AARP Hearing Center

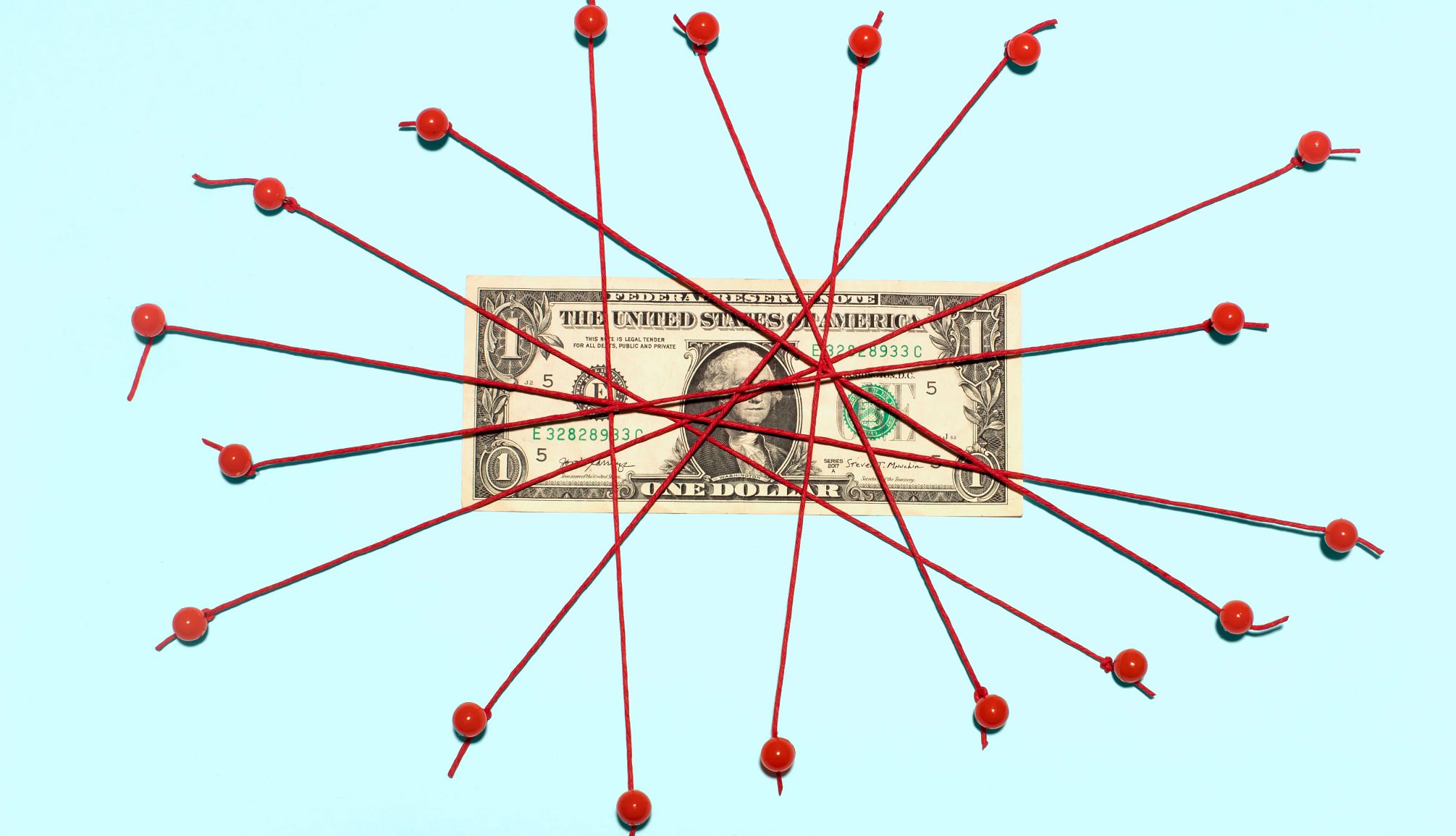

Consumers are fed up with prices at the grocery store and for good reason. Since the pandemic, food staples cost 25 percent more. Even with inflation easing, the prices of many food products remain stubbornly high. According to the latest Consumer Price Index, year-over-year beef and veal prices are up 7.7 percent, bread is 3.2 percent higher, frozen vegetables are up 5 percent, and juice is 4.8 percent more expensive.

Then there’s so-called shrinkflation: Prices may be the same, but the food companies have slashed the count, weight or size of the packaging, which means you’re getting less bang for your buck.

“Groceries are essentials. It’s not something that can be taken off the budget,” says Samantha Landau, consumer expert at TopCashback.com. “Finding a way to save money is super important” in the current environment.

Shoppers aren’t taking higher food prices lying down anymore. They are embracing penny-pinching strategies to lower their food bills. If any of these six sound familiar, you can take solace in knowing you’re not alone with your frugal shopping habits.

1. You’re switching to generics

From Albertsons to Walmart, most retailers sell their own store brands, which tend to be cheaper than the national brands and often provide the same quality. “Store brands have come a long way over the last decade, and many offer high-end ingredients similar to those offered in national name brands,” says budgeting expert Andrea Woroch. “Many store brands are made at the same facilities as national name brands, so why pay more just for packaging and advertising?”

Pro tip: Be open-minded when it comes to generics and accept that pursuing this money-saving strategy may involve a little trial and error. Woroch recommends comparing ingredients side by side to give you peace of mind. Keep in mind that grocery stores have more power to control pricing and promotion of their own brands, she says, and as a result will offer more deals on these products. Even if you’ve bought a particular brand for decades, your bank account will thank you if you give the store brand a try.

More From AARP

BJ’s vs. Costco vs. Sam’s Club: Which is Cheapest?

Before you buy in bulk, check out which warehouse club has the best deals.Staples You Should Always Buy On Sale

If they store well or freeze well, jump at the chance to buy on sale

14 Food Stores That Give Discounts to Seniors

Here’s one way to save on food pricesRecommended for You