AARP Hearing Center

When he was 9 years old, Frank Lieberman sneaked into the Mount Eden Theatre in the Bronx and walked out with his first job, earning a $20 tip to pick up sandwiches for a film crew that was working there. Decades later, at age 78, Lieberman is still working in the entertainment industry as president of NY2C, a website and app that offers videos highlighting New York City’s best restaurants, shops and other attractions.

Lieberman started the company in 2017, when he already was older than 70 with a long, successful career as a consultant and dealmaker in film, music and other industries. And he has no intention of slowing down now, making plans to expand his video guide industry to perhaps as many as 30 cities. He notes that working with the college-age students he employs boosts his energy.

“It’s amazing. I’m becoming younger,” he says. “I never thought I was going to get younger, but I am. I come from a long history of work, and it helps you stay young. The minute you go sit in a rocking chair or somewhere on a bench, it’s over.”

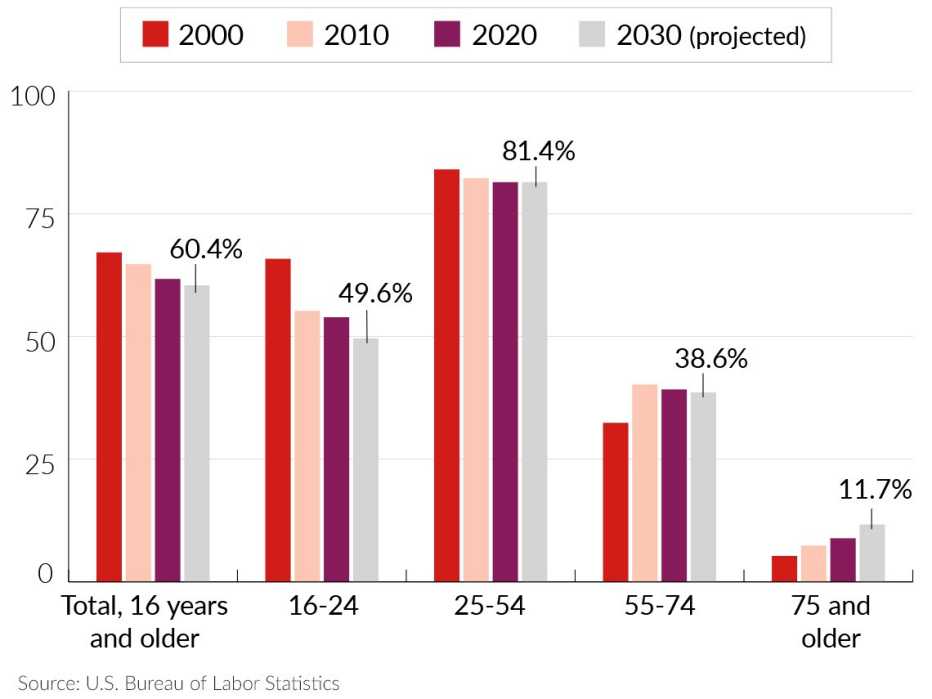

Workers Age 75 and Up Are the Only Growing Group

Percent change in civilian labor force by age, 2000–10, 2010–20, and projected 2020–30

Lieberman is not alone in his ongoing enthusiasm for employment past traditional retirement age. A growing share of the nation’s oldest workers are staying on the job longer. While the labor force participation rate — the percentage of the population either working or actively looking for work — is projected by the U.S. Bureau of Labor Statistics to decline for everyone 16 and older to 60.4 percent in 2030, from 61.7 percent in 2020, the share of workers 75 and older is expected to grow from 8.9 percent in 2020 to 11.7 percent in 2030. It’s the only age group tracked by BLS that’s estimated to expand over the 10-year period.

Better health later in life is the primary reason that the numbers of oldest workers are increasing. “COVID notwithstanding, older workers are healthier than they used to be, and that plays a big role,” says Geoffrey Sanzenbacher, an associate professor of economics and a research fellow with the Center for Retirement Research at Boston College. “People are able to work longer because they’re healthier longer.”

The need to increase savings for retirement also is driving the trend. Sanzenbacher notes that prior to 1978, when the 401(k) plan was created, previous generations depended on pensions for their retirement income.