Your Money

SELLING YOUR PARENTS’ HOME

How to handle the logistical and emotional challenges

Even in the best of circumstances, selling a home can be stressful. But selling a late parent’s home—a transaction potentially fraught with grief, financial urgency and family drama? That takes the difficulties to a whole other level.

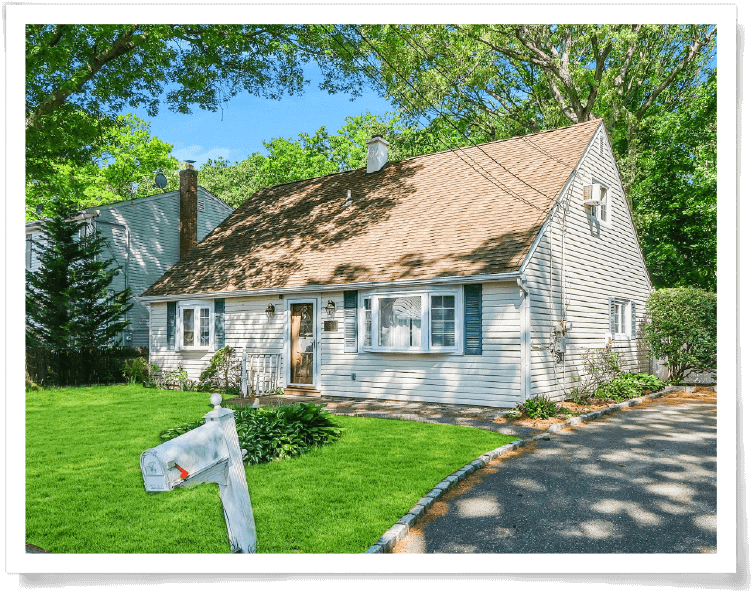

“It just makes your head spin,” says Jaclyn Tannazzo of Commack, New York, who last July sold the house her late parents had occupied for 50 years. “You’re taking care of your own home, and then you’re being asked to know when did my parents get an oil burner? How old is the roof?”

Here’s a game plan if you have this task.

STEP ONE: CLARIFY ROLES

If you’re the sole heir, you have the right to do whatever you want with the house. But when no specific instructions are given and other heirs are involved, things can get more complicated. The estate’s executor—the person formally assigned to administer the dead person’s property and distribute assets—ultimately has sole authority to determine the home’s disposition, says Crystal West Edwards, an elder law attorney in Morristown, New Jersey, with Porzio, Bromberg & Newman.

You may be the executor, but your siblings will also want their say. Some may want to keep the property, while others might want a fast sale. Coming to an agreement is difficult while you’re in mourning, says Michael Gifford, CEO and cofounder of Splitero, a financial technology company in San Diego. After people have had time to grieve, consider calling an all-hands family meeting. “Be gentle with each other,” says Maureen McDermut, a real estate adviser for Sotheby’s International Realty in Santa Barbara, California. Keeping an open dialogue with your fellow heirs will minimize the likelihood of legal challenges later, Edwards says.

STEP TWO: LINE UP HELP

You’ll need at least three on-site professionals to assist with a sale. An appraiser should give you the price for the home as it stands, which is important for tax purposes. You might also get major systems inspected, including the roof, plumbing and electricity. These could impact a buyer’s ability to get a loan. A local real estate agent can price the home correctly and shepherd it through the sale process, says Danny Hertzberg, a sales associate with the Jills Zeder Group brokerage in Miami. A real estate attorney can help with any outstanding issues, including unpaid taxes and missing paperwork.

STEP THREE: ASSESS OUTSTANDING DEBTS

Your real estate agent or attorney will run a preliminary title report, which will show if there are any mortgages or liens on the home, says Betsy Phillips, a real estate agent with Compass in Glenview, Illinois. That’s when you might learn that your parents had a second or reverse mortgage. It’s also not uncommon for older homeowners to forget to pay their property taxes, since in the past it was part of their monthly mortgage payment, says Julie Cwik, senior underwriting counsel at Proper Title, a title insurance agency in Chicago. A title search could reveal whether there’s a lien on the property for unpaid labor.

When Jaclyn Tannazzo was preparing her late parents’ New York home for sale, sorting through their possessions bogged her down. So she hired someone to clear them out and store certain items; she and her sister dealt with those later.

Any of these issues can delay or prevent a sale, so get them cleared up as soon as possible. Any money owed will be among the first payments settled with the proceeds from the sale.

STEP FOUR: MAINTAIN THE HOME

An uninhabited home is ripe for developing maintenance issues, such as freezing pipes or a leaky roof. Appearances matter, too: A property that looks abandoned is more likely to be vandalized. You could hire a handyman or lawn maintenance crew who did this work for your parents, or use someone recommended by a real estate agent. If you aren’t yet able to access an estate’s bank account to pay these expenses, keep an itemized list of payments in order to be reimbursed later.

Maintain insurance on the house and let the insurance company know the home is vacant, advises Joe Allen, a real estate broker at RE/MAX Results in Edina, Minnesota. Otherwise, the insurer might not pay a claim for theft and damage, he says. You might need an insurance policy intended for vacant buildings.

STEP FIVE: PREPARE FOR THE SALE

Don’t invest in renovations if you’re unlikely to get much more money out of the sale than what you’ll put in, advises Meredith Moore, CEO of Artisan Financial Strategies in Atlanta: “Just get it sold.” But do fix glaring problems unless your agent recommends an “as is” sale.

Phillips suggests removing any modifications installed to accommodate an aging parent. She and her siblings, for example, removed the stair lift in their late mother’s home.

Finally, be aware that the emotional pain of clearing out your parents’ possessions may be an obstacle to preparing the home for sale. That’s why Tannazzo hired someone to empty her parents’ house and store certain items for her and her sister to go through later. “I used to joke with my mom that ‘you’ve got to get rid of this stuff,’ ” Tannazzo says. “And she’d say, ‘Oh, that’s your problem someday.’ And she was right. It was.”

Liza N. Burby is an award-winning journalist who writes about real estate and business for Newsday.