AARP Hearing Center

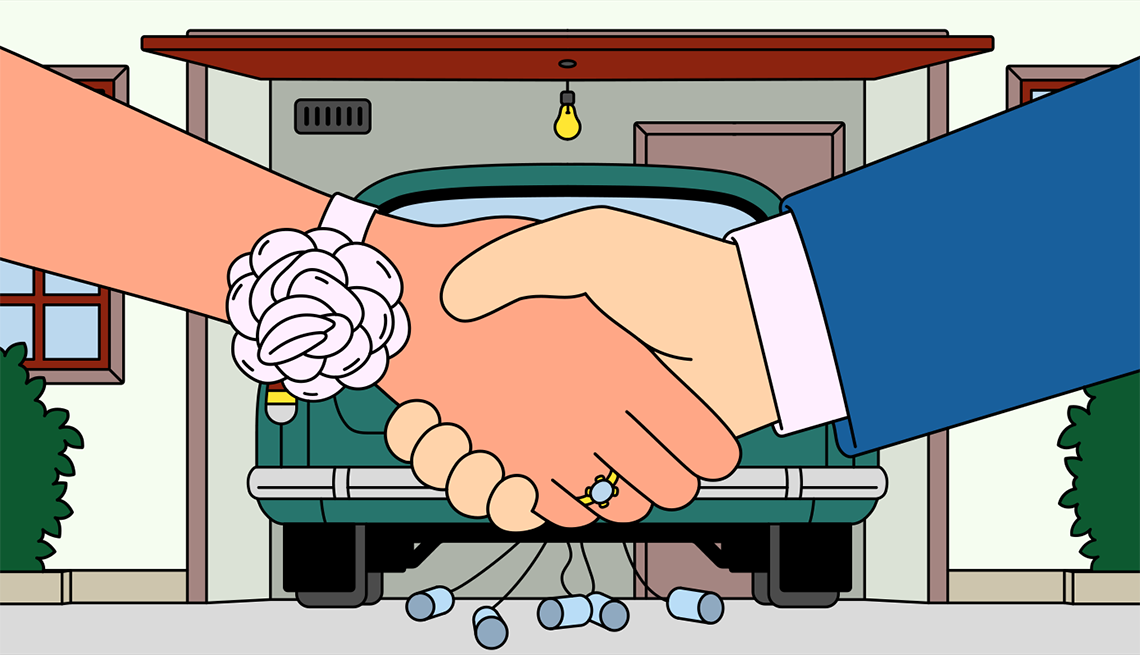

Most people are familiar with the idea of prenuptial agreements — contracts signed ahead of a wedding that specify how assets and liabilities would be divided in the event of a divorce. But there’s a lesser-known option for those who never signed such a contract before they tied the knot and have now decided they want a specific plan for divvying up their assets: postnuptial agreements.

A postnup is a legally binding document you sign when you’re already married that spells out what happens to your assets if the marriage doesn’t work out. It allows couples to create a divorce settlement with relative ease, if it becomes necessary, saving time and attorney fees.

A postnup can be especially advantageous for the skyrocketing number of couples who are divorcing after age 50, since they have less time to recover from financial losses and the cost of divorce, says Andrew Hatherley, a retirement planning counselor, divorce financial analyst and host of The Gray Divorce Podcast.

Postnups are “powerful tools in protecting individual assets, providing clarity for financial expectations [and] addressing debt issues, and they can include safeguarding provisions for children from previous marriages,” Hatherley says. “They provide peace of mind.”

What is a postnup?

A postnup is “like a prenup but after the fact,” says Meghan Freed, a divorce attorney in Hartford, Connecticut, and co-founder of family law firm Freed Marcroft. “It’s a potential opportunity to make financial decisions about how both spouses would like things to work in the event of a divorce when you have no plans to divorce.”

The timing around a prenup is pretty clear: You enter an agreement before the wedding. With a postnup, it’s a bit more varied. Some married couples enter a postnup after a separation or period of marital discord, or if their visions for their futures shift, like one spouse deciding they want to retire while the other wants to keep working.

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)

More From AARP

Why You Should Keep Checking Your Credit Report

Keep an eye out for unpaid bills and other issues6 Times When You Should Update Your Will

Don’t just set and forget this key part of your estate planWhen a Spouse Dies, Credit Score Can Take a Hit

Issues with bills, accounts can add to financial pain