AARP Hearing Center

Key takeaways

- The law signed in 1965 still applies.

- Eligibility rules are based on citizenship, age and disability.

- Workers pay into the program to accumulate credits but also pay premiums.

- Expect prescription, Medigap premium or Medicare Advantage expenses.

For nearly 60 years, Medicare has provided health insurance for Americans 65 and older as well as people with disabilities. More than 67 million are now enrolled.

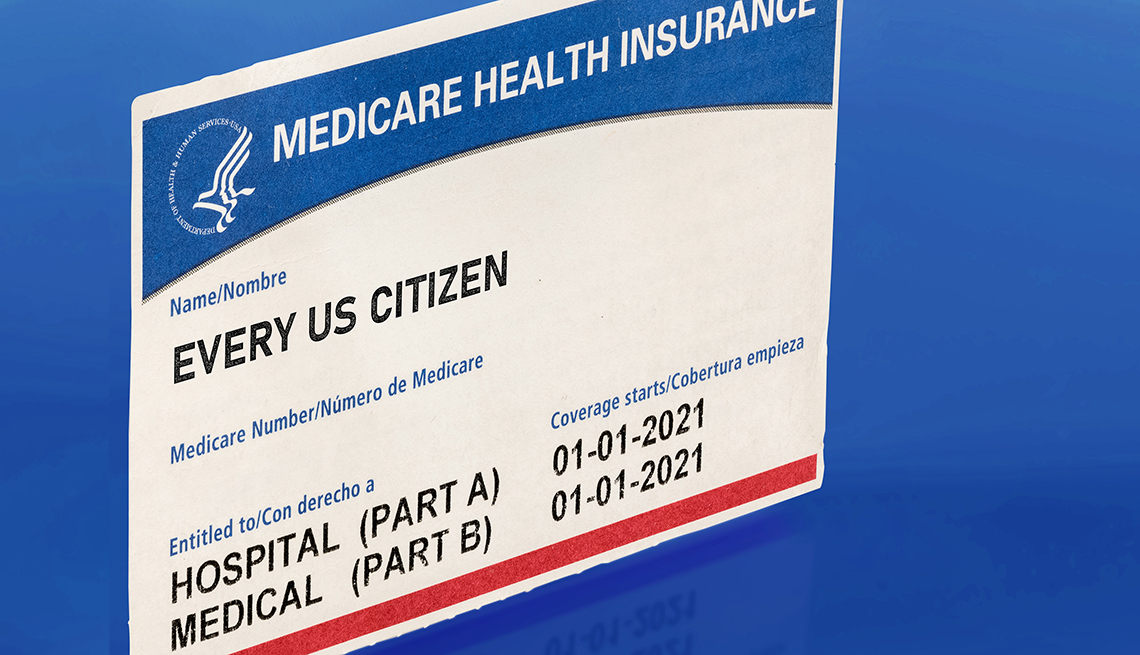

More commonly known as original Medicare or traditional Medicare, the program refers to the first two parts of Medicare, Part A and Part B, included in a bill President Lyndon B. Johnson signed into law in 1965.

- Part A helps pay for inpatient stays in hospitals and skilled nursing facilities, some home care and some end-of-life hospice care.

- Part B covers doctors’ services, diagnostic screenings, lab tests, outpatient care, preventive services, plus some medical equipment and transportation.

What are the requirements for Medicare eligibility?

Medicare’s not automatic. Just because you’re 65 doesn’t mean you qualify for Medicare. You also must meet one of these three criteria:

- A U.S. citizen.

- A person lawfully present in the U.S. who has paid or whose spouse paid Medicare payroll taxes for at least 40 quarters, or 10 years total.

Lawfully present refers to someone, such as a green card holder with permission to live and work permanently in the U.S. or someone with temporary protected status from a country that the U.S. has designated unsafe to return to. Lawful residents can qualify based on their spouse's work history if they've been married for at least one year and their spouse is at least 62. - A permanent legal resident, also known as a green card holder, can also qualify for Medicare without 40 work credits if that person lives continuously in the U.S. for at least five years before applying. If you or your spouse lived on and off in the U.S. but accumulated the required 40 credits, you don’t need to meet the five-year residency requirement. If you’re a U.S. citizen or a green card holder and neither you nor your spouse has earned 40 work credits, to receive Part A benefits you must pay monthly premiums.

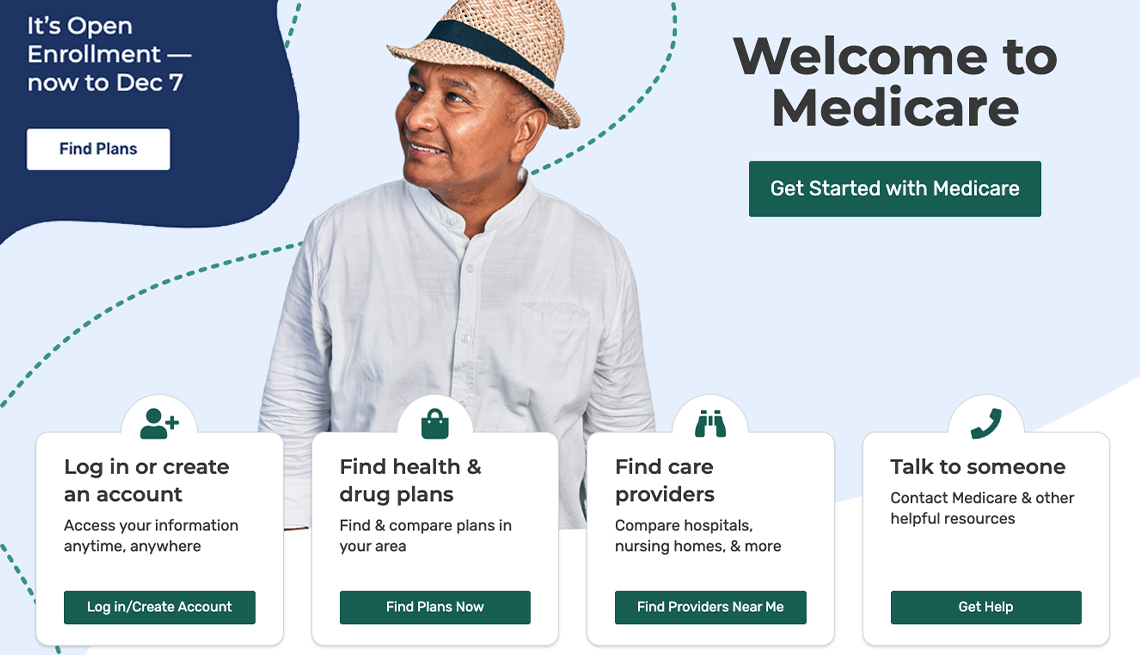

It starts at age 65 for most. You can sign up for Medicare during your seven-month initial enrollment period, which runs for the three months before and after the month you turn 65. Unless you qualify earlier because of a disability, the earliest your coverage can start is the first of the month you turn 65 or the start of the previous month if your birthday is on the first.

More on Medicare

How to Sign Up: A Guide to Medicare Enrollment

When you can enroll for health coverage, the best ways to do it and how to avoid penalties

When Do I Sign Up for Medicare if I’m Working at Age 65?

The answer will depend in part on the size of your employer

If I Retire at Age 62, Will I Be Eligible for Medicare?

No, but you have other options for health insurance