Cover Story: Your 2024 Money Guide

DRIVE DOWN INFLATION … LITERALLY

Car costs are going through the sunroof. Here are ways to help rein in the expenses

Inflation lurks everywhere when you own a car, it seems. Drive across a bridge? That’ll cost you $5. A simple car wash? $22. New wiper blades? Try the “optimal night clarity” model, $70 a pair.

And that’s just the small stuff. Over the 12 months ending in November, motor vehicle repair costs were up 12.7 percent. Auto insurance costs—prepare yourself—were up 19.2 percent. The average monthly payment for a newly originated new car loan rose 18 percent over the past two years to $726, according to the latest numbers from the Experian credit bureau. How come? Because a new car will set you back roughly $48,000, according to national averages.

We asked professionals for their thoughts on ways to keep costs lower when driving and maintaining your vehicle.

INSURANCE

→ Shop around … slowly. Seeking competing policy quotes is standard advice; Doug Heller, director of insurance at the Consumer Federation of America, recommends doing this research carefully and methodically. Start with an online comparison site to get a sense of prices, he says. Then go to brand-name insurers’ sites for quotes. You might also consult a “captive agent,” who works for just one insurer (try word-of-mouth referrals), and an independent agent, who represents multiple companies. (Comparison sites include thezebra.com, policygenius.com and valuepenguin.com; you can find independent agents at trustedchoice.com, a directory linked to an insurance trade group.) “Even relatively comparable products from brand-name providers can have wildly different prices,” Heller says. “We’ve seen premiums that are hundreds of dollars different for the exact same coverage.”

→ Go to school. Taking an online safe driver course might get you a 5 to 10 percent discount on your car insurance, says Benjamin Preston, auto reporter at Consumer Reports. If you get a ticket, which can lead to higher premiums, going to traffic school may minimize the increase. Talk to your insurer to see if that will help, Heller suggests. (Learn about the AARP Smart Driver course at aarp.org/driversafety.)

→ Agree to be followed. Many major car insurers have programs that track your driving behavior, rewarding you for safe driving. Discounts vary, Preston says, but can be up to 40 percent. Tracking is done through a device placed in your vehicle or connected to your smartphone, which collects information while you’re driving such as speed, braking, phone usage and time of day. You’re giving up your privacy, however, and your insurer might raise your premiums if it judges your driving to be unsafe.

→ Ask for a low-mileage discount. If you’ve recently retired or shifted to working from home, your driving mileage may have dramatically decreased, which can lower premiums. “Depending upon the insurance company, low-mileage drivers can expect to see savings in the range of 2 to 5 percent, though some companies don’t give mileage discounts unless you sign up with their driving data tracking program,” Heller says. One notable exception is in California, he says, where rules can result in savings of 8 percent or more for low-mileage drivers.

→ Guard your credit rating. Insurance companies in most states are permitted to factor your credit score into your insurance premium. The most important ways to protect it over the long haul: Pay your bills on time, and keep your credit card usage low.

REPAIRS

→ Go high-maintenance. “It’s a lot less expensive and easier to maintain a vehicle than it is to repair a vehicle,” says David Bennett, senior automotive manager at AAA. Following your owner’s manual guidelines for oil changes is crucial to keeping your engine running smoothly, he says. Each time you get an oil change, ask the mechanic to check the brakes, lights, tire pressure and treads, belts, hoses and fluid levels. And follow your vehicle’s other guidelines for servicing at specific mileage intervals—for example, replacing your serpentine belt (also known as a drive belt). If you don’t spend the $100 to $150 for a new one at the proper time, the old one can break, causing the engine to overheat and creating thousands of dollars’ worth of damage.

→ Try DIY for the small stuff. For almost any minor bit of repair or maintenance, there’s at least one video on YouTube that can guide you through the process step-by-step—and help you save big. The website RepairPal, for instance, estimates that a Cleveland-area shop will charge around $80 to change the engine air filter on a Toyota Camry. A replacement filter you can install yourself will run you $15, if you’re willing to get your hands dirty.

→ Establish a rapport with your repair shop. Word-of-mouth recommendations are a good way to find a reputable mechanic, Preston says. “To establish a rapport, start with something simple, like an oil change,” he says. “If you like the mechanic and feel that this person gives trustworthy advice—including telling you which services aren’t worth your money—keep going back.” Once you’ve got a relationship, it doesn’t hurt to drop off some goodies—bagels, brownies or holiday cookies—for the shop’s workers. Letting them know you’re thinking of them and want to give them a treat goes a long way. Not sure whether to work with an independent repair shop or a dealer? “Generally, labor tends to be less expensive at an independent repair shop,” Preston says. Independent shops are also more likely to offer repairs using parts made by third parties, which tend to cost less than the car manufacturer’s replacement parts, he says.

Margie Zable Fisher writes about personal finance and business for The New York Times, Business Insider and other media outlets.

TIPS FOR TRIMMING GAS COSTS

EASE UP

Driving 5 to 10 miles more slowly can improve your fuel economy by 7 to 14 percent, according to the U.S. Department of Energy (DOE).

FILL UP

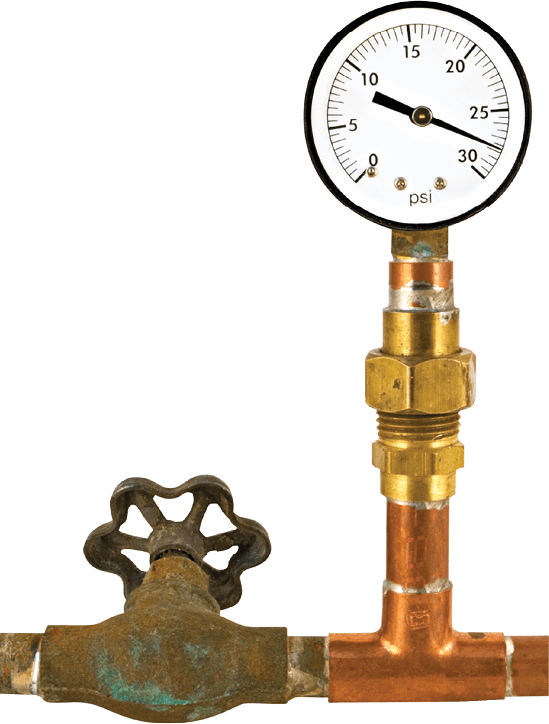

A set of tires that’s inflated to only 75 percent of the proper amount of pressure causes a 2 to 3 percent drop in fuel economy, the DOE reports.

KEEP IT CLEAN

The television show MythBusters found that a mudcaked car traveling at 65 mph got 2 miles less per gallon than it did when it was squeaky clean.

USE A CARD

A branded gas credit card can save you 5 to 10 cents per gallon, Bankrate says—as long as you avoid interest charges by paying off your full balance each month. —Julie Goldenberg

Why Did That Get So Expensive? How Did That Get So Cheap?

A LOOK AT SOME OF THE ITEMS THAT, ACCORDING TO THE CONSUMER PRICE INDEX COMPILED BY THE BUREAU OF LABOR STATISTICS, HAD SOME OF THE BIGGEST PRICE INCREASES—AND DECREASES—BETWEEN NOVEMBER 2022 AND NOVEMBER 2023.

INCREASE

Admission to sporting events: +16.4% → Growing demand and higher athlete salaries contribute to higher prices, says Wall Street Journal sportswriter Jason Gay. But the main driver, he says, is profit seeking by team owners and resellers who buy blocks of tickets. “There is absolutely this sort of mercenary ‘what the market will bear’ idea out there—that we’re going to raise prices until the point that people don’t buy them,” he says.

Food from vending machines and mobile vendors: +14.6% → Ben Goldberg, president of the New York Food Truck Association, attributes the rise to higher costs for labor and raw ingredients. “Food is a low-margin business by nature,” he says. “Inflation has made it even more so.”

Legal services: +12.4%* → Among the factors driving up prices, according to legal industry analyst Ari Kaplan: a competitive market for experienced legal talent and an increasingly complex regulatory and business environment.

Frozen vegetables: +6.1% → Part of the problem is supply shortages, like those caused by rainy weather in California, says Trey Malone, an agri-food economist at the University of Arkansas. But labor costs are a bigger issue. “We’re in the middle of a labor crisis in a way that I don’t know we’ve seen, at least in my lifetime,” Malone says. “We’re really struggling to be able to pay the appropriate wages to keep up with the employment demands throughout the supply chain.”

DECREASE

Health insurance: –30.3% → This is a statistic only an economist could love. The average workplace health plan premium rose 7 percent in 2023, says the nonprofit KFF. But the Bureau of Labor Statistics calculates this number differently: If the difference between what insurers are paid and what they pay in benefits is shrinking, it’s as if you’re getting more bang for your buck … so insurance prices are lower. “We’re not measuring the changes in your premiums, which I’m sure haven’t gone down by 30.3 percent,” says BLS economist Steve Reed.

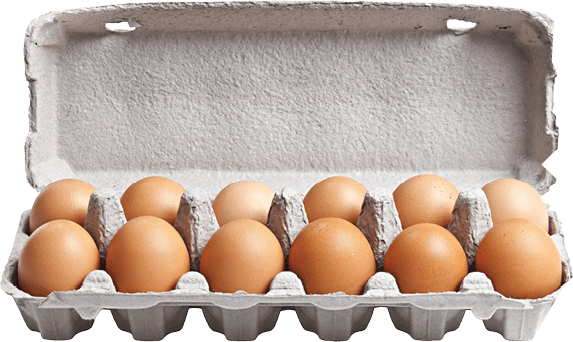

Eggs: –22.3% → As the avian flu ravaged the poultry industry in 2022, wholesale egg prices soared, reaching more than $5 a dozen in December 2022. Supply levels have since recovered, says Phil Lempert, an analyst in the food and retail industry.

Smartphones: –14% → Average selling prices are up, says IDC Worldwide Device Trackers. But the BLS collects prices after deals are factored in. And phones are one of the many items for which it deems improvements as a price reduction. So if this year’s phone has a sharper screen than last year’s, the BLS might compute a price decline, even if you paid more.

Utility (piped) gas service: –10.4% → Last winter’s mild weather meant low demand for natural gas used for heating. And the U.S. increased natural gas production in 2023, making high domestic storage levels even higher, says Chris Higginbotham of the U.S. Energy Information Administration. The result: falling prices.

*Legal services category as of the September 2023 consumer price index

Julie Goldenberg is an associate editor of the AARP Bulletin.