AARP Hearing Center

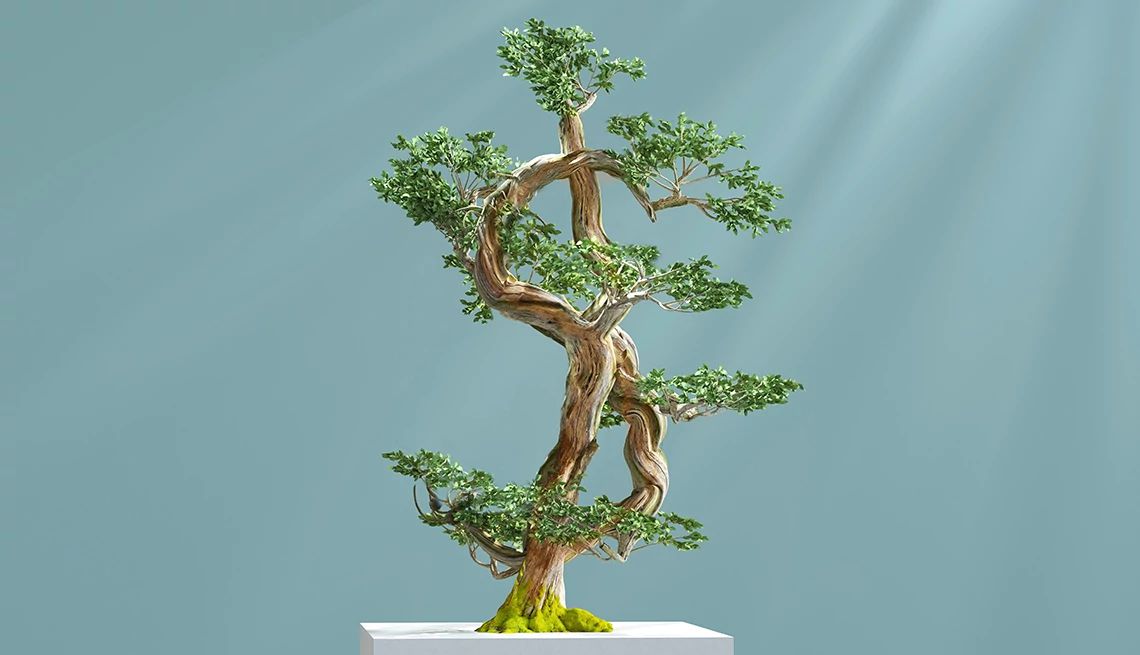

Saving for retirement is about more than growing your nest egg: It’s also about gaining an edge when it’s time to take your money out. And that’s where the Roth IRA shines.

The Roth IRA is an individual retirement account that comes with perks that traditional IRAs don’t offer. The biggest benefit of the Roth IRA is how tax-friendly it is. Although you can’t take a tax deduction on Roth IRA contributions, the money you sock away grows tax-free and also comes out tax-free, provided you follow the withdrawal rules. A Roth IRA will give you a tax-free income stream in retirement. You can keep more of what you earn.

Retirement savers are getting the message. The percentage of U.S. families with assets in a retirement account grew from 50.5 percent in 2019 to 54.3 percent in 2022 and a sharp increase in Roth IRA ownership was a key factor, according to a June 2024 study by the Employee Benefit Research Institute.

“Having sources of tax-free income in retirement makes more of your retirement dollars available for lifestyle expenses,” says Rob Burnette, chief executive officer at Outlook Financial Center in Troy, Ohio. “The old adage ‘It isn’t what you make that is important, it’s what you keep’ certainly applies to the Roth IRA.”

Another major benefit: You don’t have to take required minimum distributions (RMDs). The IRS requires holders of traditional IRAs to start taking RMDs by April 1 of the year after they reach age 73. With a Roth IRA, your money has more time to grow tax-free.

“Since RMDs are never required in Roth IRAs, this enables better control of your retirement account drawdown rates and easier tax planning during retirement,” says Kelly Gilbert, owner and fiduciary investment adviser at EFG Financial in Grand Rapids, Michigan. “Contrast that to a traditional pretax IRA which mandates RMDs at a certain age: This drawdown rate and excess taxation can drain traditional IRA accounts faster than planned, and no one wants to run out of money.”

That extra time you gain by not having to take withdrawals means both your principal and your earnings can take advantage of compounding, which has the power to transform a humble account balance into a much more sizable one if financial markets rise in value, Gilbert says.

“If you retire at 62 with $100,000 in your Roth IRA, 10 years later it may be worth $250,000, and 20 years later nearly $675,000,” says Brandon Reese, lead financial adviser at Harvest Wealth Group in Exeter, California.

Contribution limits

For the 2024 tax year, the maximum contribution is $7,000, or $8,000 for those 50 or older who take advantage of the $1,000 catch-up contribution. You can contribute to a 2024 Roth IRA until the April 15 tax filing deadline in 2025.

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)

More From AARP

Is a Roth 401(k) Right for Your Retirement?

What to know about after-tax workplace savings plansWhen Should You Claim Social Security Early?

Waiting boosts monthly payment but isn't always feasibleAARP Retirement Calculator

Do you have enough money to retire?

Recommended for You