What You Need to Know About the Medicare Insulin Cost Cap

Answers to common questions, including the July 1 implementation for pumps

One of the first provisions to take effect of a new law designed to cut prescription drug costs for tens of millions of Medicare enrollees is a $35-a-month cap on out-of-pocket costs for insulin covered by Part D prescription drug plans and Medicare Advantage (MA) plans that include drug coverage.

Here are answers to common questions about this new Medicare benefit:

Q: Does it matter whether I have Type 1 or Type 2 diabetes for me to be eligible for this benefit?

A: No. As long as the insulin your doctor prescribes is covered by the Medicare drug plan you have, you won’t have to pay more than $35 a month for that medicine.

Q: Does it matter which insulin I take?

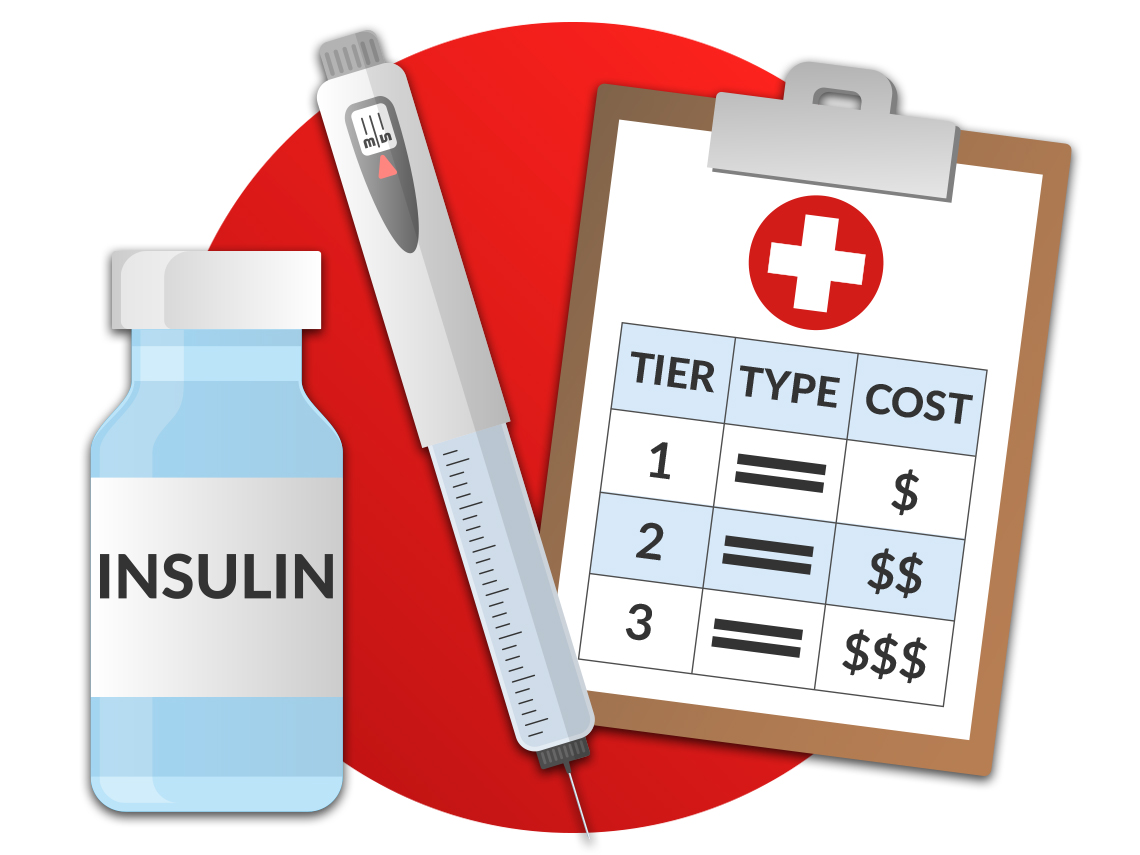

A: Yes. Not every Medicare plan covers every insulin. If the insulin you have isn’t covered by your Medicare Part D or Medicare Advantage plan, you might want to ask your provider if you can be switched to one that is covered. There are more than 70 insulins on the market, and there are different categories of insulin that you may be prescribed depending on the type of diabetes you have and other health and lifestyle factors.

Q: Does it matter how I take my insulin?

A: Only in terms of when the benefit takes effect. For Medicare enrollees who take their insulin using a vial and syringe or a prefilled pen, which is typically covered under a Part D or an MA plan, the out-of-pocket cap took effect on Jan. 1, 2023.

If you get your insulin via a pump, that is covered under Medicare Part B (which pays for doctor visits and other outpatient services). The copay insulin cap for Part B takes effect on July 1, 2023.

Q: What if I get my insulin via a pump?

A: That is covered under Medicare Part B (which pays for doctor visits and other outpatient services) and the copay insulin cap for Part B takes effect on July 1, 2023. Your insulin copay will be capped at $35 and the Part B deductible will not apply.

Q: What if I have other expenses associated with my diabetes, such as pills or injectables that aren’t insulin and test strips. Does the cap cover those?

A: No. The $35 copay limit only applies to insulin. How much you pay for other medicines and supplies, such as test strips or glucose monitors, depends on what Part D or Medicare Advantage plan you have.

Q: I signed up for drug coverage before learning about this new benefit. Is there anything I can do to change plans in 2023 and get a better deal for all my medicines now that I know about this copay limit?

A: Yes. Because the law creating the cap was signed in August 2022, after premiums and copays for Part D and Medicare Advantage plans were set, the Centers for Medicare & Medicaid Services (CMS) established a Special Enrollment Period so beneficiaries can recheck their prescription plans to see if they can get a better deal. You have until Dec. 31, 2023, to make a change.

Q: How can I get help figuring out if I can get a better deal?

A: Two ways. You can call the Medicare hotline at 800-MEDICARE (800-633-4227). That line is staffed by Medicare representatives seven days a week, 24 hours a day. You can also reach out to the State Health Insurance Assistance Program (SHIP). Each state has one that features SHIP counselors who can walk you through the details of the plan you have and what other plans might be available that can save you money. They will contact the Medicare representatives for you and make the switch.

Q: I already paid my copay for January and February, and it was more than $35. Can I get a refund?

A: Yes, insurers have until March 31 to make sure their systems include the $35 copay cap, so their members are charged the right amount. If you have already paid and were charged more than $35 for qualifying insulin, you should contact your plan. The plans have 30 days to refund you the difference between what you paid and the $35 limit.

Editor's note: This article was originally published on Feb. 10, 2023. It has been updated with new information.

Dena Bunis covers Medicare, health care, health policy and Congress. She writes the “Medicare Made Easy” column for the AARP Bulletin. An award-winning journalist, Bunis spent decades working for metropolitan daily newspapers, including as Washington bureau chief for The Orange County Register and as a health policy and workplace writer for Newsday.