AARP Hearing Center

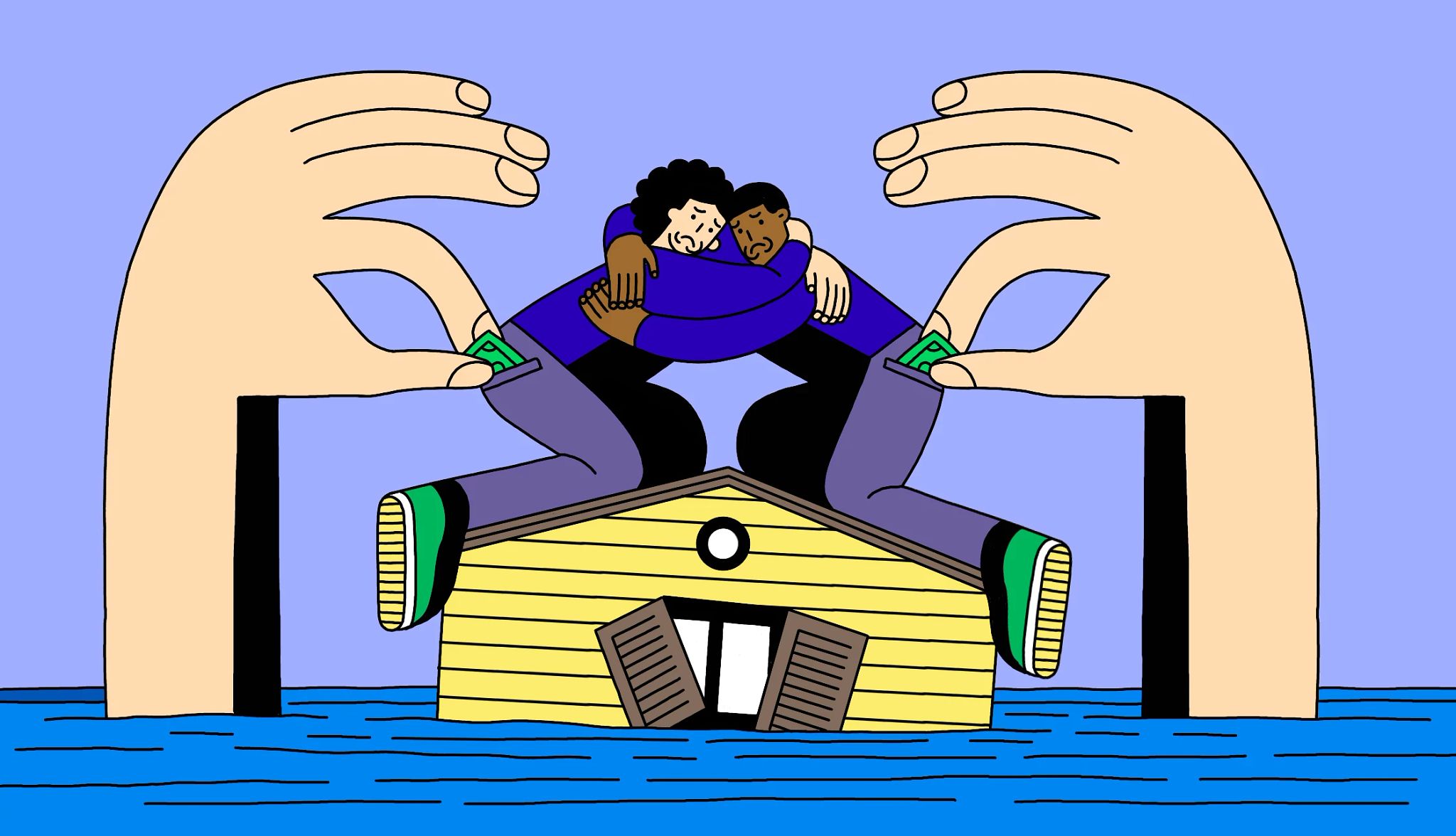

As we've seen with the response to Hurricane Helene and Hurricane Milton, disasters can bring out the best in people, as neighbors and strangers alike roll up their sleeves and open their wallets to help those picking up the pieces. They also bring out scammers, for whom others’ misfortune is just a chance to make a fast buck.

Last year, 28 disasters in the United States caused $95 billion in losses. The National Insurance Crime Bureau (NICB), a nonprofit that works to prevent and combat insurance fraud, estimates 10 percent of those losses, or $9.3 billion, was lost to post-disaster fraud.

“Scammers are also first responders,” warns Steve Weisman, law professor at Bentley University in Waltham, Massachusetts, and editor of Scamicide.com.

How disaster scams work

Some of these “storm chasers” take your money and run. Others overcharge for shoddy work. And since they lack local licensing, your homeowner’s insurance might not cover it.

Fake contractors. Two common scams are contractors that show up and use high-pressure sales tactics to push you to pay them money upfront for repairs, then disappear. Or they may tell you there’s damage to your roof when there isn’t.

“They’ll end up … being paid for a whole new roof, even though you don’t need one,” says Joe Brenckle, NICB director of public affairs. Brenckle recalls stories of scammers using hammers to smash holes in roofs to imitate hail damage.

Government, utility and insurance impostors. Criminals claim to work for the Federal Emergency Management Agency (FEMA) or other government bodies and contact victims with promises of government grants, building permits or help speeding up insurance claims.

Scammers may claim to be with the electric company and offer to give you priority reconnection to the grid if you pay a deposit or fee. And some pose as public insurance adjusters, charging high fees for doubtful damage assessments or directing you to disreputable contractors with whom they’re in league.

Bogus charities. Disasters also unleash a torrent of phony charities, which get busy pumping out calls, text, emails and social media posts soliciting donations for relief work.

More From AARP

How to Prepare for and Recover from Natural Disasters

Earthquakes, floods, hurricanes, tornadoes and wildfires are all events that you can't control. We're here to help you prepare

8 Ways to Recover Faster From a Disaster

A little planning can ease the financial hardshipRising Seas Are Wiping Out Some Older Americans’ Futures

As more older Americans move to the coasts, rising seas are wiping out their homes — and retirement dreams

What to Do If You've Just Been Scammed

How one woman worked quickly — with help — to avoid being charged through PayPal