In the News: Special Report

WHAT’S NEXT IN THE FIGHT TO CUT MEDICARE Rx COSTS

Drug price negotiations to start quickly, but expect lawsuits

David Mitchell, 73, of Bethesda, Maryland, was excited to see Eliquis on the list of the first 10 drugs Medicare named this summer to face mandatory price negotiations.

Mitchell, founder of Patients for Affordable Drugs Now, is battling incurable blood cancer, and Eliquis is one of several drugs he takes. Combined, his medications carry a yearly price tag of almost $1 million, with high copays coming out of his pocket.

The price negotiations slated to begin this month between the Centers for Medicare & Medicaid Services (CMS) and major drug companies “will improve both the financial well-being and the health of people, more of whom are going to be able to buy and take the drugs they need,” Mitchell says. But getting to actual price reductions could be a long road.

Drug industry and business groups have already filed several legal actions to stop the negotiations, including a lawsuit in Ohio by several chambers of commerce that calls the effort to force negotiations unconstitutional.

“With over a half dozen cases already filed across the country, the pharmaceutical companies and their allies are looking to delay the process and get to the Supreme Court,” says William Rivera, senior vice president for litigation for AARP Foundation. “They likely will. Continued delay and uncertainty in the meantime will harm the health and well-being of millions of older adults.”

Legal challenges aside, drug companies must respond with their product data by early October. CMS will then hold “listening sessions” for each of the 10 drugs to hear from people taking them; those should wrap up in mid-November. By February, CMS will propose the maximum fair prices for the 10 drugs. The drug companies can counter, but the negotiations must end by Aug. 1. A new price for the drugs will take effect in 2026.

A second list of 15 drugs will be announced in February 2025.

Critics have noted that some of the first 10 drugs picked may soon face competition or will do so by 2026. But Leigh Purvis, prescription drug policy principal at the AARP Public Policy Institute, noted that, combined, these 10 drugs cover over 8 million Medicare beneficiaries and accounted for more than $50 billion in Medicare Part D spending from June 2022 to May 2023—roughly 1 of every 5 dollars the program spent on prescription drugs.

Those drugs are critical to millions of older Americans trying to treat cancer, heart disease and diabetes, or to prevent blood clots.

Negotiations are an important step forward, advocates say. “Letting Medicare negotiate for lower prices will save seniors money and cut government overspending,” says Nancy LeaMond, AARP’s chief advocacy and engagement officer.

In order to be eligible for negotiation, medicines typically gotten at a pharmacy must have been on the market for seven years and not have a generic alternative. Another group of drugs made from living cells or organisms must have been available for 11 years, with no nearly identical alternatives available.

Drugmakers that decline to negotiate prices will face substantial taxes and financial penalties or must stop selling drugs to Medicare and Medicaid, the health coverage program for people with low incomes and individuals with disabilities.

About 53 million Medicare beneficiaries are either enrolled in a Part D prescription drug plan or get drug coverage through an Advantage plan. —Dena Bunis with Michael Hedges

The First 10

Here are the 10 medications facing negotiations between Medicare and drug companies, what they cost Medicare from June 2022 to May 2023, and how many Medicare Part D enrollees use them.

Eliquis, a blood thinner used to prevent strokes and blood clots. Medicare spent $16.5 billion. Taken by 3.7 million enrollees.

Xarelto, a blood thinner. Medicare spent $6 billion. Taken by 1.3 million enrollees.

Farxiga treats diabetes, heart failure, chronic kidney disease. Medicare spent $3.3 billion. Taken by 799,000 enrollees.

Enbrel treats rheumatoid arthritis, psoriasis. Medicare spent $2.8 billion. Taken by 48,000 enrollees.

Stelara treats psoriasis, psoriatic arthritis, Crohn’s disease, ulcerative colitis. Medicare spent $2.6 billion. Taken by 22,000 enrollees.

Jardiance treats diabetes, heart failure. Medicare spent $7 billion. Taken by 1.6 million enrollees.

Januvia treats diabetes. Medicare spent $4 billion. Taken by 869,000 enrollees.

Entresto treats heart failure. Medicare spent $2.9 billion. Taken by 587,000 enrollees.

Imbruvica treats blood cancers. Medicare spent $2.7 billion. Taken by 20,000 enrollees.

NovoLog and Fiasp insulins for diabetics. Medicare spent $2.6 billion. Taken by 777,000 enrollees.

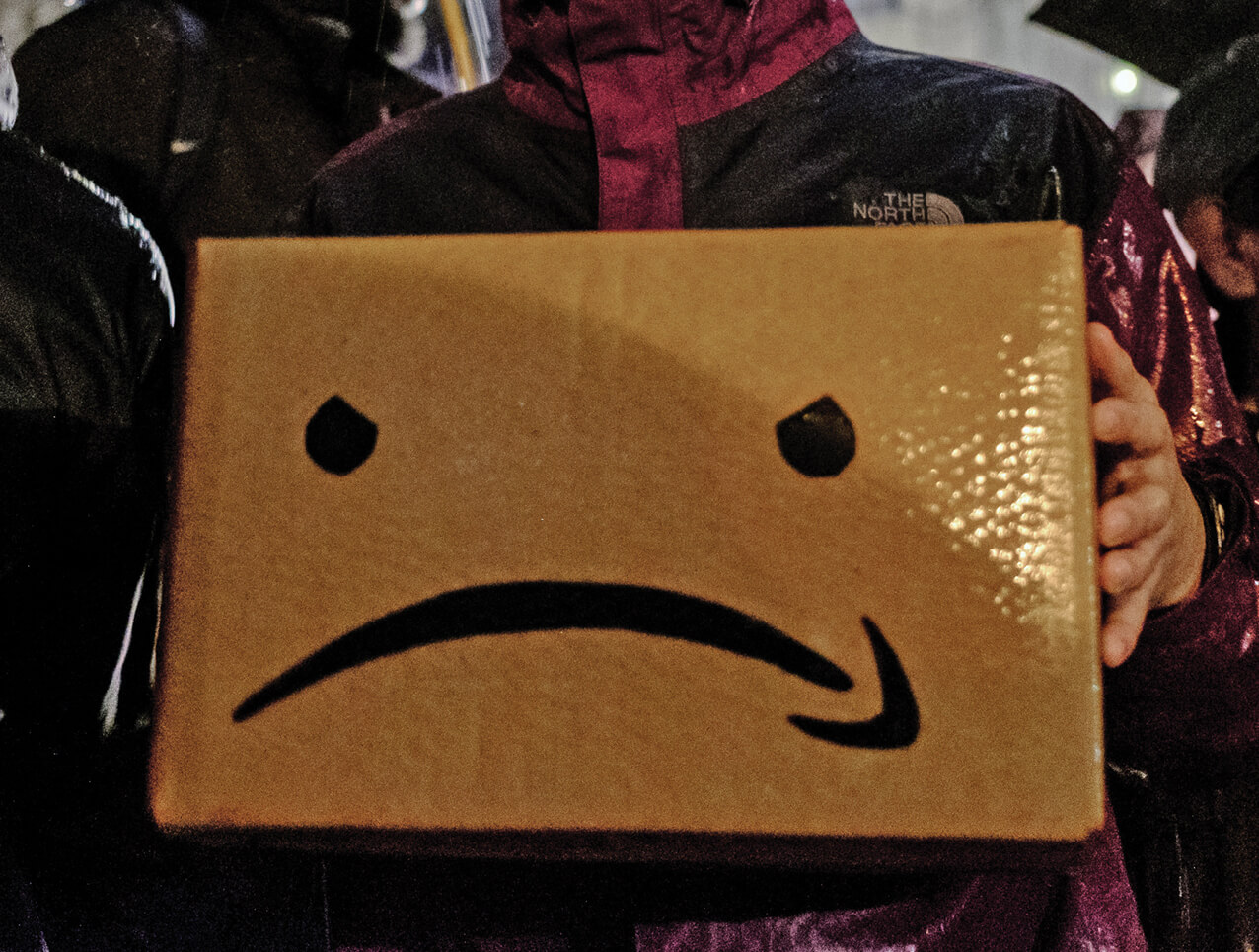

DECEPTIVE DEALINGS?

THE FEDERAL TRADE Commission has sued Amazon, saying the digital retailer used “manipulative, coercive or deceptive” tactics to get customers to sign up for its $139-a-year Prime service, and intentionally made it confusing to cancel. Amazon did not respond to a request for comment.