AARP Hearing Center

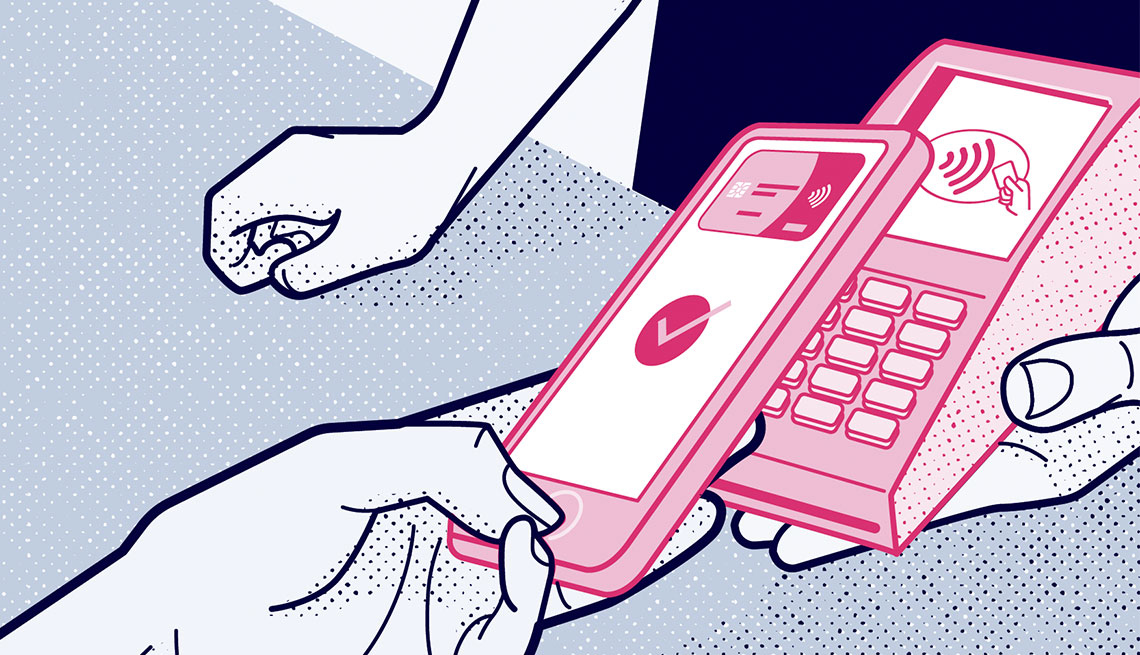

At most stores that accept credit cards, you can pay with plastic just by tapping your phone on a wireless terminal. The process can be safer and more secure than using your actual card, since the merchant will never get a chance to see your security code, card expiration date or even the card number.

Follow this step-by-step guide to using a credit card … without the card.

1. Find your wallet

A “digital wallet” is a smartphone app that securely stores your credit card information. The one you can use depends on the phone you have. Here’s how to find the three major wallets and their payment systems:

Apple Wallet: Preinstalled on iPhones. It stores your credit cards to use with Apple Pay.

Google Wallet: Usable on Android phones. Not preloaded on yours? It’s a free download from the Google Play store.

Samsung Wallet: Preinstalled on supported Samsung Galaxy phones.

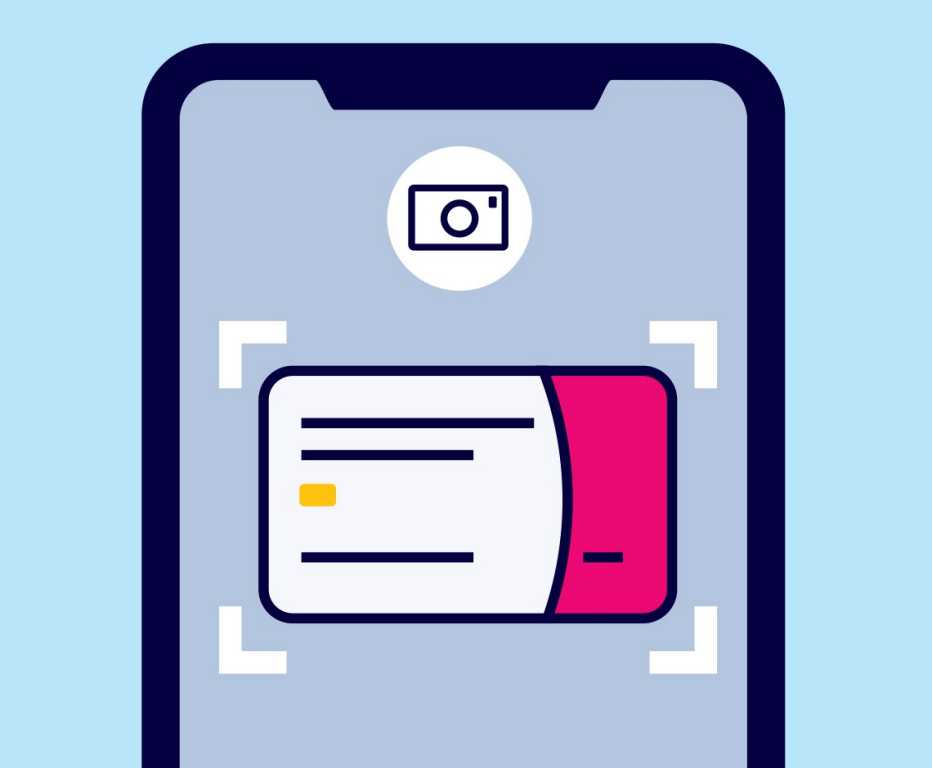

2 . Add a card

Open your wallet by tapping the icon, then tap the “+” button (Apple and Samsung wallets) or “+ Add to Wallet” (Google Wallet). When prompted, aim your phone at the side of the credit card displaying its number. The card info should automatically load onto your phone. You can add details that don’t transfer or skip the photo and enter everything manually. The app will then spend a minute or less communicating with your card issuer.

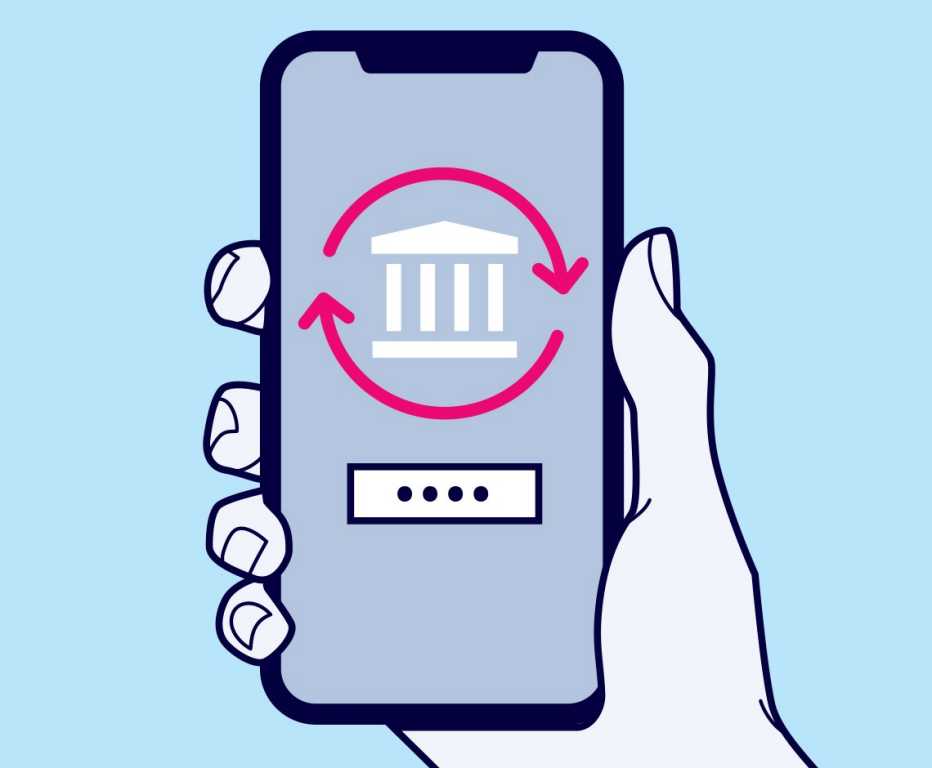

3. Get validated

For security purposes, your card issuer will verify that you’re the authorized user. The process varies by wallet and card; your issuer may send you a verification code to enter in the app, or maybe you’ll have to log in to your bank or card issuer’s app. Once you’ve done this, your card will be added to the wallet and you’ll be free to use it. Do you have more than one credit card to add? Hit the “+” button again and repeat the process.

.jpg?crop=true&anchor=13,195&q=80&color=ffffffff&u=lywnjt&w=2008&h=1154)

More From AARP

6 Innovations to Help People Live Better as They Age

Safety, independence are possible by leaning into tech

'Grandfluencers' Find Stardom on Social Media — and Fight Ageism at the Same Time

Young fans seek connection, wisdom and a glimpse of what aging can look like

Is Someone Impersonating You on Social Media?

How to report an impostor on 5 of the major platforms