AARP Hearing Center

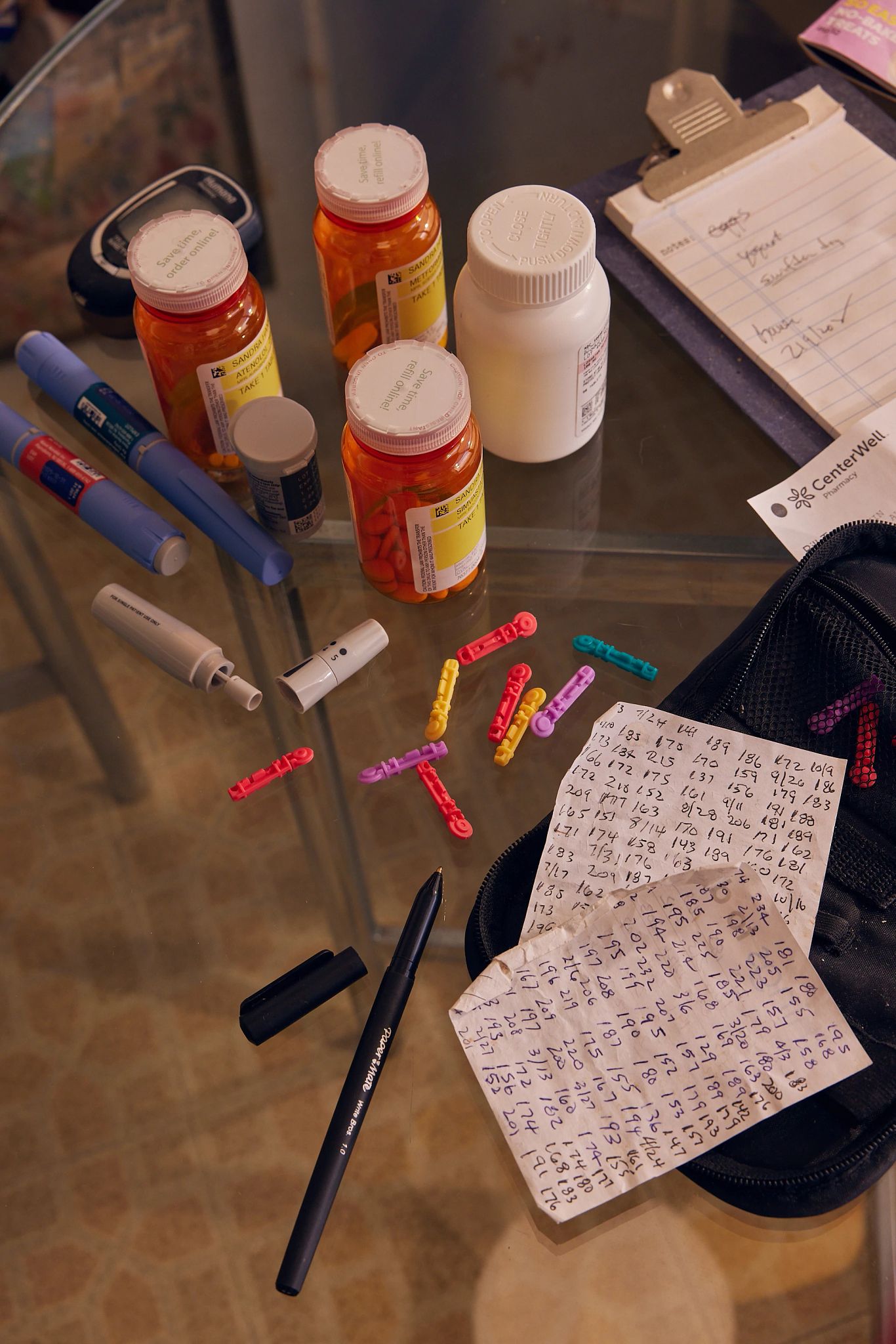

It’s not unusual for Gordon Irwin to shell out $500 or more at the pharmacy counter when picking up his medications, which include prescriptions that help regulate his blood sugar and reduce complications from atrial fibrillation, or A-fib. He’s also no stranger to paying nearly $1,000 a month, though that tally can vary, for outpatient medications to help manage his wife’s multiple myeloma and other health conditions.

In 2023 alone, the Knoxville, Tennessee, couple spent more than $17,000 out of pocket on their prescription medications. The year before that, the figure was even higher, “because my wife’s cancer medicine cost about $400 a month less last year” than in 2022, says Irwin, 80, a retired educator.

LIMITED TIME OFFER: Labor Day Sale!

Join AARP for just $9 per year with a 5-year membership and get a FREE Gift!

Irwin is one of nearly 3.2 million Americans who is expected to save money on prescription medications next year under a new law that caps out-of-pocket expenses for people with a Medicare prescription drug plan at $2,000.

By 2029, more than 4 million people with a Medicare drug plan who do not receive the program’s low-income subsidy will hit the annual ceiling and see savings when they go to fill their prescriptions, according to a new report published by AARP.

A High Cost to Bear

- An estimated 82 percent of Americans age 50 and older believe that prescription drugs are too expensive, research from AARP shows.

- Nearly half of people polled by AARP report not filling a prescription due to its cost, or knowing someone who has done so.

- Twenty-one percent of older adults surveyed by AARP report spending more than $1,000 out of pocket in the past year on prescriptions.

- Nearly three-quarters of surveyed adults (71 percent) say that they or someone they know will benefit from the new out-of-pocket cap.

Source: AARP, 2024

“It’s huge,” Irwin says, noting that he will be saving thousands. “My wife and I have always lived a reasonably frugal life, but obviously these costs have had an effect.”

Nearly 56 million adults in the U.S. have a plan under Medicare that helps cover the cost of outpatient prescription medications — the kind you get from a pharmacy and take at home. And for the most part, satisfaction with this program, known as Part D, remains high, a 2024 report to Congress shows.

But Part D plans have historically not had a limit on out-of-pocket spending. This, coupled with rising drug prices, has resulted in a financial nightmare for many people, especially those on pricey medications. A 2023 study published in JAMA Network Open found that a significant share of older adults have coped with increasing out-of-pocket drug expenses by skipping doses of their medicine or by not filling their prescriptions.

An AARP-backed law passed in 2022 aims to address this growing burden by placing an annual limit on the amount of money people with Medicare drug plans pay out of pocket for their prescription drugs. The new $2,000 cap takes effect Jan. 1 and will be adjusted for inflation every year, along with the other parts of the Part D benefit.

“No person should have to face unaffordable prescription drug costs year after year,” says Leigh Purvis, AARP’s prescription drug policy principal. “This new law will bring relief to so many people who have been struggling with the effects of skyrocketing drug prices.”

More From AARP

AARP Backs New Legislation to Lower Drug Prices

U.S. Senate bill targets patent abuses that keep prescription costs highFTC Blasts PBM Business Practices

Report is critical of influence over medication access, affordabilityHow States Are Helping to Make Medications More Affordable

A look at efforts to lower prescription drug costsRecommended for You