In the News

HEALTH CARE UPDATE 2024

ALZHEIMER’S DRUG COSTLY TO MEDICARE

Treatment brings hope—and big price tag

The drug Leqembi shows promise for patients with early-stage Alzheimer’s disease, but supplying it will cost Medicare an estimated $3.5 billion next year, officials say.

Leqembi has been covered by Medicare since the Food and Drug Administration (FDA) gave it unconditional approval as a treatment for Alzheimer’s last summer after it showed promise in halting progression of the disease in its early stages. Because it is administered intravenously in a doctor’s office or other outpatient setting, it is covered by Part B rather than Part D prescription drug coverage.

Both original Medicare and Medicare Advantage plans currently cover Leqembi for eligible patients. But since the FDA’s approval came after Medicare Advantage plan rates were set for the year, spending for MA plans is not affected by Leqembi costs in 2024, but those are part of the $3.5 billion cost projections for 2025.

The drug is subject to the 20 percent Part B coinsurance, which could be covered by a Medigap policy or other supplemental plan. Out-of-pocket costs can differ under Medicare Advantage plans.

Before Medicare covers Leqembi, you must meet requirements:

▶︎ Be diagnosed with mild cognitive impairment and have documented evidence of beta-amyloid plaque on the brain.

▶︎ Use a physician who participates in a qualifying registry with a clinical team and follow-up care.

Despite the high cost estimates, there may not be a huge impact on Part B premiums in 2025, says Juliette Cubanski, deputy director of Medicare policy for KFF, formerly the Kaiser Family Foundation. “I know $3 billion might sound like a lot, but it might not actually translate into a noticeable increase in the Part B premium … though it could be one factor among many if we do see a higher Part B premium next year,” Cubanski says.

WEIGHT LOSS DRUG OK’D TO TREAT HEART DISEASE

The Food and Drug Administration has approved the use of the weight loss drug Wegovy for overweight people with heart disease.

The move will allow Medicare Part D to pay for Wegovy for people whose doctors recommend it for cardiovascular treatment.

Medicare already covers the cost of Ozempic, another popular weight loss drug, when it’s used to treat diabetes.

Medicare Part D, which pays for many prescription drugs, is specifically excluded by a 2003 law from paying for drugs prescribed for weight loss or weight gain, as well as drugs used for fertility, hair growth, and treatment of sexual or erectile dysfunction.

More than 40 percent of Americans 60-plus are obese, according to the Centers for Disease Control and Prevention. That increases the risk of heart disease, stroke and type 2 diabetes.

A survey from the Business Group on Health found that 92 percent of large employer health plans covered the drugs for diabetes in 2023, and 46 percent for weight loss.

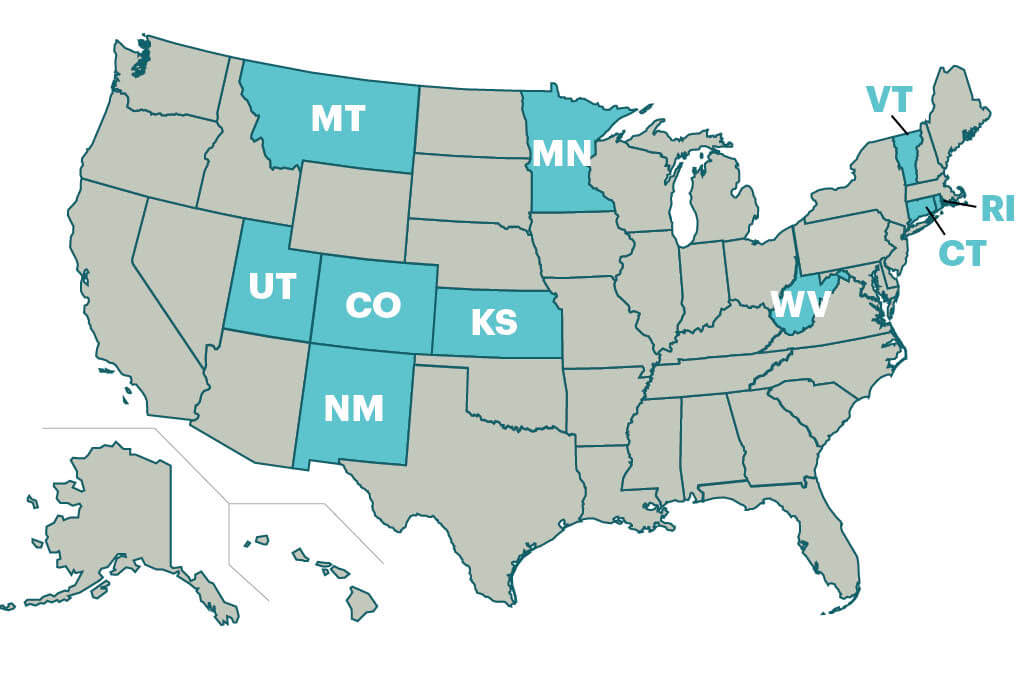

Does Your State Tax Social Security Benefits?

■ No Social Security benefits taxed

■ Some Social Security benefits taxed

West Virginia lawmakers this spring passed a law eliminating state taxes on Social Security benefits, with a 35 percent reduction for 2024 and the rest phased out by 2026. AARP state offices have worked with legislators across the country to eliminate taxes on Social Security. Missouri and Nebraska ended them for 2024, leaving just 10 states, including West Virginia, that tax some or all of their residents’ Social Security income. Here’s a look at where the taxes still exist.

Protections for Retiree Investments Strengthened

Financial advisers giving investment guidance to those saving for retirement will have to act solely in the best interest of clients, under a Labor Department rule finalized in late April.

Advisers to those with individual retirement accounts, 401(k)s and similar plans will be considered fiduciaries, who are prohibited from boosting their bottom lines by steering savers toward retirement products that may not best fit the clients’ needs.

“This rule closes legal loopholes that allowed some advisers to recommend investments with excessive fees and unnecessary risks, which cost retirement savers billions of dollars a year,” says Nancy LeaMond, AARP’s chief advocacy and engagement officer.

The new rule builds on a Securities and Exchange Commission regulation that sets the best-interest standard for advice on purchasing securities such as mutual funds.

The rule features additional provisions that expand the best-interest standard to cover advice given on a onetime basis, such as whether to roll over a 401(k) into an individual retirement account (IRA) or annuity, which would also come under the best-interest standard.

It also covers advisers’ recommendations to employers on what investments to include in workplace retirement plans.

The final version of the rule is scheduled to take effect Sept. 23.

DELAYING ‘STAIRWAY TO HEAVEN’

A study of nearly half a million people found those who climbed the most stairs had a 24 percent lower risk of dying from any cause and a 39 percent lower risk of death by cardiovascular disease. The study by the European Society of Cardiology was published by ScienceDaily.