Staying Fit

Jump to the State

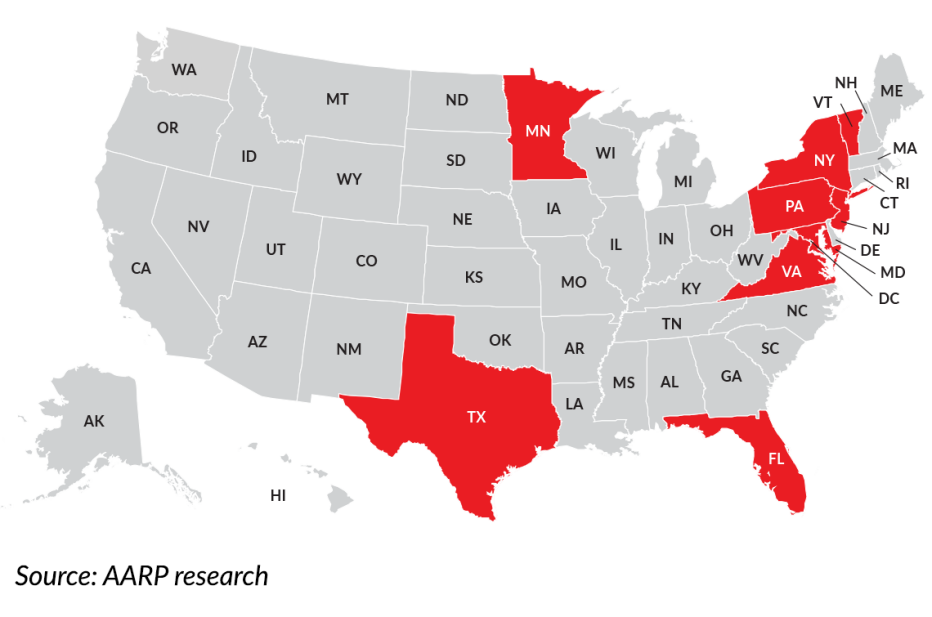

Florida • Maryland • Minnesota • New Jersey • New York • Pennsylvania • Texas • Vermont • Virginia • Washington, D.C. • Saving on medicine

Save for in Illinois, there is no state sales tax on prescription drugs, but the same isn’t true for over-the-counter medicines and remedies. Only a handful of states and Washington, D.C., give consumers a break on these products that many older Americans rely on to help maintain their health and wellness.

Meanwhile, 41 states impose a sales tax on OTC medicines. As for Illinois, it imposes a 1 percent sales tax on prescriptions and on nonprescription items claimed to have medicinal value, such as aspirin and cough medicine. The state otherwise charges a 6.5 percent sales tax.

AARP Membership— $12 for your first year when you sign up for Automatic Renewal

Get instant access to members-only products and hundreds of discounts, a free second membership, and a subscription to AARP the Magazine.

States That Don’t Tax OTC Medicines

1. Florida

Along with exempting remedies prescribed by a licensed health care provider, the Sunshine State has a long list of over-the-counter drugs exempt from the tax. They include aspirin and other pain relievers, bandages, antacids, eye drops, sinus relievers, skin medications, sleep aids and a lot more.

2. Maryland

Sales of nonprescription medicine, medical supplies and medical equipment are not taxed. The list is long and includes everything from nonprescription drugs to antiseptics.

Estimate Your 2023 Taxes

AARP’s tax calculator can help you predict what you’re likely to pay for the 2023 tax year.

3. Minnesota

The North Star State does not tax over-the-counter drugs, but you won’t get a tax break on grooming and hygiene products.

4. New Jersey

The Garden State exempts all over-the-counter drugs prescribed by a doctor as well as many without a prescription. Like other states, it runs the gamut from aspirin to zinc.

5. New York

Everything from antacids to cold and flu medicines is tax-free in the Empire State. The tax applies to most cosmetics and toiletries, but some are exempt, including dandruff shampoos and sunscreens with an SPF factor of 2 or more.

6. Pennsylvania

Most nonprescription drugs and some toiletries are exempt from taxes in the Keystone State. The list includes toothpaste and toothbrushes, sunburn treatments and colostomy supplies.

More From AARP

10 OTC Medications That Become Risky With Age

Many popular pills can have surprising side effectsDrugstore Showdown: Which Is Cheapest, CVS, Walgreens or Rite Aid?

We filled a basket and totaled up the billMillions Skimp on Prescription Meds Due to Cost

An estimated 9.2 million adults cut back on prescriptions to save money in 2021

Recommended for You