AARP Hearing Center

Social Security was born 89 years ago this Wednesday, in 1935, and over the subsequent decades it has matured into a vital source of inflation-adjusted income for retirees, people with disabilities, and their dependents and survivors. As of June 2024, the program was paying monthly benefits to more than 72 million Americans. Here’s a time line of significant events in the history of Social Security.

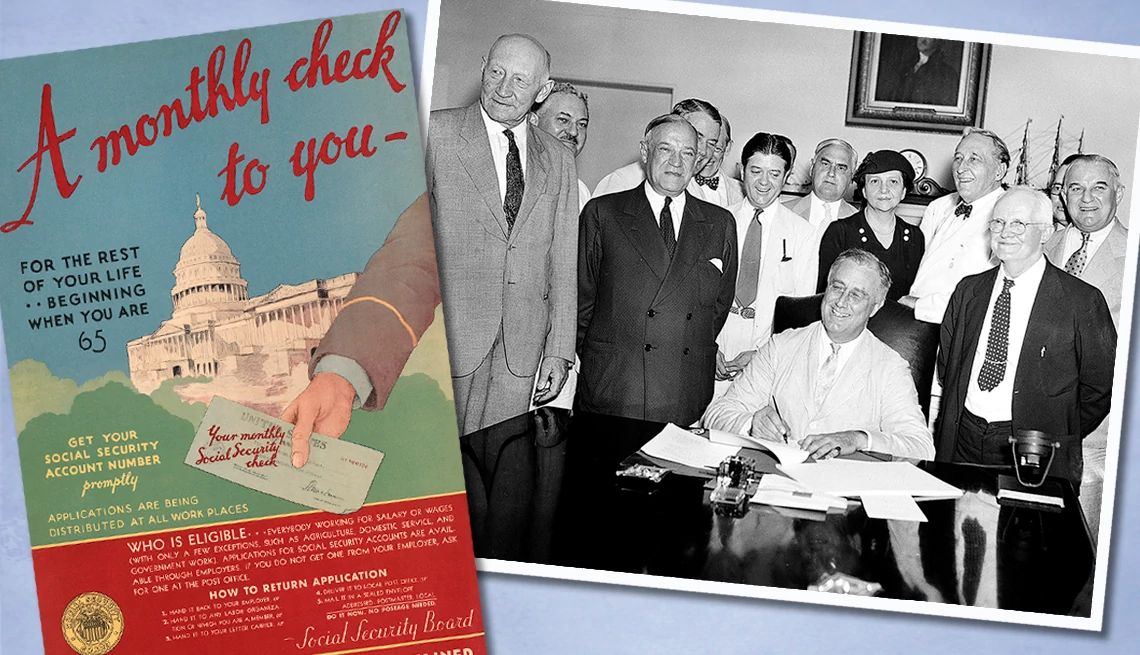

Aug. 14, 1935: President Franklin Delano Roosevelt signed the Social Security Act into law.

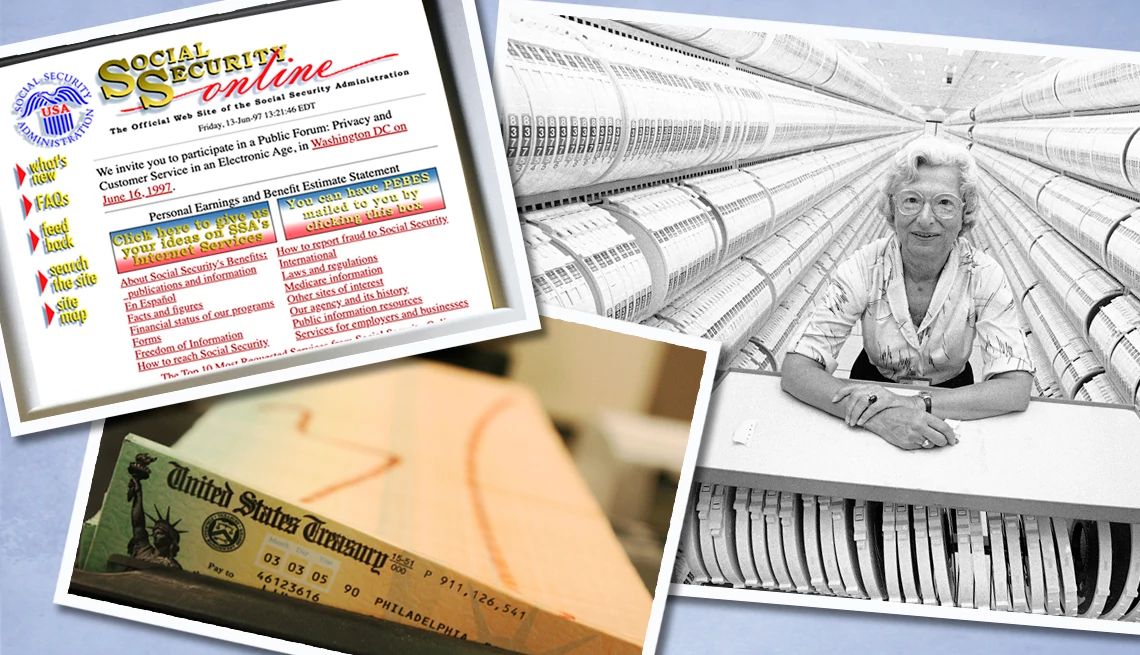

Jan. 1, 1937: First Social Security benefits paid out in the form of one-time, lump-sum payments.

Aug. 10, 1939: Program broadened to include benefits for workers’ dependents and survivors.

Jan. 31, 1940: Ida M. Fuller became the first person to receive a monthly benefit. Her first check was for $22.54, the inflation-adjusted equivalent of $509.46 today. Fuller lived to the age of 100.

October 1950: Congress authorized the first cost-of-living adjustment (COLA), an increase of 77 percent.

Aug. 1, 1956: Social Security Act amended to provide benefits to workers with disabilities ages 50 to 64 and adults with disabilities dating to childhood, and to allow women to take early retirement at age 62, albeit at a reduced Social Security benefit. Previously, no one could claim retirement benefits until age 65.

September 1960: President Dwight Eisenhower signed a law amending the disability rules to permit payment of benefits to workers with disabilities of any age and to their dependents.

June 30, 1961: Social Security Act amended to reduce the minimum eligibility age for retirement benefits to 62 for all workers, regardless of gender.

Oct. 30, 1972: Congress established Supplemental Security Income (SSI), a national benefit program administered by Social Security that provides monthly cash payments to people who are 65 or older, blind, or have a disability and have very low incomes and limited assets.

July 1975: The first annual automatic COLA kicked in, boosting benefits by 8 percent. Before 1975, congressional authorization was required to adjust benefits for inflation.

July 1980: Beneficiaries received the highest annual COLA increase ever — 14.3 percent. The inflation rate in 1980 was 12.5 percent.

More From AARP

My Biggest Retirement Mistake: ‘I Wish I Had Started Saving Earlier’

A retired nomad learns to make do with less8 Things You Didn't Know Social Security Could Do For You

Surprising, useful services beyond monthly checks

10 Social Security Myths That Refuse To Die

Misconceptions about funding, retirement age and more

Recommended for You