MONEY SAVER

The Price of Protection

It’s not just the stuff you buy that’s getting more expensive. The insurance for your stuff is getting costlier too. Check out these numbers, and what’s behind them.

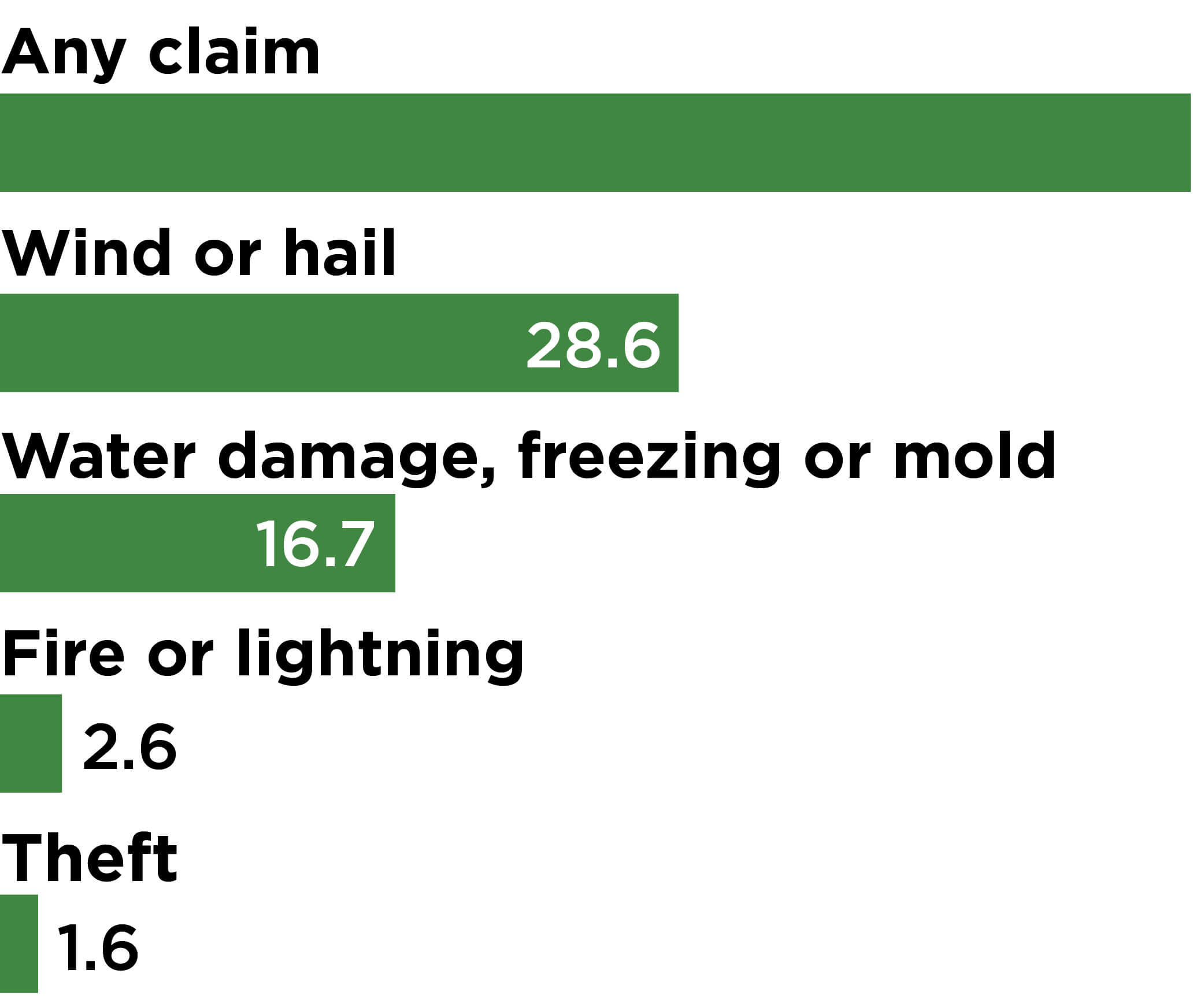

HOMEOWNERS INSURANCE

Annual Frequency of Claims

per 1,000 insured homes

Highest Premiums*

You can blame hurricanes for prices in Florida and Louisiana. Tornadoes, wind and hail are the major culprits in Nebraska and Oklahoma.

Average Annual Premium

$2,230

Prices are up 7.9% year over year.

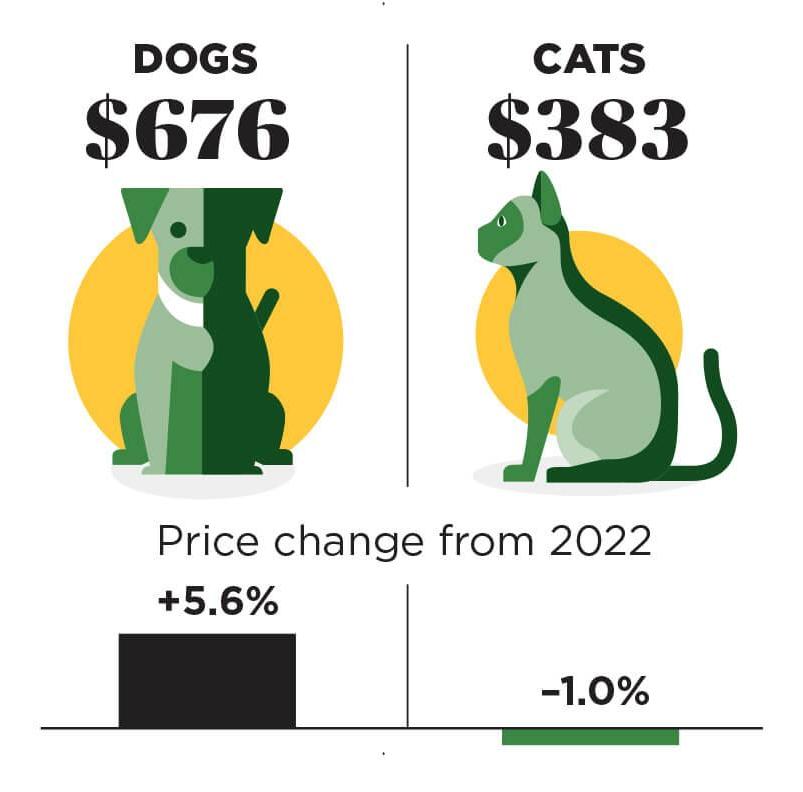

PET INSURANCE

Average Cost of Accident and Illness Coverage in 2023

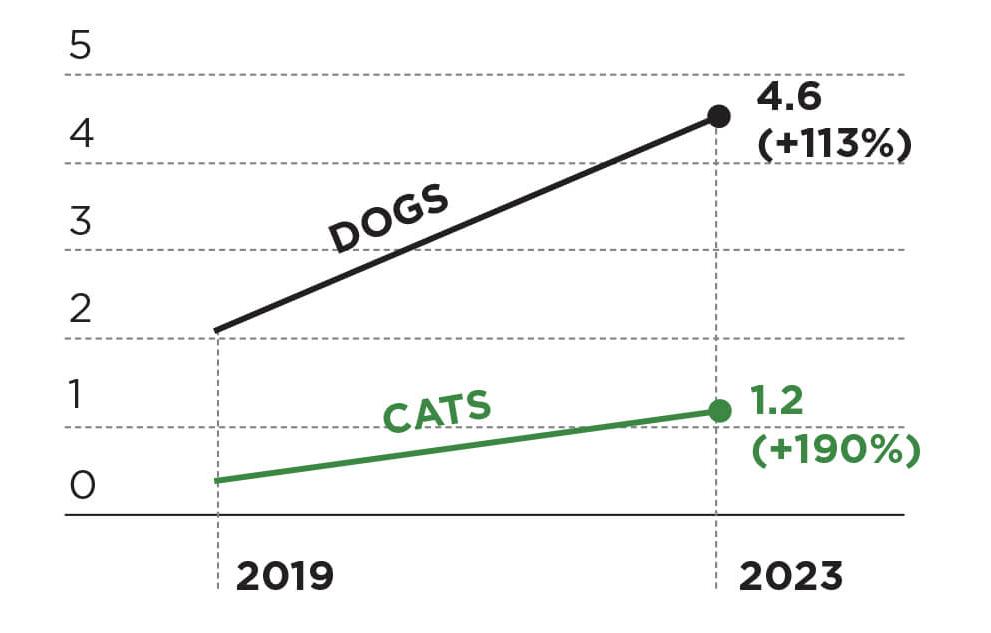

Total U.S. Pets Insured (in millions)

Insurers paid out $2.5 billion in claims in 2023, up 30% from 2022.

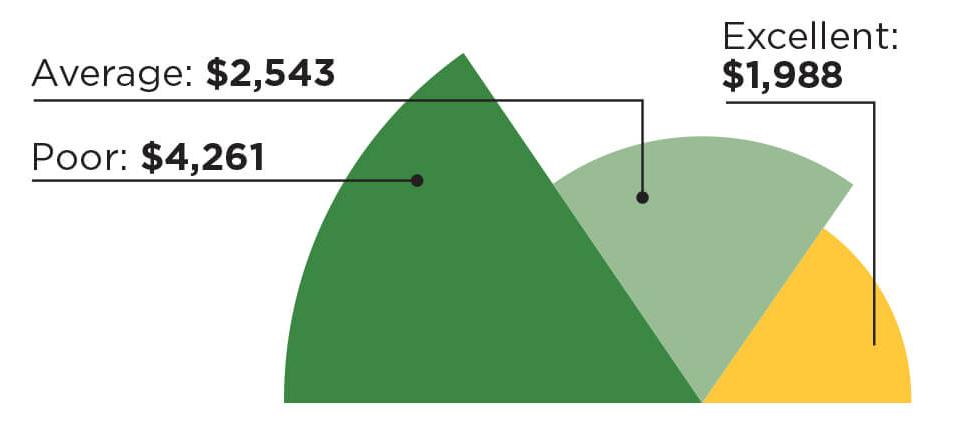

CAR INSURANCE

Average Annual Cost of Full-Coverage Car Insurance**

$2,311

Up 20.3% year over year

Average Cost by Credit Score

In 47 states, a bad credit score can raise your premium. If your score is poor, get quotes from multiple carriers, including those writing high-risk policies, advises Bankrate’s Shannon Martin.

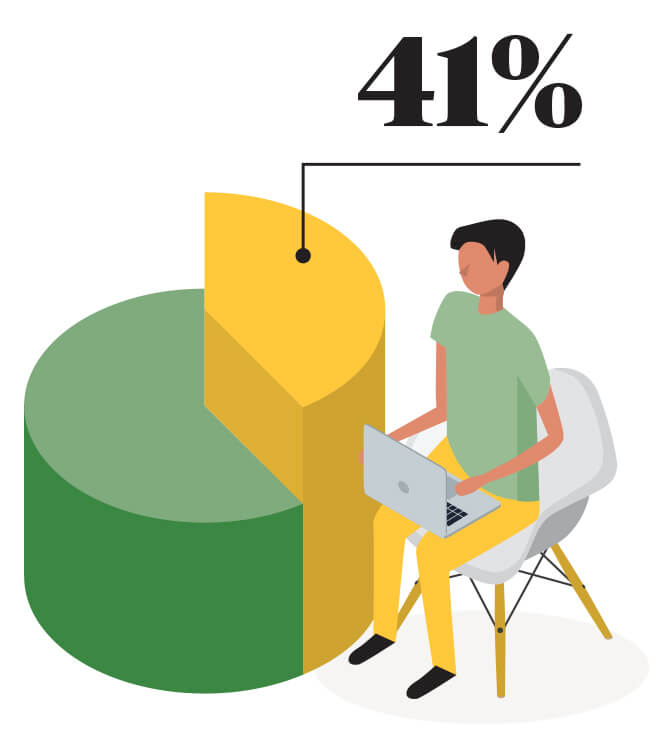

Car Owners Who Shopped for Insurance at Least Once in 2023

Newly retired? Driving fewer miles? Tell your insurer, says Douglas Heller of the Consumer Federation of America. You might get a lower rate.

*Homeowners insurance premiums are for $300,000 in dwelling coverage in June 2024.

**Full-coverage auto insurance rates are for June 2024 for a 40-year-old male or female driver with a clean driving record, good credit and a 2022 Toyota Camry driven 12,000 miles annually. Story sources: Bankrate, Bureau of Labor Statistics, Insurance Information Institute, North American Pet Health Insurance Association, LexisNexis