kindness. But she didn’t stay down: Eventually, she rose from the wreckage, determined to help others recognize signs of fraud and prevent further victims.

The scam begins: A surgeon in a faraway land

Kleinert was married for 26 years. She quit her secretarial job to care for her husband, Bernie, during the last two years of his life, until his death in 2009. Her no-dating approach to widowhood fell by the wayside after her new Facebook friend, “Tony,” entered her life in 2020. He said he was a Norwegian surgeon working for the United Nations in Iraq, had two children and shared Kleinert’s interest in dogs and gardening.

At his suggestion, they started communicating on Google Hangouts, talking and texting many times a day. Moving toward romance very quickly, Tony said his kids were in an English boarding school and asked if they could call her “Mom.” Never having children, she said that was the “Achilles heel” that made her vulnerable.

Later, his “daughter” texted to ask for funds to buy feminine products. Kleinert sent her a gift card, unwittingly opening the floodgates for more requests for money.

A red flag: Never meeting in real life

Though the two never met in person, Tony talked about marriage, said he purchased a ring and asked her to look for a house for them near where she lived. All the while, he kept prodding her for gift cards — and promising he’d repay her. He even provided her with a password for a purported bank account with a $2 million balance.

The two were to meet for the first time in December 2020; he said he’d fly to Philadelphia International Airport. She had her hair and nails done and waited at home in her best dress for his call. A bottle of wine was chilling. Hours passed, without a word from him.

A day later, Kleinert got a call from a man who claimed to be a lawyer saying Tony had been arrested at the airport because someone planted drugs in his luggage. Tony was said to be confined to a Philadelphia jail and needed $20,000 for bail— money she did not have. Later, Tony called and messaged to urge her to get the money somehow, even if it meant lying to her family. She refused. But her reservations melted away when he complained about the “awful” food in jail and asked for small sums, which she sent.