AARP Hearing Center

Milton strengthened to a Category 5 hurricane Oct. 7 with the storm barreling toward Tampa Bay and other areas along Florida’s west coast, carrying winds of up to 160 mph. The hurricane, expected to make landfall midweek, could cause devastating damage to homes in its path.

Following a natural disaster like Hurricane Milton, you might find yourself struggling with your insurer to cover damage to your home and its contents. But you can reduce the chances of insurance battles, both beforehand and during a crisis. Take these steps to help speed up payments after a flood, fire or other disaster.

Know your coverage

Review your homeowners or renters insurance policy to verify which claims can be reimbursed. In addition to losses from fire and smoke, standard policies cover damage caused while putting out a fire. If a disaster leaves your home uninhabitable, these policies also reimburse you a certain amount for living expenses, such as rent or hotel bills, restaurant meals and transportation.

Pro tip: Set up time with your insurance agent or a representative from your insurer to talk through disaster scenarios unique to your home and property. What coverage would you have if wind knocked that maple tree in your front yard onto your home? If a fire is caused by human error? If a leaky old pipe damages a wood floor? Sometimes talking it out is easier than deciphering a policy’s fine print.

Focus on flooding

This is key: Most home insurance policies do not cover flood damage. For that, whether you own or rent, you must purchase a private flood policy. Homeowners, generally speaking, can get up to $250,000 in coverage for the structure itself; owners and renters can get up to $100,000 in coverage for the home’s contents. For more information and links to companies selling insurance in your area, go to the government website FloodSmart.gov. Be aware: After a storm that includes high winds, rain and flooding, expect insurers to dispute the true cause of the damage, in hopes that the other insurer is on the hook to pay up.

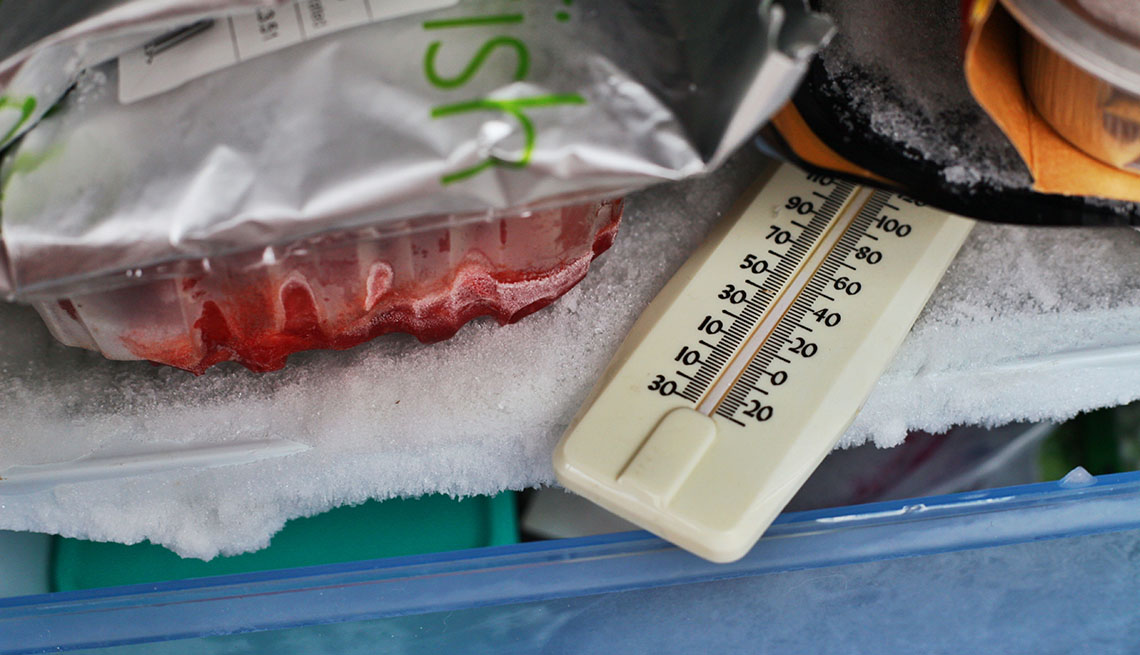

The presence of flooding may make it difficult to convince your insurer to pay your claims, as Jennifer Hauber discovered. In September her rental home on Florida’s Sanibel Island was hard hit by Hurricane Ian, which caused wind and rain damage, as well as flooding from storm surge. Hauber, who had renters coverage, filed a claim for losses to her personal property. But citing the flooding, the insurer has so far denied her claim, saying the damage was not covered. She has received only a $250 check to cover the spoiled contents of her refrigerator. “I’ve made repeated phone calls, but the insurance company won’t review my claim,” she says.

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)

More From AARP

Climate Change Clouds Picture for Retirement Moves

Heat, storm risk rise in popular Sun Belt destinationsSave at the Grocery Store With These 25 Strategies

Food prices are still elevated, but there’s ways to saveHow Older Adults Should Prepare for Floods, Hurricanes and Other Emergencies

Don’t forget important items that might not make the typical list