Your Money

“CONGRESS HAS REDUCED OUR STAFF TO A 25-YEAR LOW”

Social Security chief Martin O’Malley explains how he’s trying to turn the struggling agency around

With the Social Security Administration under fire from retirees, Congress and advocacy groups including AARP, SSA Commissioner Martin O’Malley has no easy job. Sworn in last December for an abbreviated term that expires in January, the former governor of Maryland might have only a short amount of time to address the agency’s deteriorating customer service. In this interview with AARP, O’Malley talks about the challenges the SSA faces and what he believes is the key to its long-term success.

Two customer service priorities that you’ve identified are long wait times on Social Security’s 800 number and growing wait times for people making disability claims. Where are you in fixing these?

At the end of last year, when I was confirmed, the average wait time on the 800 number was 41.2 minutes. We’ve wrestled that bad boy down on a rolling 30-day average to 17.8 minutes. Depending on when you call, some people will get longer wait times, some people shorter. We’ve installed a callback assist. [Rather than wait on hold, callers can leave their number, so an SSA representative, when available, can call them back.]

It’s also important to communicate honestly and clearly with our customers about what their expectations should be, so that they don’t feel like they have to call the 800 number because they were told to expect something within two weeks, when the reality is it would take 40 days.

What about disability claims?

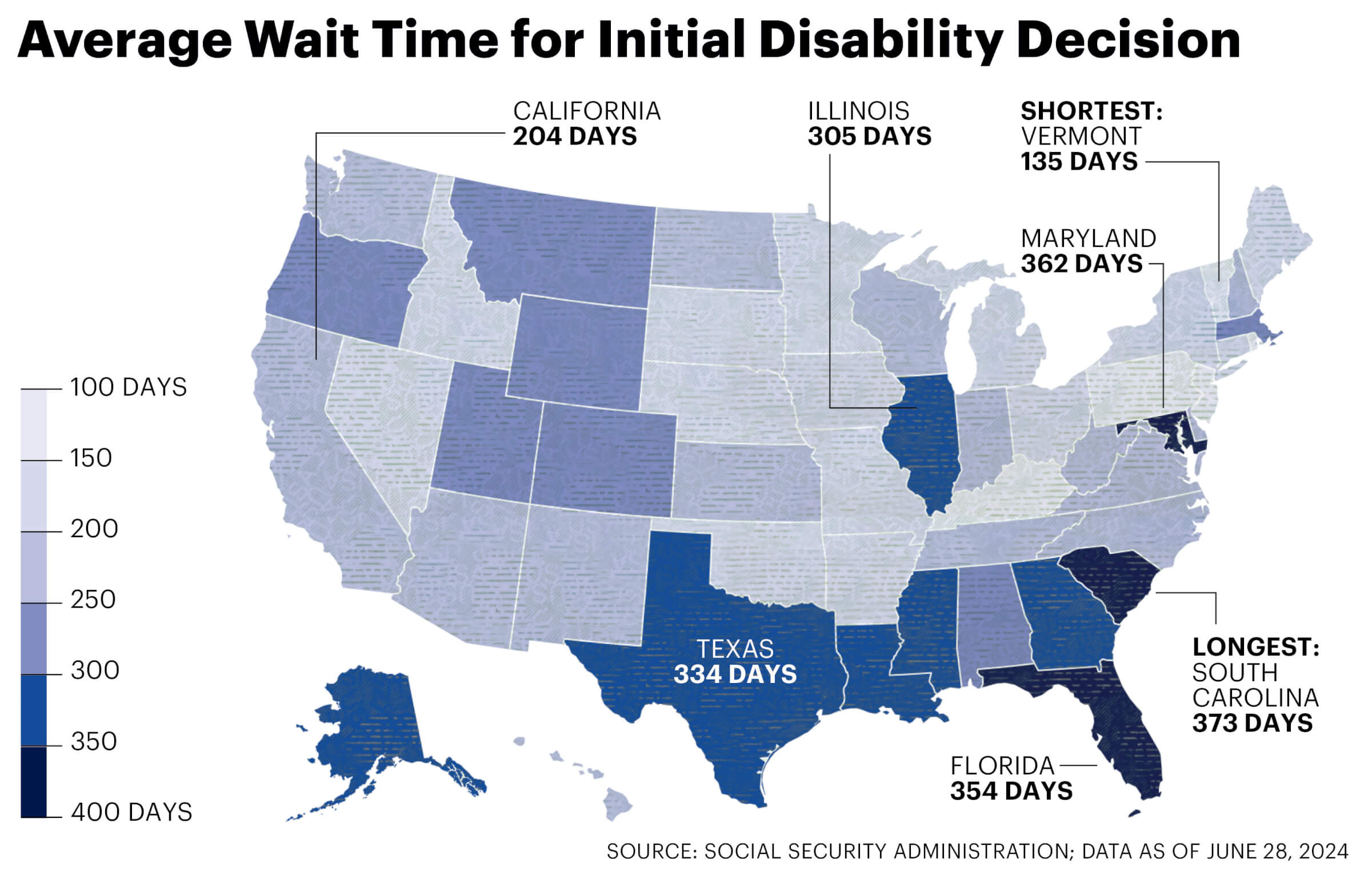

Probably the biggest fire-breathing dragon we confront right now is the growing numbers of people applying for disability determinations. There’s a huge backlog. In 2023, according to our actuary, we had 30,000 people dying as they awaited their initial disability determination. We’re doing a couple of things on that front. One is better use of technology to identify early those cases that are very likely going to be allowable cases. The other thing is to expand the use of technology so that the people making those initial disability determinations can more quickly get to the heart of the medical record, instead of flipping through a thousand pages.

Having callback assist and rolling out video appointments, which you’ve recently announced, are things organizations with large customer bases have been doing for a long time. Why was the SSA so slow to adopt some of these changes?

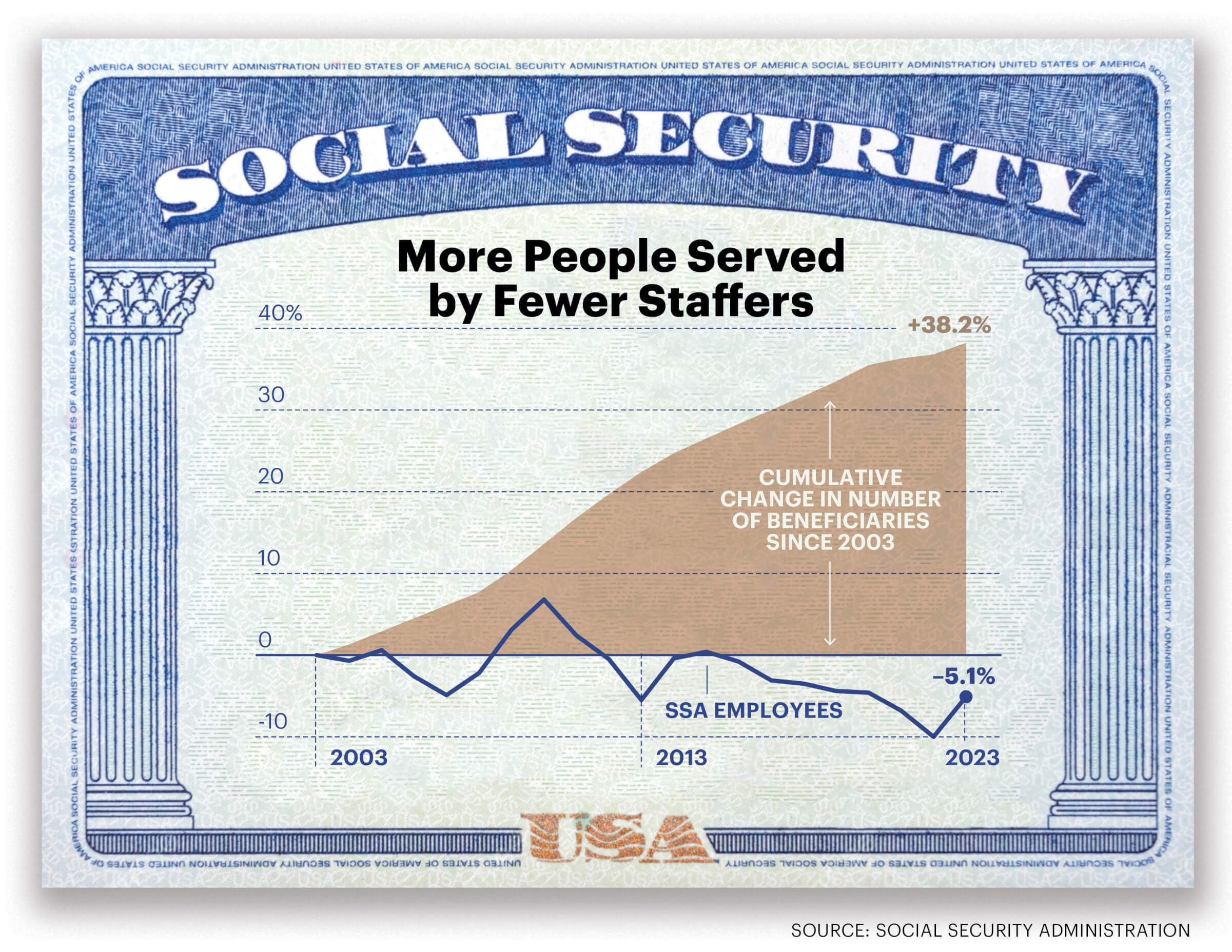

The context of everything we struggle with here and now is the truth that we are serving more customers than ever, because of us baby boomers. And Congress has reduced our staff to a 25-year low; I don’t think it was intentional, I think it was inattention. We can’t get enough people on the phones to answer as quickly as we used to. So everything with which we struggle, the largest part of that context is the reduction in staffing coupled with the great increase in beneficiaries.

SSA’s O’Malley

“As long as Americans work, Social Security will continue to pay benefits. That’s the elegant simplicity of this system.”

You’ve come out of a hiring freeze that the SSA was under when you took office. How many people have you been able to hire, and where have you been able to deploy them?

We’re now going to be able to hire, approximately, another 1,200 people. We are going to be deploying them to a few primary areas. One is the 800 number, so people get their calls answered in a more timely fashion. The second is the field offices, so people get their appointments and their applications in. The third is the actual processing of those applications. The fourth is the Disability Determination offices, which the federal government pays for but the states run. That is where our largest backlog is right now. That time period [for decisions on disability claims] used to average 120 days, when Congress allowed us to operate on our 1.2 percent overhead. That 120 days has now ballooned to 228 days. In some states, it’s even larger. That’s unacceptable, and that’s our biggest challenge right now. The number of applicants is going to continue to grow. But the rate of attrition in all of those 50 state Disability Determination offices—we have been scrambling to try to backfill against what is one of the worst attrition rates anywhere in any department funded by the federal government. And unless Congress pulls us out of this downward spiral, we’re going to have fewer and fewer staff to deal with those claims.

When you say 1.2 percent overhead, you’re talking about the amount of money the SSA spends on customer service as a percentage of the amount that goes out in benefit payments?

That’s right. Social Security can be thought of as a big insurance company. We insure people so that no senior has to live in poverty or under a bridge when they’re no longer able to work. If you look at the effectiveness of this insurance company and compare it to the private sector, you will see that we traditionally—until Congress started reducing our staffing—provided the customer service at a pretty high level, with just 1.2 percent overhead for the amount of benefits we paid out every year. If you compare that to other private corporations, Allstate operates on 19 percent overhead. Liberty Mutual operates on 23 percent overhead. So it is a very cost-effective program that all of us have already paid for.

I want to pivot to the other Social Security issue that’s on everybody’s mind. Absent action by Congress, in a decade or so, the Social Security trust funds are going to run short of their reserves, and benefits are going to be cut by 17 percent. That’s a circumstance nobody wants, but Congress hasn’t done anything to address it yet. What is your view of some of the proposals that are on the table?

As the administrator of Social Security, my job is not to propose policy but to give members of Congress and the president the numbers accurately that the actuary produces for Social Security, so they can make the right call. Now, when I ran for president in 2016, my proposal to strengthen Social Security for the foreseeable future was to ask people who earned a lot more to pay, again, into Social Security. President Biden has proposed asking those that make more than $400,000 a year to start paying into FICA, into Social Security, again, once they reach that $400,000. [Editor’s note: In 2024, taxes under the Federal Insurance Contributions Act are collected only on wage income up to $168,600. The president and some members of Congress proposed applying the payroll tax to income above $400,000.]

Other members of Congress propose other things. There are some who say that you should raise the retirement age, but there are others who push back on that and say, “Wait a minute: People that work harder, more physically demanding jobs have a much lower life expectancy and might not even reach the age where they could claim benefits.” I just came back from South Dakota. I was on the Pine Ridge Reservation there. You know what the average life expectancy is in Pine Ridge? Forty-eight years for men, 52 years for women.

There will be a lot of policies out there. The good news is that in the past, whenever we faced events like this, Congress came together and figured out what they thought was their best fix for the foreseeable 75 years, which is a long time. When I was a younger man in college, we used to always say, “I wonder if Social Security will even be there for me when I’m 62.” Hey, guess what? Next year I’m 62, and it’s still here. As long as Americans work, Social Security will continue to pay benefits. That’s the elegant simplicity of this system.

This interview has been edited for length and clarity.

Andy Markowitz is a writer and editor at AARP covering Social Security and retirement.