01PREVENTS LOSS

AND SAVES MONEY

02CREATES STRONGER CUSTOMER RELATIONSHIPS AND TRUST

03 IMPROVES EMPLOYEE MORALE AND PERFORMANCE

04 INCREASES BRAND DISTINCTION AND REDUCES REPUTATIONAL RISK

AARP BANKSAFETM INITIATIVE

Become a financial superhero.

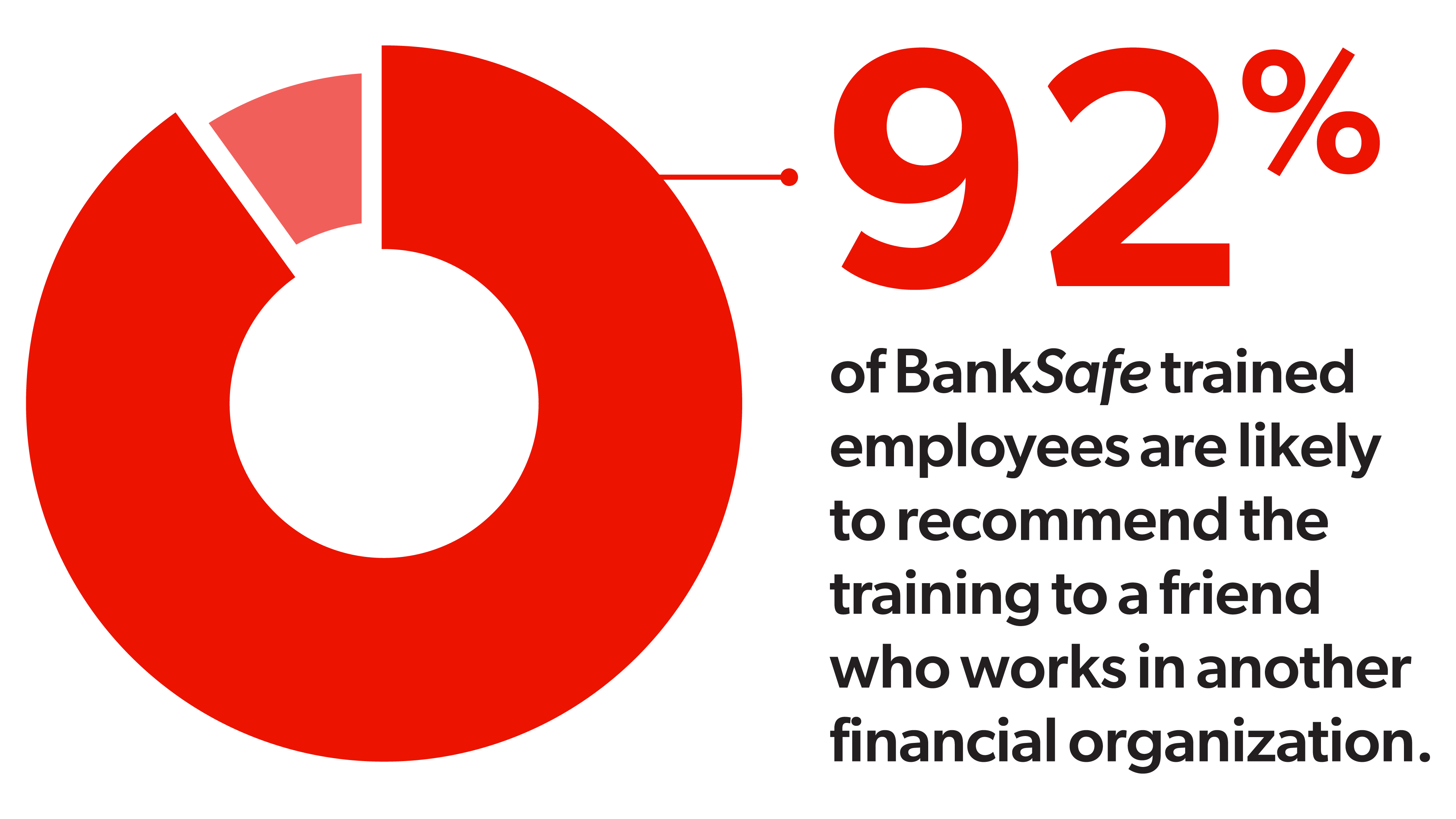

BankSafe-trained financial organizations have protected more than 150 million consumers and saved more than $200 million from exploitation.

Get to know BankSafe.

The BankSafe Initiative helps financial organizations better safeguard the hard-earned assets of their consumers with a three-pronged approach.

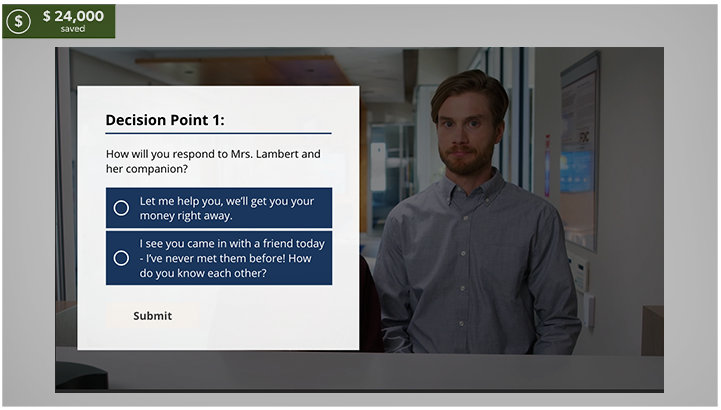

FREE TRAINING & EDUCATION: AARP's BankSafe combines industry knowledge and experience with a state-of-the-art online learning experience. The training equips employees with the skills necessary to identify potential exploitation and take the right actions to stop it—saving millions of dollars. REGISTER >

INTERVENTIONS THAT WORK: AARP asked more than 2,000 BankSafe participants to share the most effective action steps involved in instances of suspected exploitation. This research-backed approach differentiates BankSafe from other financial exploitation trainings. LEARN MORE >

RESEARCH THAT MATTERS: AARP has interviewed thousands of experts on approaches to working with the 50+. We have studied BankSafe's effectiveness, the true cost of financial exploitation, as well as promising practices to spot and stop it. EXPLORE RESEARCH >

The BankSafe difference

The BankSafe

difference

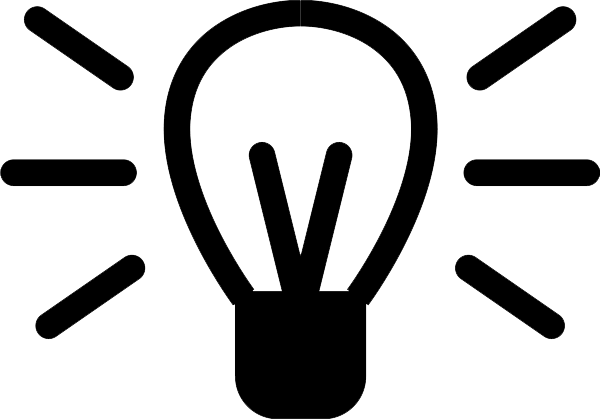

The BankSafe training platform shows frontline employees how to spot—and, more importantly, stop— financial exploitation.

BankSafe's core features differentiate it from other exploitation prevention

training

solutions on the market. Plus, it's free for all financial organizations that use it.

LEARN

MORE >

01PREVENTS LOSS

AND SAVES MONEY

02CREATES STRONGER CUSTOMER RELATIONSHIPS AND TRUST

03 IMPROVES EMPLOYEE MORALE AND PERFORMANCE

04 INCREASES BRAND DISTINCTION AND REDUCES REPUTATIONAL RISK

Real stories. Real money saved.

See how we've helped these financial organizations better protect their consumers.

BankSafe Training in Action: One Massachusetts bank's inspirational

story

Hear from the teller who raised the red flag and saved one customer nearly $30,000.

“Protecting senior investors from financial exploitation is a top, long-term priority for SIFMA. We are pleased to be working with AARP to offer BankSafe to our broker-dealer members as they work to help protect their aging client base."

Kenneth E. Bentsen, Jr.,

SIFMA President & CEO

BankSafe Training in Action: Superhero moment for Pennsylvania

bank

Hear from the staff members who jumped in and protected their customer.

“Our frontline staff are more confident knowing how to handle and approach suspected exploitation situations involving seniors because of their BankSafe training. We all have to be vigilant in protecting our seniors and their finances. At Suncoast Credit Union, we welcome any programs that can assist us in these efforts, and the AARP BankSafe training has been incredibly helpful!"

Donna Moses, Member Victim Advocate

Suncoast Credit Union

Ready to earn the BankSafe Trained Seal?

Banks, credit unions and investment firms in good standing can apply for the seal

if

they confirm that at least

80% of their frontline staff completed the BankSafe training and

they

have a policy to report financial exploitation.