In the News

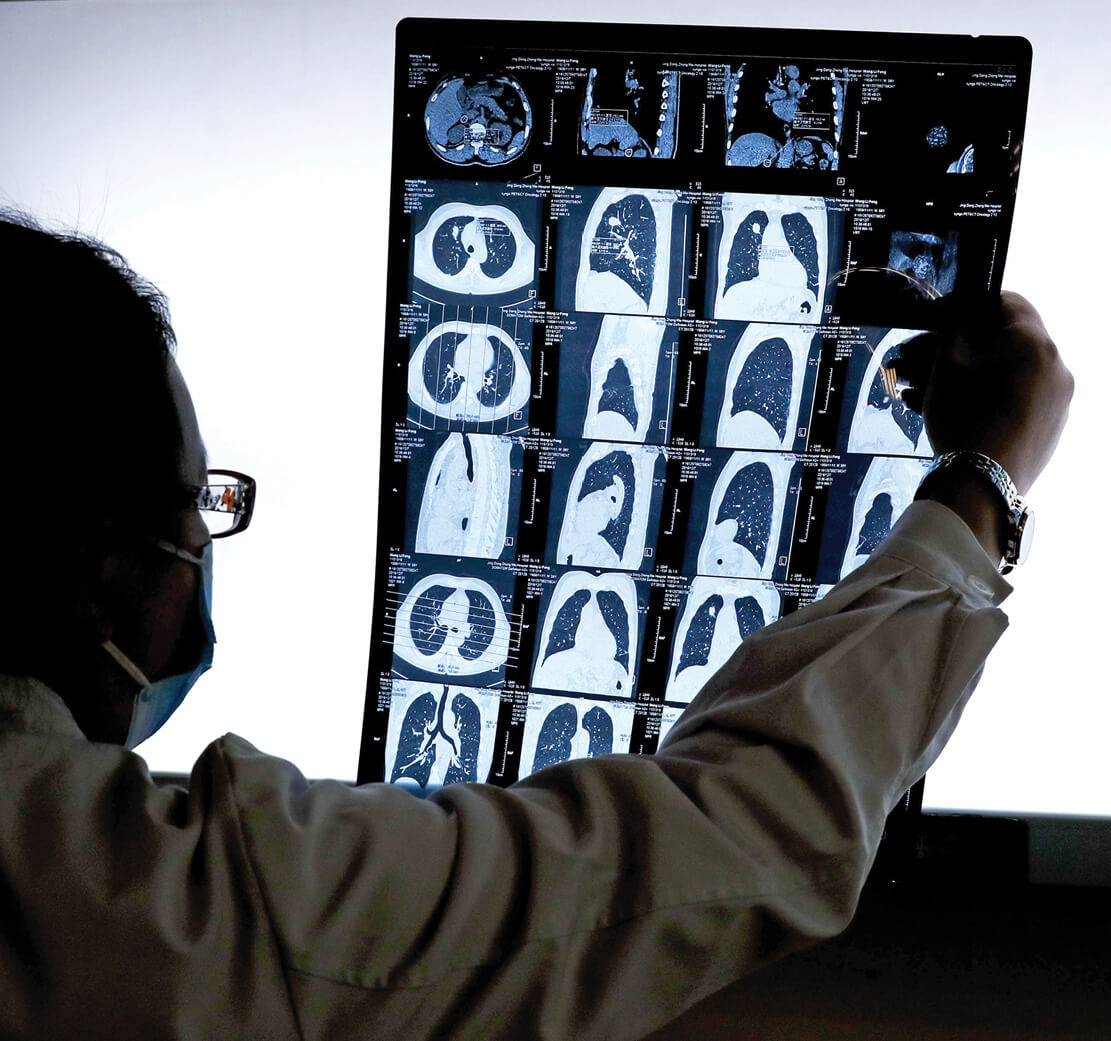

LUNG CANCER GUIDELINES CHANGED FOR EX-SMOKERS

IF YOU EVER SMOKED and are age 50 to 80, you should have a yearly lung cancer screening—even if you last lit up decades ago.

Recommendations by the American Cancer Society issued late last year say anyone who smoked a pack of cigarettes a day for 20 years needs to get an annual lung CT scan, no matter how long ago they quit.

ACS guidelines previously said that those who quit 15 or more years ago were in the clear.

Robert Smith, ACS senior vice president, said in a news release that the change is based on new studies that showed expanding screening eligibility saved lives, even among people who quit smoking years earlier.

Lung cancer can occur in anyone, but smoking is the top risk factor and is linked to 80 to 90 percent of lung cancer deaths. Most people diagnosed with the disease are 65 or older.

The disease is often symptomless until it’s at an advanced stage, when it’s harder to treat. Large-scale trials show that early detection can lead to a 20 to 25 percent improvement in survival rates, researchers say.

A 2022 report from the American Lung Association found that only 5.8 percent of people eligible for lung cancer screening in the U.S. get screened.

Medicare Part B will cover lung cancer screenings once a year for many people up to age 77 who smoke or quit in the past 15 years, with an order from a doctor.

SCAMS FEARED MORE THAN VIOLENT CRIME

MORE THAN TWICE AS MANY Americans fear being the victim of a scam or having their identity stolen than fear being murdered, a Gallup poll reveals.

This growing concern about fraud is understandable, experts say. “The reported financial losses to scams more than tripled during the pandemic and have reached an epidemic level,” says Kathy Stokes, head of fraud prevention programs at AARP.

In the November survey, 8 percent of people said they had been victimized by scams. Fifteen percent said someone in their household had been a victim.

The study also showed:

→ 72 percent of respondents were afraid their identity would be stolen by hackers.

→ 57 percent were afraid they’d be duped out of money in a scam.

→ In comparison, 28 percent feared being murdered, 37 percent feared being mugged, and 44 percent feared being burglarized.

New Laws Ban Predatory Real Estate Deals

CALIFORNIA GOV. GAVIN NEWSOM (D) signed a state law that protects homeowners from what AARP and other consumer advocates call unfair real estate agreements, the latest step in a campaign to have the practice eliminated across America.

The Golden State law restricts “homeowner benefit agreements” in which a brokerage firm would offer a homeowner—usually an older person—a small amount of cash to sign an agreement that gave the firm the sole right for up to 40 years to list the home for sale if it ever went on the market. Homeowners who changed their minds could face a penalty of up to 3 percent of the property’s value under the agreements. When the penalty wasn’t paid, the firm could place a lien against the home, preventing its sale. And the deals could bind people who inherited the property.

AARP and other consumer activists call the contracts unfair and, in some cases, little more than a scam.

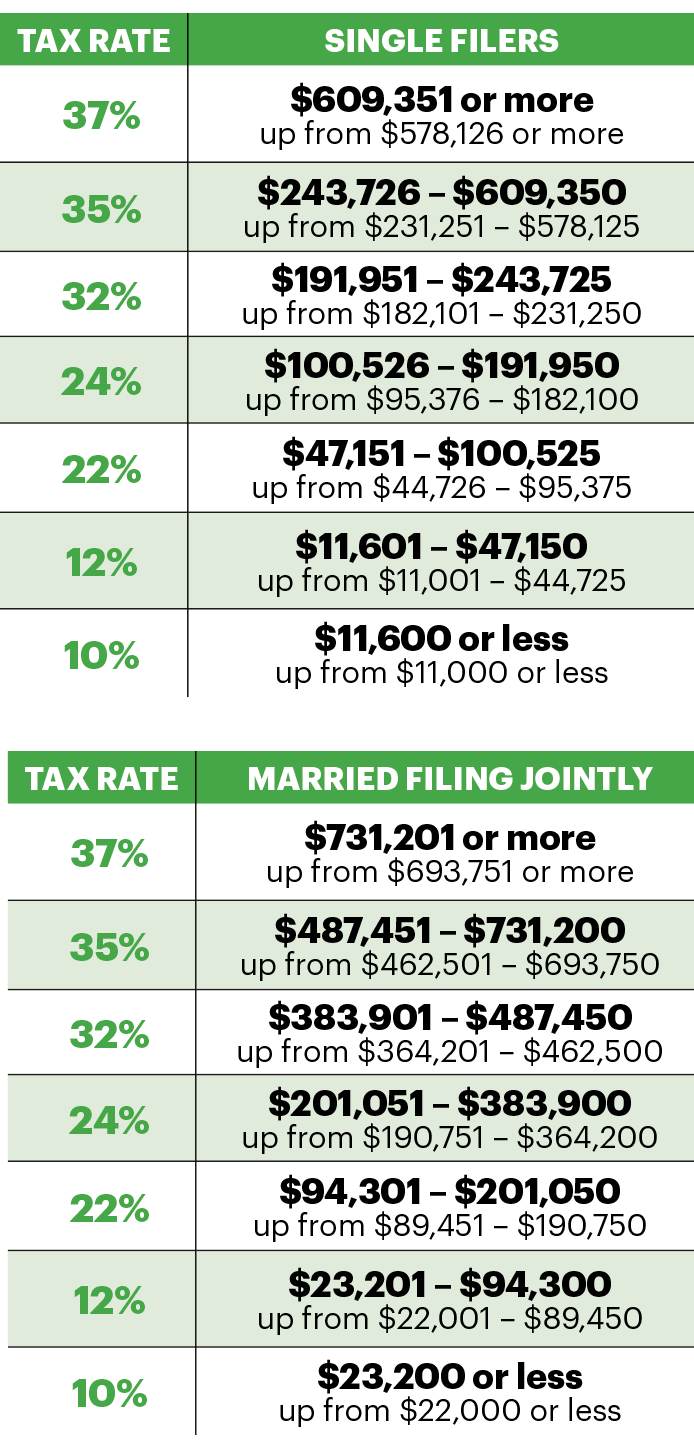

New IRS Brackets Could Lower Taxes for Some

INFLATION HAS HURT LOTS OF PEOPLE on fixed incomes, but it has also created a potential piece of good news: The money you make this year might be taxed a bit less as federal tax brackets have been adjusted to reflect inflation. That could mean you may fall into a lower bracket, paying a smaller percentage of taxes on income.

Another change: The standard deduction is $14,600 for single filers for the 2024 tax year, up from $13,850 for 2023. The standard deduction for couples filing jointly is $29,200 in 2024, up from $27,700. And more good news for older taxpayers: Joint filers can increase the standard deduction by $1,550 apiece, for a total of $3,100 if both joint filers are 65-plus. In total, a married couple 65 or older would have a standard deduction of $32,300.

Here’s a look at the new brackets.

SOURCE: INTERNAL REVENUE SERVICE

CANINE COMFORT

CANINE COMFORT Owning a dog lowered the risk of disability among 11,000 older Japanese adults who took part in a study published in the journal PLOS One. Researchers attribute this partly to the dog owners’ increased physical activity. Cat ownership, on the other hand, had no effect on disability risk.