AARP Hearing Center

Key takeaways

- Medicare Part D began covering prescriptions in 2006.

- Part D plans vary in lists of covered drugs; some types aren’t included.

- You may face certain restrictions.

- Plans charge premiums, have cost sharing, but financial help is available.

- Penalties apply if you miss sign-up deadlines.

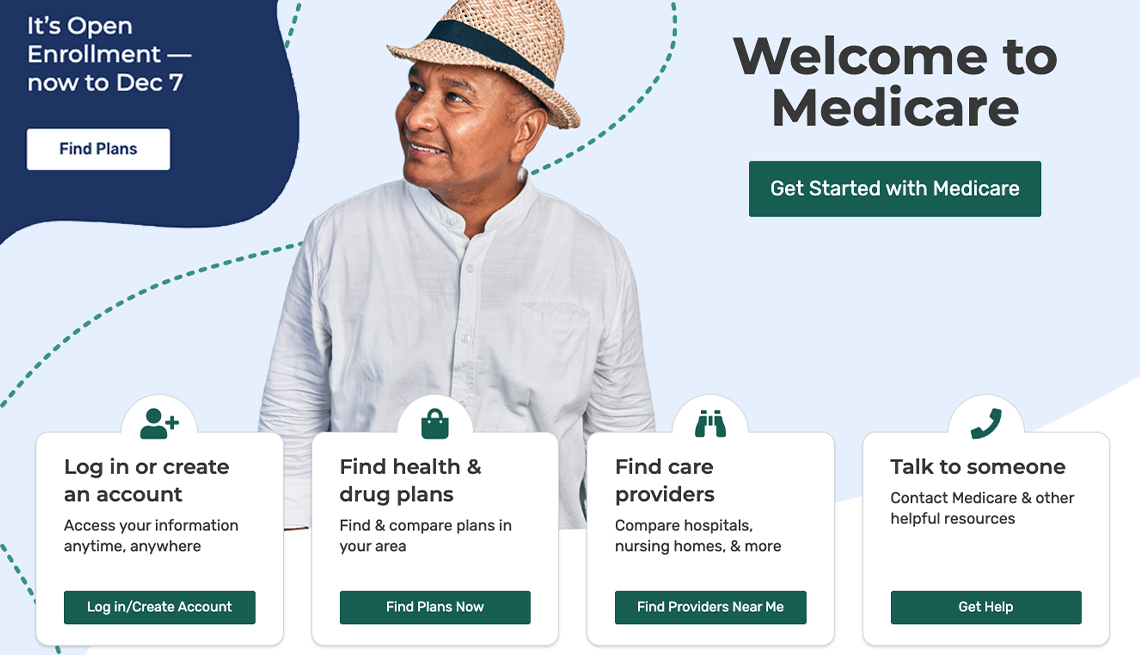

- Use the Medicare Plan Finder to compare plans.

- You can change plans during open enrollment each year.

Medicare Part D prescription drug coverage debuted in 2006, more than 40 years after Congress created Medicare to provide health insurance coverage for Americans 65 and older.

The program allows private insurers that the federal government regulates to sell voluntary, stand-alone drug plans to participants in original Medicare and to incorporate this coverage into most Medicare Advantage plans.

What is Medicare Part D?

The insurance helps pay for prescriptions that you take yourself, whether it’s an antibiotic for a short-term infection or a drug that you’ll need to take for the rest of your life, such as blood pressure pills.

Plans vary based on where you live. In 2024, the average Medicare beneficiary has 21 stand-alone Part D options and 36 Medicare Advantage drug plans to choose from, according to KFF, a nonprofit health policy research group. Each has different premiums, deductibles, copayments, preferred pharmacies and lists of covered drugs, but they all must meet federal requirements.

The Inflation Reduction Act of 2022 continues to roll out changes benefiting consumers, including negotiating prices with drugmakers, capping out-of-pocket costs and making many vaccines free to enrollees.

What does Medicare Part D cover?

Part D pays for outpatient prescription drugs. While Medicare Part B covers chemotherapy, dialysis or medications injected or administered intravenously at a doctor’s office or outpatient center, Part D covers some self-injected medicines, such as insulin for diabetes. Brand-name and generic drugs are included, but you may pay a larger share of the cost for brand-name drugs.

But Part D doesn’t cover all medications, only certain categories. Specific drugs vary by plan. That’s why it’s important to check that your prescriptions are in a plan’s formulary (its list of approved drugs).

What doesn't Part D cover?

Part D doesn’t pay for over-the-counter medications or some types of prescriptions, such as those to help grow hair, prescribed vitamins, or medicines to help you gain or lose weight.

However, Medicare recently announced that it will cover Ozempic and Mounjaro for diabetes or Wegovy for people with cardiovascular disease who also are overweight, because the drugs are being used for FDA-approved purposes other than weight loss.

More From AARP

Medicare Announces First 10 Negotiated Drug Prices

Millions of older Americans are expected to save on their prescriptionsWill Medicare cover you when traveling or on vacation?

How to avoid big bills if you get sick when travelingAARP Smart Guide to Oral Health

The health of your mouth could impact you overall wellbeing

Recommended for You