AARP Hearing Center

Retirement income comes in all forms, and pension payouts are just one of them. To the federal government, most pension payouts are fully taxable as income. To the 50 states and the District of Columbia, however, the tax picture for pension payouts is a bit more complicated.

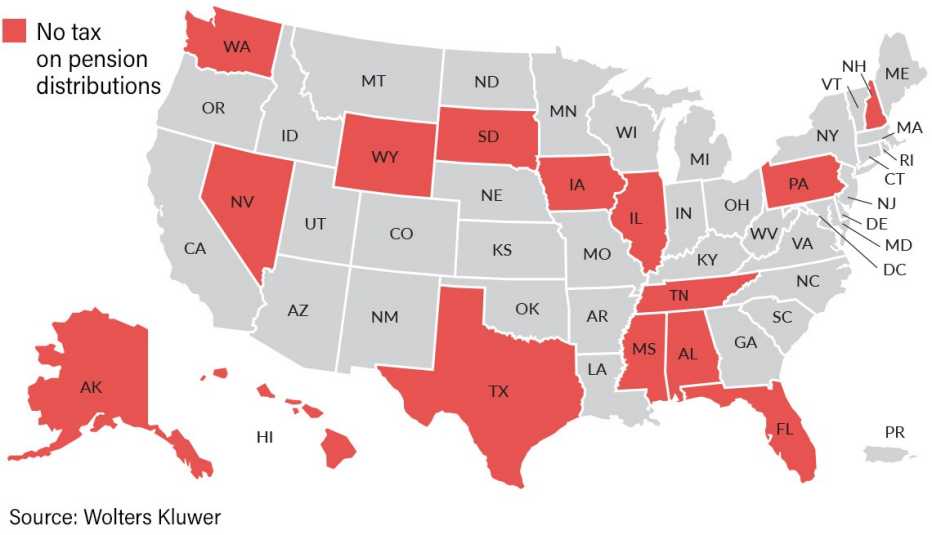

A patchwork of tax rules

Eight states —Alaska, Florida, Nevada, South Dakota, Tennessee, Texas, Washington and Wyoming — don’t tax income at all. New Hampshire taxes only interest and dividend income. And six states — Alabama, Hawaii, Illinois, Iowa, Mississippi and Pennsylvania — exclude pension income from state taxes.

If you don’t live in one of those 15 states, you may still avoid paying taxes on all or some of your pension. According to Wolters Kluwer, a tax publishing company, 26 states tax some, but not all, retirement or pension income. Often these states tax pension income only above a certain level of adjusted gross income. For example, Connecticut exempts pension income from state income taxes for single filers with a federal adjusted gross income of less than $75,000. The number is $100,000 for married couples filing jointly.

Others exclude some pension income from state taxes. New York, for example, exempts $20,000 in pension income from state taxes, and excludes government pension income (including Social Security benefits) as well.

Pensions pay out a defined amount each month until an employee dies, which is why they are called defined benefit plans. Your payout typically depends on your salary over time and how long you worked at the company. Pensions are becoming increasingly rare among private employers, however: Only 11 percent of workers at private companies participated in a pension plan in 2023.

More From AARP

AARP State Tax Guides: What You’ll Pay in 2024

Find out about tax breaks, sales tax and whether your state taxes Social SecurityTop 5 States Where Retirees Are Moving

South Carolina gained on Florida as retirement relocations took a big jump in 20239 States With No Income Tax

Don’t overlook other state taxesRecommended for You