AARP Hearing Center

After you enroll in Medicare, your next step is to determine if you want coverage from original Medicare or Medicare Advantage, insurance that a private company manages within rules that the federal government sets.

If you decide to get coverage through original Medicare, you can use any doctors or hospitals that accept Medicare payments. But you’ll still have out-of-pocket costs, such as copayments, deductibles and other expenses.

If you have employer, retiree or Tricare for Life military health insurance, those policies can fill in some of Medicare’s gaps. If not, you could benefit from buying a supplemental Medigap policy from a private insurer.

Although you’ll pay an additional monthly premium for a policy, it can cover most of Medicare’s copayments, deductibles and other out-of-pocket expenses. You can’t buy a Medigap policy if you have a Medicare Advantage plan, which usually has different out-of-pocket costs.

You can buy a Medigap policy anytime, but in most states the best time to buy is within six months of enrolling in Part B at age 65 or older. That way, insurers can’t reject you or charge you more because of a preexisting condition.

Using the Medigap Plan Finder

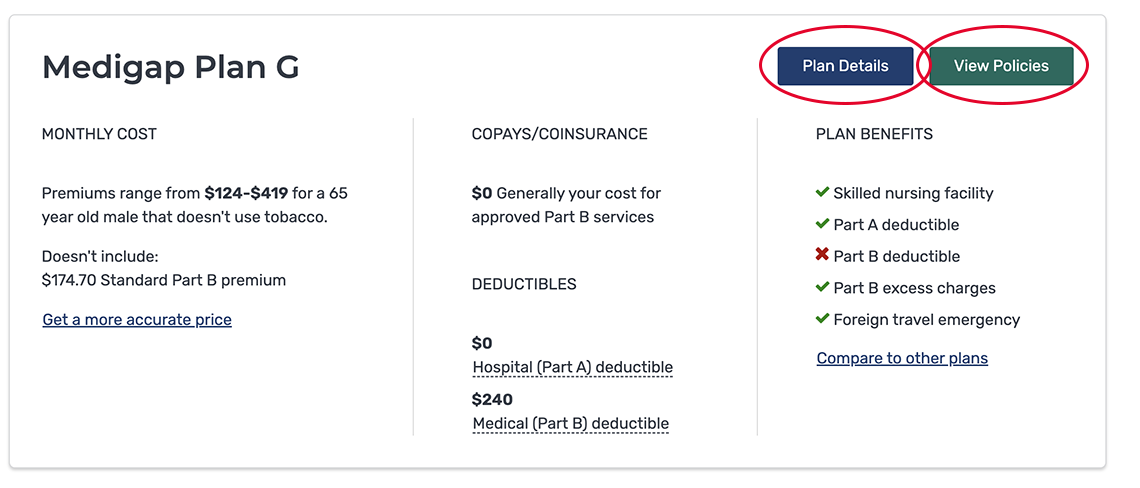

Even though private insurers sell Medigap plans, federal and state rules standardize coverage. Insurers can offer up to 10 plans, each with a different letter designation.

In most cases, each letter plan has to offer the same benefits, no matter which insurance company issues it. But two plans with the same letter designation may have different premiums.

Massachusetts, Minnesota and Wisconsin offer different standardized plans. For more information about what policies cover, visit Medicare.gov, or you can check out the Medigap plan finder. We show you how:

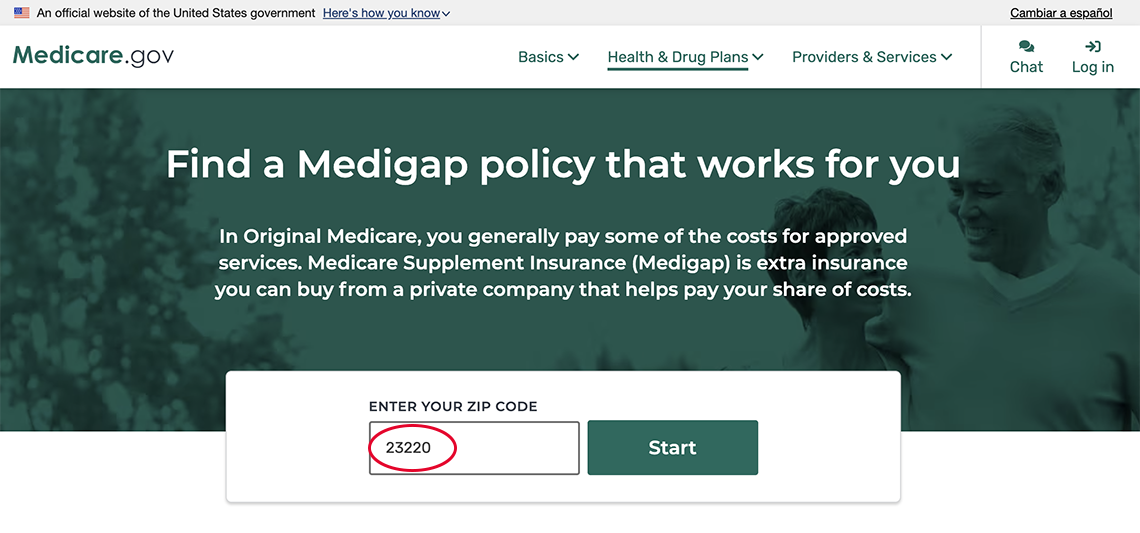

1. Go to the Medigap plan finder and type in your zip code.

More on Medicare

Understanding Medicare’s Options: Parts A, B, C and D

Making sense of the alphabet soup of health care choices10 Common Medicare Mistakes to Avoid

Errors can prove costly to new enrolleesMedicare Open Enrollment: Everything You Need to Know

When it starts, when it ends, and how it works for original Medicare and Medicare Advantage