AARP Hearing Center

A wave of website headlines, videos and social media posts are spreading misinformation about a supposed "fourth stimulus check" headed to older Americans or people with disabilities. Don't believe the hype — there's no fourth stimulus going out, to anyone.

“We’ve paid out all the Economic Impact Payments,” IRS spokesman Anthony Burke says, using the official term for the three rounds of federal stimulus payments sent to more than 160 million U.S. taxpayers as part of the COVID-19 relief measures Congress passed in 2020 and 2021.

The IRS says people who missed a stimulus payment or received less than they should have can still try to claim the money by applying for a Recovery Rebate Credit (see below). “People should go to IRS.gov as the definitive source of information," Burke says.

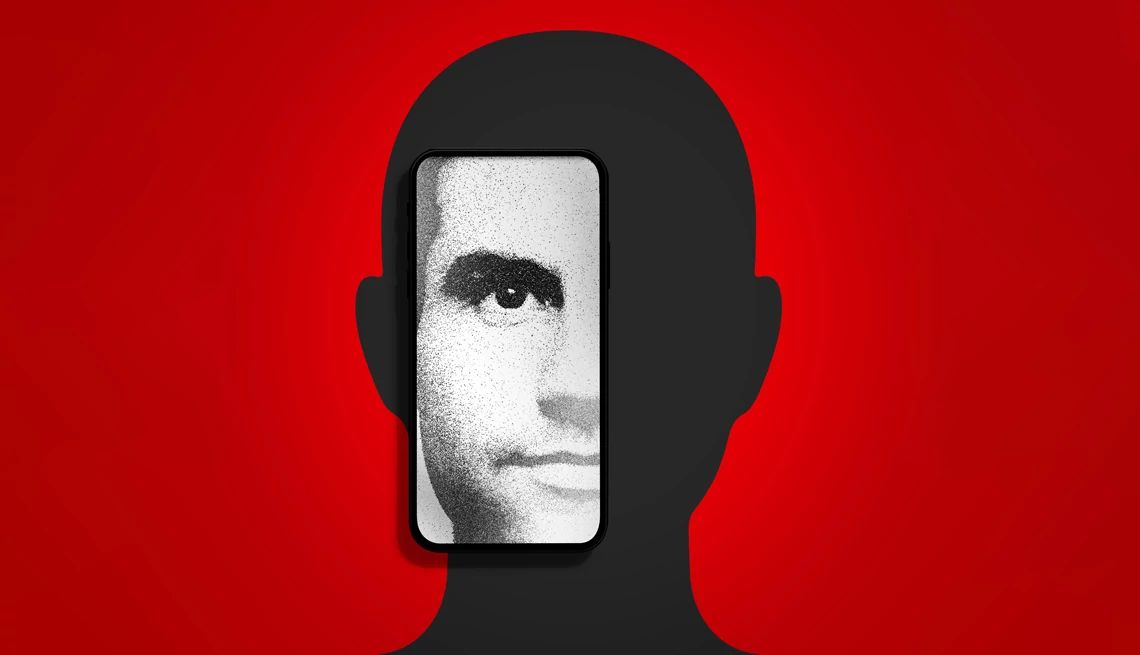

More than three years after the third and final federal pandemic payment went out, claims that new ones are on the way are due in part to the growth of generative artificial intelligence (AI) in creating content, says McKenzie Sadeghi, AI and foreign influence editor for NewsGuard, a company that monitors misinformation in online media.

Learn more

Senior Planet from AARP has free online classes to help you discover more about artificial intelligence.

Imminent stimulus checks are a staple of “content farms,” she says — supposed news sites that regurgitate dubious information and often rely on AI-generated articles with little or no human oversight.

“We’ve seen this claim come up regularly on these websites — that you can get a fourth stimulus check,” Sadeghi says. “It's very in line with the type of content that we see from them, which are hoaxes aimed at generating clicks and getting people to the site.”

Seeking clicks

The latest round of stimulus stories tease possible payments of up to $2,600 for older Americans or assert outright that the payments have been “confirmed” by authorities and will go out in July. Similar claims have made the rounds of suspicious sites in recent months and have cropped up on social media, too.

Late last year, social media posts asserting that older residents of 10 states would be getting new stimulus checks Nov. 30 went viral, the Associated Press reported. Purportedly finance-focused YouTube channels with thousands or even hundreds of thousands of subscribers regularly post videos touting imminent extra payments to Social Security recipients or low-income Americans.

The distribution of legitimate, congressionally approved relief payments in 2020 and 2021 was accompanied by a raft of related scams, with robocalls, emails, text messages and social media posts promising to deliver faster or bigger stimulus checks if you paid a fee or provided personal information.

More From AARP

FCC Outlaws Robocalls Made With Artificial Intelligence

Agency says AI makes rampant scam calls that could deceive voters11 Ways to Fight Election Disinformation

The 2024 election is on the horizon. How can you tell if photos, videos and stories are real?Does ChatGPT Give Good Retirement Planning Advice?

How the AI chatbot handles saving, investment questions

Recommended for You