AARP Hearing Center

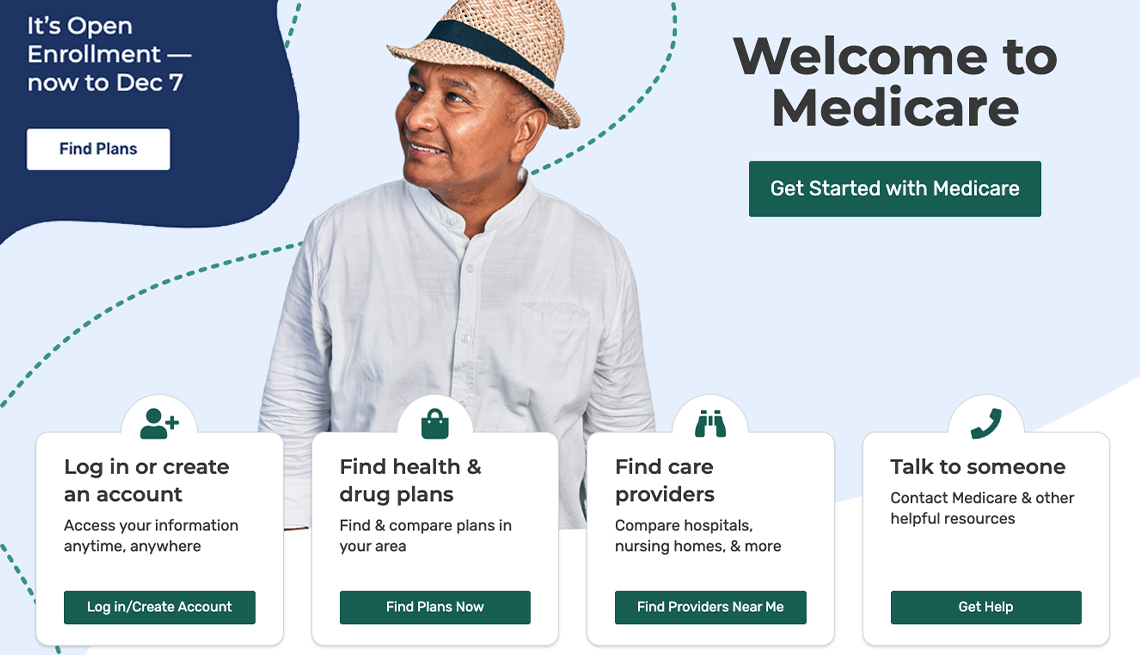

Medicare is complicated and can be confusing. To make it easier, the program has been broken into four parts that include coverage for everything from hospital care to doctor visits to prescription drugs.

Part A — Hospital coverage

When you apply for Medicare, you will automatically be enrolled in Part A. It covers hospital stays, hospice care and some skilled nursing care that you may need after being hospitalized for a stroke, a broken hip or other episodes that require rehabilitation. Most people don’t have to pay a premium for Part A. You’ve already paid into the system in the form of the Medicare tax deductions on your paycheck.

However, Part A isn’t totally free.

Medicare charges a hefty deductible each time you are admitted to a hospital. It changes every year, but for 2024, the deductible is $1,632. You can buy a supplemental or Medigap policy to cover that deductible and some out-of-pocket costs for the other parts of Medicare.

Medicare pays for virtually all hospital services for the first 60 days you’re in the hospital. There are some exceptions — it won’t pay for a private room, for example.

If you are a U.S. citizen or permanent resident and have not worked long enough to qualify for Medicare, you may able to buy into the program by paying a Part A premium.

Part B — Doctor and outpatient services

This part of Medicare covers doctor visits, lab tests, diagnostic screenings, medical equipment, ambulance transportation and other outpatient services. Unlike Part A, Part B involves more costs, and you may want to defer signing up for it if you are still working and have insurance through your job or are covered by your spouse’s health plan. But if you don’t have other insurance and don’t sign up for Part B when you first enroll in Medicare, you’ll probably have to pay a higher monthly premium for as long as you’re in the program.

The federal government sets the Part B monthly premium, which is $174.70 for 2024. It may be higher if your income is more than $103,000.

You’ll be subject to an annual deductible, set at $240 for 2024. And you’ll have to pay 20 percent of the bills for doctor visits and other outpatient services. If you are collecting Social Security, the monthly premium will be deducted from your monthly benefit.

Part C — Medicare Advantage

Medicare Advantage is the private health insurance alternative to the federally run original Medicare. Think of Advantage as a kind of one-stop shopping choice that combines various parts of Medicare into one plan. If you decide on a Medicare Advantage — or MA — plan, you’ll still have to enroll in parts A and B and pay the Part B premium. Then, in addition, you will have to choose a Medicare Advantage plan and sign up with a private insurer.

More on Medicare

The Big Choice: Original Medicare vs. Medicare Advantage

Which path you take will determine how you get your medical care — and how much it costs

Does Medicare Cover All the Costs for My Health Care?

No. You will have various out-of-pocket expenses

10 Common Medicare Mistakes to Avoid

Errors can prove costly to new enrollees