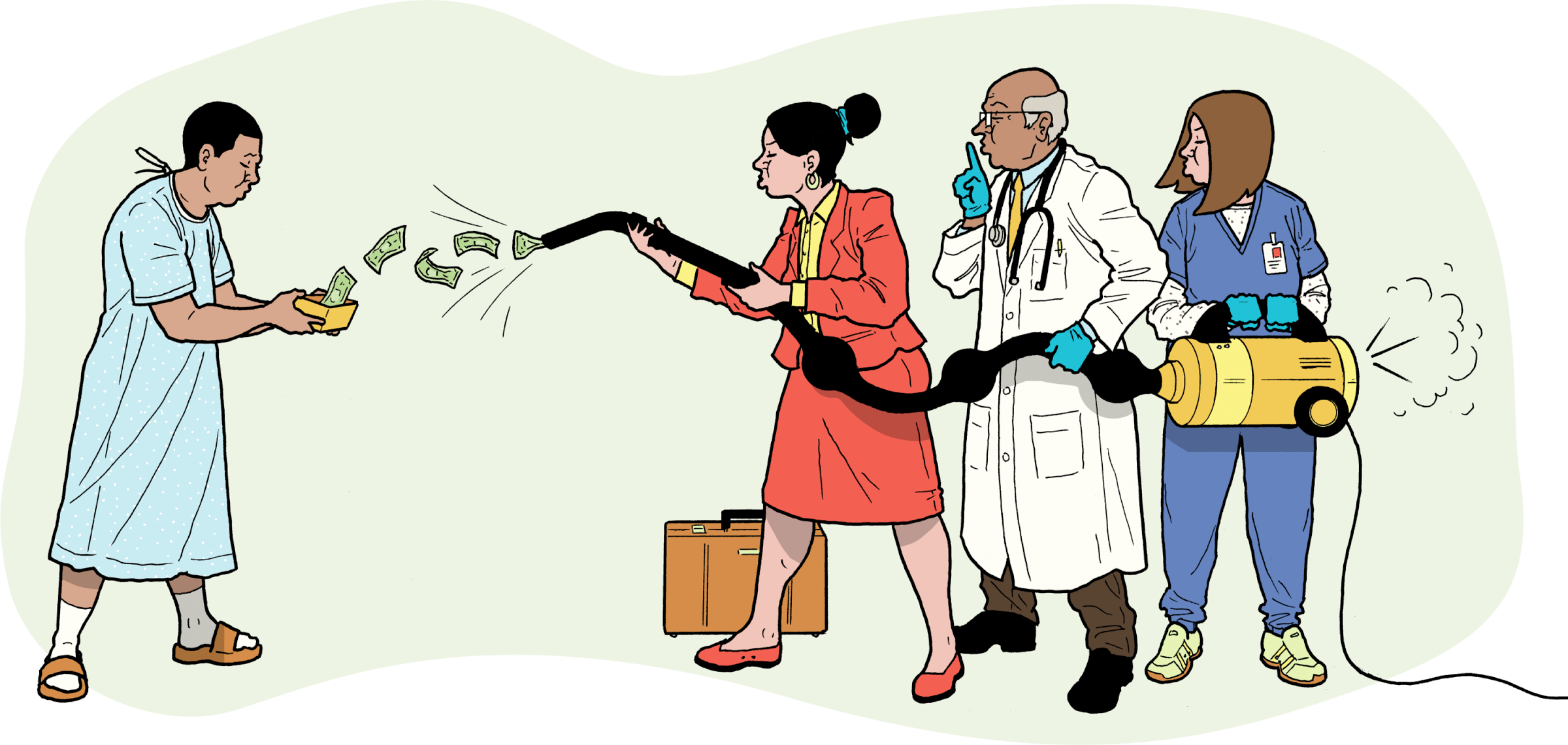

Your Money

HOW YOUR MEDICARE COSTS COULD GROW

Age, inflation and medical spending all play a role

From 2023 to 2024, the standard Medicare Part B premium—paid monthly by most Americans 65 and older—grew 5.9 percent. Over the coming years, will you see similar increases for Part B and other components of Medicare? Very likely, yes. Here’s what you can expect, plus some hints for keeping your costs down.

Original Medicare (Parts A & B)

Each year, the government determines what you’ll pay for Medicare Part A, primarily hospital insurance, and Part B, medical insurance. Part A is premium-free for most people, but over the past 20 years, the Part B monthly premium, now $174.70, grew at an annualized rate of 4.9 percent, compared with inflation of about 2.6 percent. On top of premiums, people pay 20 percent of most outpatient costs, with no cap on out-of-pocket expenses.

There’s little sign that costs will grow more slowly. Medicare trustees estimate that Part B premiums will increase by 6.2 percent on an annualized basis through 2033, and overall Medicare spending will grow even faster. On an annualized basis over the same time period, the deductible for Part A is forecast to increase 3.6 percent; the Part B deductible, 6.4 percent.

Medicare Advantage (Part C)

People enrolled in private Medicare Advantage (MA) health plans pay the same Part B premiums as do those on original Medicare (OM). The average premiums paid for MA on top of Part B have fallen in recent years, though cost-sharing and covered services vary by year and plan. In 2024, 75 percent of people enrolled in MA plans with drug coverage paid no MA premium on top of their Part B premium, according to nonprofit health policy research organization KFF; among those who pay for a plan with drug coverage, the average monthly cost is $56. Most MA plans cover some vision, hearing and dental care not available through OM. But the trade-off is often flexibility, since MA enrollees typically have a limited network of providers and regularly have to get prior authorization for specialist visits and higher-cost services.

Forecasting trends in MA out-of-pocket costs is difficult. Most MA plans don’t have deductibles, and unlike OM, MA plans set an out-of-pocket maximum for covered services—on average, $4,882 for in-network services in 2024 and $8,707 for both in-network and out-of-network services, according to KFF. Yet MA enrollees may pay more than people with OM for some services because MA plans are able to set how much people pay out of pocket in coinsurance. People with MA receiving out-of-network care usually face higher out-of-pocket costs. One study found that on average fewer than half of Medicare physicians in a county are in MA plan networks.

You can shop around and switch MA plans each year during certain enrollment periods, or return to OM if you wish.

Part D prescription drug plans

Premiums for these stand-alone drug plans have risen about 2.8 percent annually since 2006, based on KFF data. The average base premium this year is $34.70, although Part D plans’ premiums, covered drugs and out-of-pocket costs vary considerably.

In 2025, out-of-pocket costs for covered drugs will be limited to $2,000 for the year; that cap will be updated annually. In 2026, prices will drop for 10 of Medicare enrollees’ costliest and most widely used drugs. As with MA and OM, you can switch plans every year.

Medigap policies

Monthly premiums for Medicare supplement insurance (Medigap), designed to cover costs that OM does not, range from $40 for a high-deductible policy to several hundred dollars for the most comprehensive coverage. Everyone first enrolling in Part B after age 65 gets a six-month Medigap open enrollment window during which companies must offer you a policy at the best available rate regardless of your health history.

Unlike changing MA or Part D, you can’t easily switch Medigap plans in most states, so shop carefully; after your guaranteed issue period, companies can refuse to sell you a policy or charge higher premiums because of preexisting medical conditions. Only four states—Connecticut, Maine, Massachusetts and New York—prohibit denial of enrollment or coverage based on medical history.

Pricing for Medigap policies falls into one of three structures, which affect how their costs increase. Community-rated (or “no-age-rated”) policies charge the same premium to everyone in a particular geographical area and rise only with inflation. Issue-age-rated policies are priced based on how old you are when you enroll; after that, premiums may rise with inflation but not with age. Attained-age-rated policies increase premiums based on your age as well as inflation. If you have a choice of pricing methods—in many states, you don’t—be aware that, over the long run, community-rated policies tend to be the most affordable choice.

Average price increases for Medigap went from less than 4 percent in the early 2000s to 5 to 8 percent in recent years.

Brandy Bauer is joint center director of Senior Medicare Patrol and State Health Insurance Assistance Program (SHIP) resource centers.

SHORT ON FUNDS?

If you can’t afford Medicare coverage, you may qualify for financial help. Options include Medicare Savings Programs, Medicaid and, for Part D, the Extra Help program. To learn more, visit medicare.gov/help or contact a State Health Insurance Assistance Program at shiphelp.org.