AARP Hearing Center

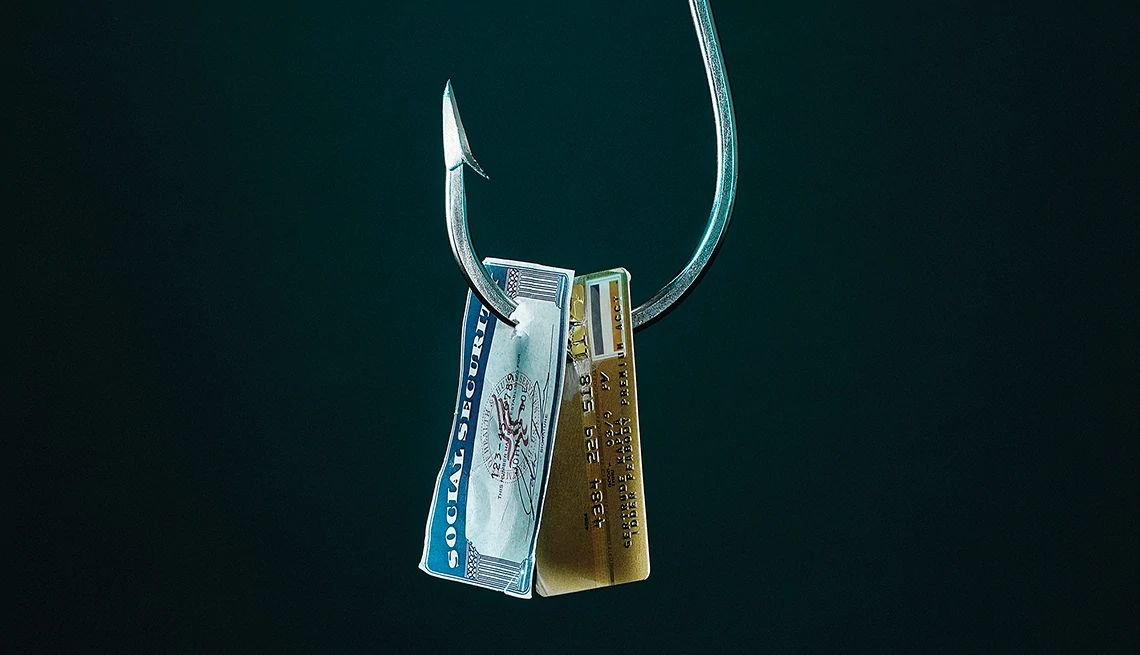

Scammers are very active these days as more and more of our payments and purchases go digital. And the military community is particularly at risk.

Last year, the Federal Trade Commission found that con artists stole $477 million from veterans, military personnel and their spouses. That was a $63 million increase compared to 2022. According to a 2022 poll by cybersecurity company Aura, 7 in 10 military vets and active-duty servicemembers have been victims.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

With a little knowledge, you can avoid this fate. Here’s what to look out for:

Veterans benefit scams

Scammers know that veterans are eager to get all the VA benefits they’re entitled to, and they use that desire against fraud victims. A scammer may tell you that you’re entitled to new or different benefits. They’ll direct you to call back to start an application and then will solicit personal information.

How to avoid: Be suspicious of unsolicited messages from anyone proposing to help you get VA benefits, especially if the caller seems urgent. Contact the VA via official channels to discuss your benefits.

Mortgage scams

Home buyers and homeowners should be alert to mortgage-related scams. There are a variety of scams in this space. In one example, a scammer might contact you saying they represent the VA or your home loan servicer and offer to help you refinance for a fee. Or a scammer might contact you with an offer for a “VA reverse mortgage,” which does not exist.

Subscribe Here!

You can sign up here to AARP Experience Counts, a free email newsletter published twice a month.

How to avoid: Never send money to anyone offering you a mortgage-related product or service if you did not initiate the process with a trusted provider. Research any unfamiliar products or companies before embarking on mortgage-related activity.

IRS scams

Scam artists play on people’s anxiety about taxes by posing as IRS officials and asking for money. They might contact you by phone, email or text, saying that you owe taxes. They will instruct you to send the money in a particular way, typically with a sense of urgency.

How to avoid: If you receive a voicemail, email, or text from an IRS agent, ignore this message. The IRS will typically only contact you by letter through regular mail. The IRS may occasionally call a taxpayer, but not until they have already sent multiple notices by mail.

More From AARP Experience Counts

The Simple Advice That Led Gregory Gadson Through the Military

A meeting in 1993 provided inspiration and a plan, which led to salvation when crisis hitShe Helped Pave the Way for Women in Combat

Sheila Chewning worked intercepting enemy planes during Desert StormAn Emotional Return to Vietnam Battlefields

Veterans are leading poignant tours to help their brothers connectRecommended for You