AARP Hearing Center

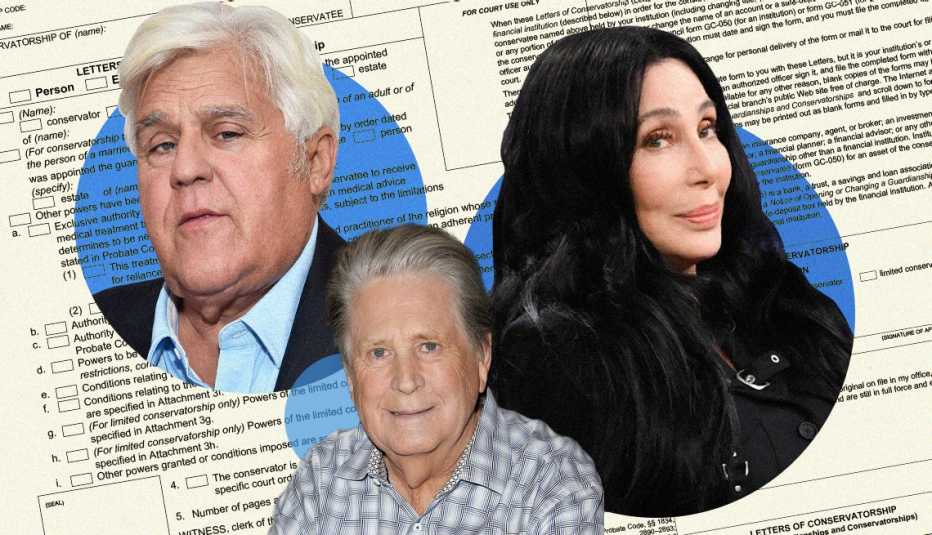

Beach Boys legend Brian Wilson has been placed under a conservatorship following a May 9 ruling in Los Angeles. Superior Court Judge Gus T. May found “from clear and convincing evidence that a conservatorship of the person is necessary,” and noted that the musician “consents and does not object.” Original filings said that Wilson suffered from a “major neurocognitive disorder (such as dementia).”

Wilson’s longtime business manager, LeeAnn Hard, and manager-publicist, Jean Sievers, will serve as conservators; they have been ordered to consult with Wilson’s children regarding all material related to health care decisions, according to court filings obtained by People magazine.

Wilson’s family filed for conservatorship in February following the Jan. 30 death of his wife, Melinda Wilson, 77, who, according to documents, had been assisting him with his daily physical needs.

Wilson, 81, is the latest celebrity to bring focused attention on conservatorships, a legal arrangement that’s an option when a person is incapacitated and unable to make important decisions by themselves. Former late-night TV host Jay Leno made news in January when he petitioned a Los Angeles court to make him the conservator of his wife, Mavis, who has dementia.

In a conservatorship in California — in many states, they’re called guardianships — a court gives someone, often a family member, the authority to control another person’s affairs and make decisions for him or her.

“Someone who’s filing for it says, ‘My mother is no longer able to take care of her finances or manage her affairs, and she needs help,’” says Joan Burda, an adjunct professor of law at Case Western Reserve University and a practicing attorney who specializes in estate planning and probate.

Here are some more of the basics of what a conservatorship is, and how it works.

What is the purpose of a conservatorship?

A conservatorship is intended to safeguard the conservatee, the legal term for the person who is giving up control. In the case of an older person, the situation may be that “you have an adult who has no ability to care for themselves, or provide for their needs for housing, food and clothing, or to resist fraud,” says attorney Chris Melcher, a partner at Walzer, Melcher & Yoda in Woodland Hills, California. “And that is a persistent condition. They don’t have the capacity to protect themselves and make their own decisions, so now somebody else needs to step up.”

More From AARP

8 Major Health Risks for People 50 and Older

A look at the top killers — and how to dodge them

6 Tips on Caregiving from Actress Yvette Nicole Brown

The ‘Community’ and ‘Mayor’ star is advocating for paid time off and moreDon’t Let Family Caregiving Ruin Your Financial Future

8 ways to protect your money while caring for a family member or friend

Managing a Loved One's Money

What caregivers need to know about taking care of someone else's finances

Recommended for You